The CoreLogic Property Pulse for September shows the housing market may have moved off the bottom of a near two-year downturn, although sales activity still remains well below normal levels.

CoreLogic estimates there were nearly 370,000 settled home sales over the twelve months to August 2019.

This is 17% lower year-on-year and is about 30% below the peak seen in September 2015.

Home sales appear to be stabilising: the six-month trend seen above has found at a floor around the same lows seen in 2008 and 2010-12 and has been tracking higher since June 2019.

CoreLogic Head of Research Tim Lawless said such large reductions in market activity has implications on the economy, especially regarding consumption.

“Reduced housing activity implies less spending on retail items such as home furnishings, white goods and appliances,” Mr Lawless said.

“With both values and volumes falling, state government stamp duty revenues have experienced a big hit, and of course we see real estate industry and finance sector participants receiving less income based on lower rates of sale and lower values.”

According to Mr Lawless, there are three key factors that have led to this stabilisation:

- A boost in confidence following the federal election which removed housing tax uncertainty

- Lower mortgage rates and policy changes from APRA that relaxed home loan serviceability restrictions

- An improvement in housing affordability driven by an 8.4% fall in housing values nationally

“Most of the capital cities have seen either a stabilisation in settled sales activity or a rise in the trend rate of sales,” he said.

“Housing turnover is rising the most sharply in Adelaide, with a more subtle improvement across Sydney, Melbourne and Canberra. The trend in sales has stabilised across Brisbane, Perth and Darwin but is still trending lower in Hobart.

“The fact that housing values are now under some upwards pressure while housing turnover remains low presents somewhat of a paradox.”

Treasurer encourages lending

Treasurer Josh Frydenberg warned regulators against being too stringent in enforcing responsible lending standards at The Australian Financial Review’s Property Summit in Sydney today, saying a 10% increase in house prices could boost the GDP by 0.5%.

“It’s in everyone’s interest that the aspirations of hard-working families are not collateral damage in this regulatory process,” Mr Frydenberg said.

“If responsible lending laws are applied too stringently, they will also negatively impact consumer behaviour.

“Clearly, the risk that the provision of credit may cause substantial hardship to some should not result in a significantly reduced ability to access credit by the vast majority of borrowers.”

Pleased to deliver the keynote address at the @AFRproperty summit in Sydney today. I spoke about the importance of a strong housing market & Government initiatives to support the sector by boosting supply & demand. @MichaelSukkarMP

— Josh Frydenberg (@JoshFrydenberg) September 26, 2019

Read my speech here: https://t.co/y5nE2iftFn pic.twitter.com/1g4z4MGCP6

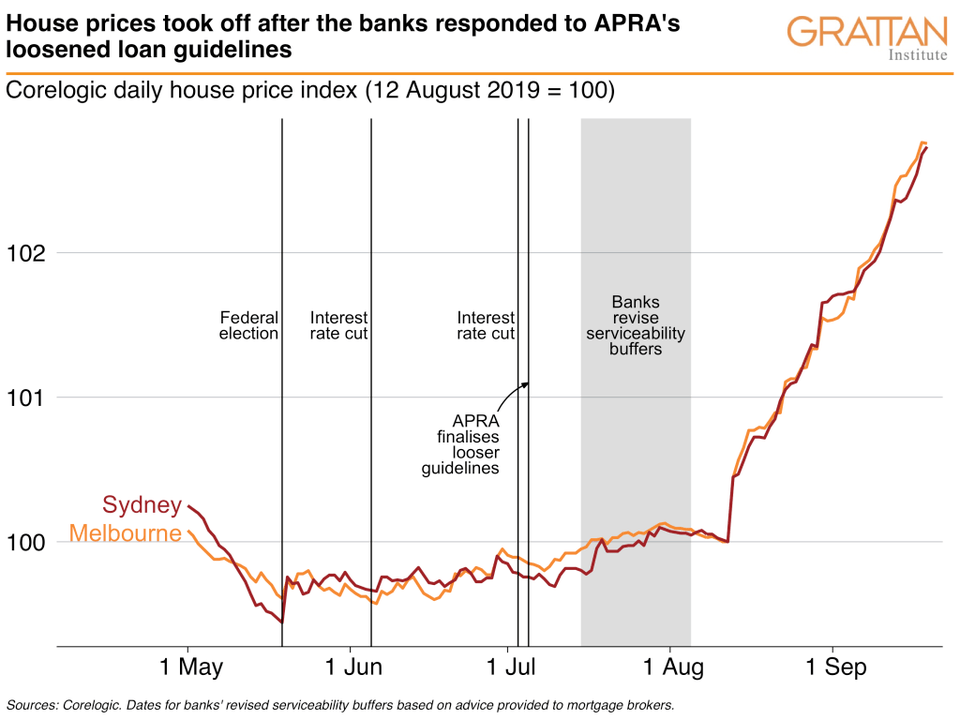

The Australian Prudential Regulation Authority did remove its 7% interest rate floor in May, which meant banks assessed if a borrower could afford repayments at that rate.

This 7% rate is much higher than current mortgage rates, which is why it was scrapped.

Westpac and ANZ quickly cut their serviceability rates shortly after, while Westpac cut its serviceability rate for a second time just this week to 5.35%.

This graph from the Grattan Institute shows the change in banks’ serviceability buffers has already had a massive impact on house prices.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper