A telegraphic transfer occurs when you request an international money transfer from a bank. This means money will travel from your bank account through a network of correspondent banks before landing into the necessary overseas account. It’s important to note money will only pass between correspondent banks with pre-existing commercial relationships. However, each correspondent bank your money passes through en route to the final destination will take a cut as they handle the money to cover processing fees.

-

Given the fact that the money has to travel across a network, telegraphic transfers can prove to be both slower and more expensive than other types of international money transfers.

Once upon a time transferring money overseas, or international money transfers (IMTs) used to be quite costly, however now there are some cheap alternatives available in the market. Brands such as OFX and Transferwise offer competitive IMTs, and may be cheaper than traditional providers and big banks. Before committing to transferring money overseas it’s important to compare not only the fees, but the exchange rates they offer as these can add up in the long run.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- Bonus rate for the first 4 months from account opening

- No account keeping fees

- No minimum balance

How can I make a telegraphic transfer?

To make a telegraphic transfer, the steps include:

-

Visiting to your local bank branch, internet banking website or mobile app and asking to send a telegraphic transfer (TT).

-

Fill in the details of the person you're sending the money to. If you're sending it to your own international account, fill in your own details.

-

Pay your bank the transfer amount and applicable fees.

Telegraphic transfer costs and fees

A significant expense of performing a telegraphic transfer is the associated costs and fees. Given money has to pass through multiple banks, there are four fees applicable. These include:

-

Your bank transfer fees - In Australia, this fee ranges from $6 to $30, depending on the bank.

-

Corresponding bank fees - Middleman or corresponding bank fees for transferring money usually via the SWIFT network. While your bank may warn you about these prior to transfer, it may be unclear how much these fees are.

-

Exchange rate margin - Banks add a margin to the exchange rate to cover their own fees or make a profit.

-

Receiving (overseas) bank fees - Foreign banks may charge you a processing fee, which is deducted from the amount of money sent.

What details do I need to provide for a telegraphic transfer?

To send a telegraphic transfer to an overseas bank account from Australia you usually need to provide the following information:

Transfer details

-

Amount

-

Currency

-

Reason for transfer

Your details

-

Your name (or person you're sending money on behalf of)

-

Account number

-

Personal address

Recipient (Overseas) account details

-

Bank's name

-

Branch address

-

IBAN/SWIFT Code

-

Recipient international bank account number

-

Recipient account name (full name without initials)

Your bank may request more information about the intended international money transfer to meet anti-laundering regulations or internal security policies. If receiving money from overseas, the process is identical just in reverse.

Telegraphic transfer pros and cons

Pros

-

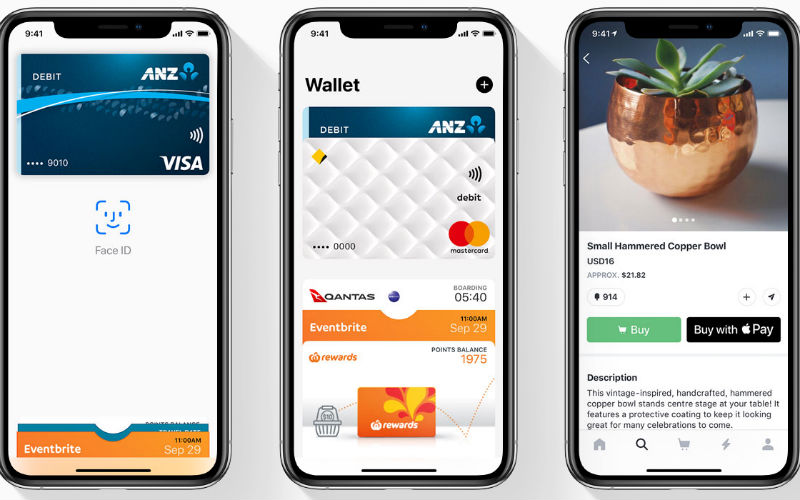

Convenience: Transferring money can be done through your own bank’s app.

-

Security of transfer: Banks are usually pretty secure and have numerous stop-gaps in place to prevent fraud and other financial crimes.

Cons

-

Speed of transfer: As your money passes through a few hands, getting from point A to point B might take longer than with other types of transfers.

-

Fees: Associated costs make this method more expensive than other types of IMTs.

See more: How to plan your finances for an international exchange

Image by Sigmund via Unsplash

Brooke Cooper

Brooke Cooper

Emma Duffy

Emma Duffy