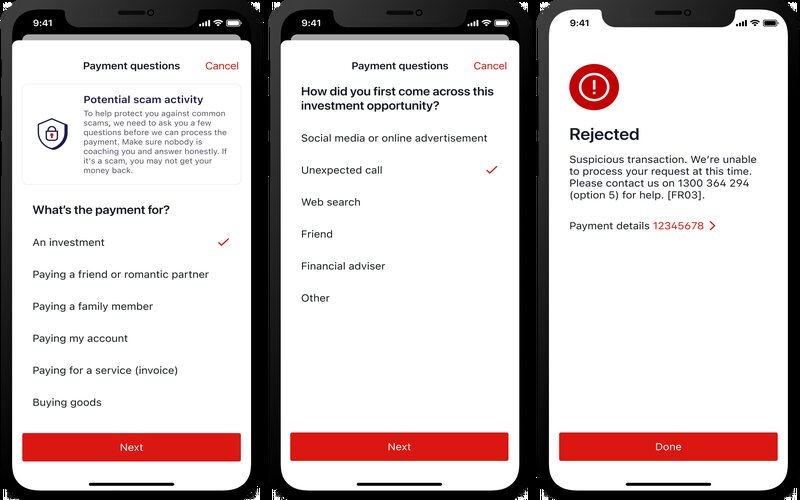

The Westpac SaferPay feature detects new payments with a high scam risk using AI, then asks questions to make a determination on whether the customer is being scammed.

If SaferPay decides the customer is likely being scammed, the payment cannot be processed through the app, the first such feature introduced in Australia.

Westpac Head of Fraud Ben Young called SaferPay a "really important step forward" in combatting scammers.

"Australians are still losing millions of dollars to scams every year," he said.

"This new initiative will target the scam types that we still see lots of people falling for and losing lots of money to; the investment scams, the remote access scams, the romance scams."

The customer will initially be asked about the purpose of the payment: whether it's for an investment, an online purchase, a transfer to a friend and so on.

The follow up questions will be based on the initial response, and will be continually updated based on new scam trends.

Customers who want to go ahead with the payment regardless will need to contact the Westpac Scam Assist team on 1300 364 294.

This forms part of a wider narrative in the payments sector about re-introducing some 'friction' back into the system.

How the process might play out

Winning the war on scammers?

Westpac customer scam data suggests losses are tracking 32% lower this financial year compared to 2023.

Total monthly cases are down 37%, while Westpac recorded the lowest month of scam losses in January 2024 since August '21.

According to the ABS, the number of Aussies victimised by a scam has been tracking down, 2.5% of Australians affected in 22/23 compared to 2.7% in 21/22 and 3.6% in 20/21.

Last year the ACCC launched the National Anti-Scam Centre, where Aussies can find the latest information on how to spot and avoid scams, as well as report the ones they come across.

The Australian Banking Association have also launched a Scam Safe Accord that aims to deliver a "higher standard of protection for customers".

Part of the accord is a $100 million investment into a fresh "confirmation of payee system" to be implemented across all Australian banks.

This means when a customer or business goes to pay someone new or amends an existing payee, they get a message from the bank confirming whether or not the details entered match the account of whoever is being paid.

The Scam Safe Accord also involves more warnings and payment delays, expanding intelligence sharing between banks and more controls to prevent identity fraud.

ABA data is also encouraging, with overall scam losses in the last quarter of '23 down 43% compared to '22.

ABA CEO Anna Bligh however emphasised the importance of staying vigilant to the ever present risks.

"Unfortunately, when one scam disappears another will appear and therefore it’s critical banks, government, telcos, social media platforms as well as consumers continue to work together to stay one step ahead of scammers," she said.

Westpac CEO Peter King called the Scam Safe Accord a "significant step forward", but called for the same protections to be implemented across "the entire scam ecosystem".

"So long as scammers can freely operate across mobile phones, web browsers and social media platforms, Australians remain vulnerable to scams," he said.

"We welcome the work underway by the Federal Government on a mandatory industry code that considers a whole-of-ecosystem approach to effectively tackle this problem."

Read more: More old people scammed because of bank branches closing?

Picture from Westpac

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury

Rachel Horan

Rachel Horan