- What is Apple Pay?

- How does Apple Pay work?

- Do the big four offer Apple Pay?

- Apple Pay supported banks

- Alternatives to Apple Pay

The invention of the smartphone has led to many problems in our modern society, like the ability to create an Instagram account for your dog that isn’t as cute as you think it is. But one positive of the smartphone era is the ability to make instant contactless payments without needing to dig out your credit card.

This can be done through the use of digital wallet services such as Apple Pay.

What is Apple Pay?

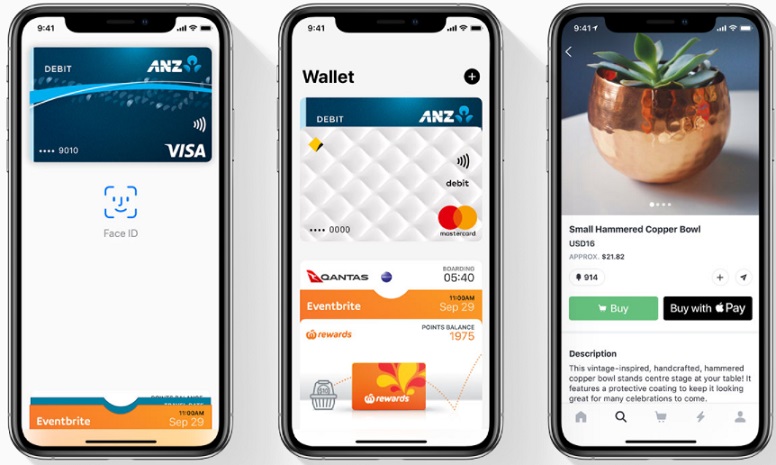

Apple Pay is a form of contactless payment technology exclusive to users of Apple products, of which there are about 1.4 billion around the globe. Essentially you can pre-load your credit or debit card information onto your Apple product – whether it’s an iPhone or Apple Watch – and pay with a simple wave, instead of getting the card out of your wallet or purse and paying in more than 10 seconds like some sort of chump. Time is money after all.

And it also means if you happen to leave your physical cards behind, you still have a backup option in the form of a virtual card. null

Source: Apple

Apple Pay first launched in Australia in 2015, with American Express the first institution to allow customers to use it. Globally, it’s been downloaded by 43% of the world’s iPhone users, while closer to home, Commonwealth Bank said it had seen a 270% increase in the number of digital wallet transactions made between January 2019 (when it installed Apple Pay) and March, while 2020 saw record numbers of users.

How does Apple Pay work?

Apple Pay is a type of digital wallet technology that stores your bank account and card information securely in your Apple device. It then utilises your phone’s Near-Field Communication (NFC) chip to connect to EFTPOS machines and merchant terminals the same way the physical card would except you can’t insert it (unless you want to try jamming your phone in a credit card slot).

It’s used exclusively for tap-and-pay purchases and doesn’t require a pin to be entered for purchases under $200.

With Apple Pay functionality, you can also easily make purchases online using your phone or iPad. By storing your card’s information it can auto-fill details when doing online shopping, which can be dangerous in the sense that it becomes easier for you to buy all the junk you’re tempted by.

As a fairly recent innovation, Apple Pay is only available with some of the more modern Apple devices. According to Apple, the following devices support Apple Pay:

- Any iPhone beyond the 6 series

- Any iPad beyond the mini 3

- Apple Watch Series 1 and 2 and later

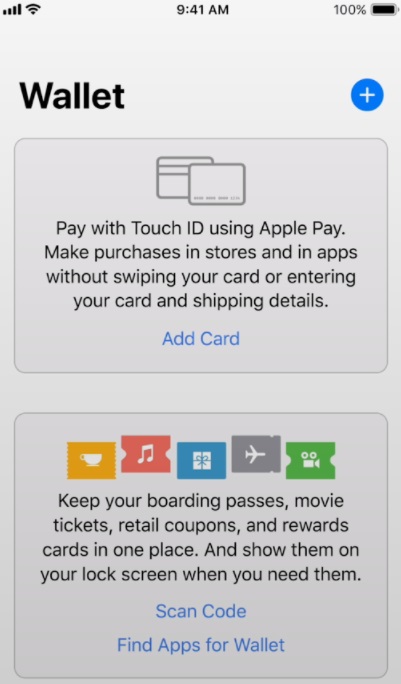

Your iPhone should have a ‘wallet’ section in settings – you can click on this and simply enter your card’s details to start using Apple Pay pretty much instantly.

Source: Apple

Does Apple Pay cost anything to use?

Nope, Apple Pay costs as much as it does to use your physical card in that you still might have to pay a surcharge, but this is charged by the merchant, not Apple Pay itself. It can cost the banks something to allow you to use it, but that’s another story.

Are there any dangers to using Apple Pay?

The only real danger of using digital wallet tech to make purchases is the temptation to overspend. With Apple Pay, you don’t have to worry too much about security – Apple doesn’t keep your transactions or card numbers on its servers, and when a transaction is made, it creates a random token for that purchase that replaces your card number.

This can actually make it safer than using an ordinary card since these can easily be lost or stolen.

Do the big four banks offer Apple Pay?

As of 2021, each of the big four banks currently offer Apple Pay to their Australian customers, although most were somewhat reluctant to take it up. Commonwealth Bank, NAB and Westpac actually banded together with Bendigo and Adelaide Bank to ask the ACCC to force Apple to give them access to its mobile payments technology instead of having to pay for it, which would’ve allowed them to build their own.

It was revealed in 2019 the banks pay between 0.04% – 0.06% of the value of purchases on Apple products, which was the cause of the contention. But the ACCC rejected their demands, and slowly but surely, more of the big banks started offering Apple Pay.

Does ANZ offer Apple Pay?

Yes, ANZ was actually the first big bank to offer Apple Pay in Australia, introducing it all the way back in April 2016.

"The RBA is trying to remind people that property prices don't always go up & having a lot of debt can be dangerous," @wmdglasgow pic.twitter.com/bV2W0CDFa4

— ABC News (@abcnews) October 13, 2017

It would be almost two years before the next big bank adopted Apple Pay.

Does Commonwealth Bank offer Apple Pay?

Yes, Commonwealth Bank does offer Apple Pay. It was made available to CommBank customers in January 2019, and also applies to its subsidiary bank Bankwest. As mentioned before, it saw a huge increase in contactless payments immediately after making Apple Pay available, implying customers were clamoring for it to be introduced.

Apple Pay is now available to @CommBank and @Bankwest customers. https://t.co/ae6w1PvfR8

— CBA Newsroom (@CBAnewsroom) January 22, 2019

“In 2019, customers can expect us to continue listening, innovating, and providing the best possible experiences when they bank with us,” CmmBank Group Executive of Retail Banking Services Angus Sullivan said at the time.

Does NAB offer Apple Pay?

As of May 2019, NAB and UBank (which NAB owns) customers can use Apple Pay with eligible Visa debit or credit cards. The bank also added Apple Pay due to consumer demand.

It’s here. NAB customers can now use Apple Pay. Just add your NAB Visa Card and start using Apple Pay wherever you can tap and pay. Apple Pay with NAB. Easy. T&Cs apply. https://t.co/bs5t9VIGwT pic.twitter.com/fDY5vbMRDA

— NAB (@NAB) May 20, 2019

Does Westpac offer Apple Pay?

Last but not least, Westpac switched on Apple Pay in April 2020 for all debit and credit cards.

Photo via Westpac, Twitter (@Westpac)

Apple Pay supported banks in Australia

A huge number of Australian financial institutions currently support Apple Pay, and the list is ever-expanding. In August 2019 79 banks and mutual banks offered Apple Pay. That number is now more than 100 if you include non-bank institutions.

The complete list of Apple Pay supported banks is as follows:

- 86 40

- Acquire One

- American Express

- AMP Bank

- ANZ

- Australian Military Bank

- Australian Unity

- Auswide Bank

- AWA Alliance Bank

- Bank Australia

- Bank First

- Bank of Heritage Isle

- Bank of Queensland Specialist

- Bank of Sydney

- Bank of us

- BankVic

- Bankwest

- BDCU Alliance Bank

- Bendigo Bank

- Beyond Bank Australia

- BOQ Specialist

- Border Bank

- Central Murray Credit Union Ltd.

- Central West Credit Union Ltd.

- CIRCLE Alliance Bank

- Citi Australia

- Coastline Credit Union

- Coles Financial Services

- Commonwealth Bank of Australia

- Community First Credit Union Ltd.

- Credit Union SA Ltd.

- CUA

- Defence Bank

- DiviPay

- Edge

- EML Payment Solution Ltd

- Endeavour Mutual Bank

- Fire Service Credit Union

- Firefighters Mutual Bank

- First Option Bank

- Geelong Bank

- Goldfields Money Ltd.

- Goulburn Murray Credit Union

- Hay

- Health Professionals Bank

- Heritage Bank

- Holiday Coast Credit Union Ltd.

- Horizon Bank

- HSBC

- Hume Bank

- Illawarra Credit Union Limited

- IMB Bank

- C Payments

- ING

- Intech Credit Union Ltd.

- Klarna Australia Pty Ltd.

- Laboratories Credit Union Ltd.

- Latitude Financial Services

- Lombard Finance

- Macquarie

- ME Bank

- MoneyMe

- Move Bank

- MyLife MyFinance

- MyState Bank Ltd.

- National Australia Bank

- Nexus Mutual

- Northern Beaches Credit Union

- Northern Inland Credit Union

- Nova Alliance Bank

- Once Credit

- Orange Credit Union

- P&N Bank

- PayWith

- People's Choice Credit Union

- Police Bank

- Police Credit Union Ltd.

- Qbank

- QCCU

- Qpay

- Qudos Bank

- RACQ

- Revolut

- RSL Money

- SERVICE ONE Alliance Bank

- Skye provided by FlexiCards Australia Pty Ltd

- South West Slopes Credit Union

- Southern Cross Credit Union

- Spriggy

- Summerland Financial Services Limited

- Suncorp

- Sydney Mutual Bank

- Teachers Mutual Bank

- The Broken Hill Community Credit Union Ltd

- The Mac

- The Mutual Bank

- TransferWise

- UBank

- UniBank

- Unity Bank Ltd.

- Up Money

- Vault Payment Solutions

- Warwick Credit Union Ltd.

- WAW Credit Union

- Westpac Banking Corporation

- Woolworths Group Limited

- Woolworths Team Bank

- Zip

As you can see, not all of these are banks or credit unions. Some, like Afterpay, Klarna or Zip, are buy now, pay later platforms (BNPL); Some are money transfer services like TransferWise or Revolut; or simple payment platforms.

What are the alternatives to Apple Pay?

If you’re an Apple aficionado, it might surprise you to learn there are other types of smartphones out there.

With so many different models of smartphones available from the likes of Samsung, LG and Google, you don’t have to just stick with Apple Pay for mobile wallet services. The main alternatives to Apple Pay are:

- Google Pay: originally launched as Android Pay, Google Pay is Google’s alternative to Apple Pay and is available on most modern Android devices.

- Samsung Pay: Samsung Pay is available with Samsung’s latest smartphones from Galaxy S6 models onwards, as well as Galaxy Watch and Gear smartwatches.

- Garmin Pay: Garmin Pay is a contactless payments solution for people who have a Garmin smartwatch. Paying with your watch can make you look like even more of a big dog than paying by phone like an amateur.

- Fitbit Pay: you can also pay on after doing your morning run with Fitbit pay, which is the same thing just available on Fitbit smartwatches.

Some banks also have their own mobile payment services like Commonwealth Bank’s Tap & Pay. These obviously aren’t as widely available as other mobile wallets.

Savings.com.au’s two cents

Contactless payment technologies such as Apple Pay are fast becoming the new norm in Australia and in many countries around the world where cash is no longer king. Of course, you don’t have to adopt these technologies if you don’t feel comfortable with them. For instance:

- You might be tempted to overspend

- You might still be sceptical about giving another corporate monolith your personal information, especially your credit card details

And that’s okay.

But if you do decide to use Apple Pay, it can be a very easy way to pay for things and can make your life smoother in some ways. If easy payments are important to you, then check out banks that offer Apple Pay or rival payment options like Samsung or Google Pay.

Photo source: Apple

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy

William Jolly

William Jolly

Jacob Cocciolone

Jacob Cocciolone