Regional migration is seemingly back on the agenda. The latest Regional Movers Index report from CommBank and the Regional Australia Institute (RAI) showed city-to-regional relocations are now 19.8% above pre-pandemic averages – at their highest level since 2022.

"As a nation, we must acknowledge we are in a new era of migration where regional Australia is at the forefront," RAI CEO Liz Ritchie said.

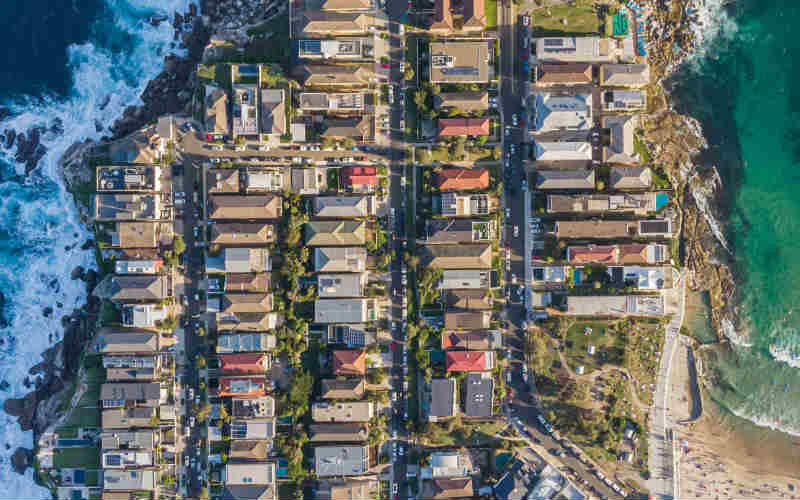

As one of the nation’s premiere regional spots, the Central Coast could be one of this new era's largest beneficiaries. The beaches are beautiful, Sydney and Newcastle aren’t too far away – interest in Central Coast property doesn’t appear to be going anywhere.

After an indifferent couple of years, property prices have started to pick back up on the Central Coast.

Take Killarney Vale for example, where the median house price hit $917,500 in July ‘22 before dropping 13% to $800,000 by June ‘23. As of November, houses in Killarney Vale are back to an average of $887,500 and are reapproaching their peak.

If you’re exploring relocating, or even investing, these are the Central Coast suburbs experts are tipping for a big 2025.

All median house and unit price data is from realestate.com.au and was accurate as at December 2024.

Narara (2250)

| Property Type | Median Price (November 2024) | Annual Growth | Median Weekly Rent (November 2024) | Annual Growth |

|---|---|---|---|---|

| Houses | $928,000 | 6.1% | $650 | 9.2% |

| Units | $634,000 | 0.7% | $555 | 5.7% |

Buyer's agency Hello Haus' data-driven approach identified Narara as a top pick.

"We prioritise high-confidence data areas that demonstrate strong affordability, low supply levels, and growing demand metrics," Hello Haus analyst Samuel Powell explained.

"This is key to identifying locations likely to outperform the Australian average growth rate."

Narara is located about 15 kilometres inland, so property tends to be relatively inexpensive compared to more coastal suburbs. It still experienced decent growth through 2024 though, and Mr Powell says the numbers point to further price increases next year.

"Low stock on market and inventory levels suggest high demand in Narara," he said.

"The strong clearance rate reflects robust market health while a favourable IRSAD [Index of Relative Socio-economic Advantage and Disadvantage] score indicates a stable socioeconomic environment."

McMasters Beach (2251)

| Property Type | Median Price (November 2024) | Annual Growth | Median Weekly Rent (November 2024) | Annual Growth |

|---|---|---|---|---|

| Houses | $1,844,000 | -9.6% | $800 | -1.8% |

| Units | - | - | - | - |

If you’ve got the means to buy a multi-million dollar property, the Central Coast is probably appealing. There are jaw-dropping houses in blue-chip suburbs like Terrigal, Wamera, or Avoca Beach available for a fraction of what an equivalent property would cost in Sydney.

For those who can afford it, local agent Baroka Leporte says McMasters Beach is another "hidden gem" for premium property that could be primed for growth in the coming years.

"McMasters has about 850 homes… it’s a very quiet little isolated nook," he told Savings.com.au.

"It’s a five-minute drive to Kincumber which is the nearest shopping centre area, but you feel like you could be hours away."

"There’s a lot of beautiful preserved shacks that have been there since the '50s and '60s that are meticulously maintained, but still very original… a lot of people buy into the area for nostalgia."

The median house price in McMasters Beach dipped in 2024 to sit below $2,000,000 after nearly doubling between the end of 2019 and 2022. Mr Leporte says buyers who can get in now can benefit from "very strict developmental controls" that may limit future supply in McMasters.

"You don’t see new units or townhouses going up; if there’s a knock-down rebuild it’s an architectural home free-standing," he said.

Kincumber (2251)

| Property Type | Median Price (November 2024) | Annual Growth | Median Weekly Rent (November 2024) | Annual Growth |

|---|---|---|---|---|

| Houses | $1,150,000 | 14.1% | $660 | 10% |

| Units | $595,000 | -7% | $500 | -5.7% |

Unlike McMasters, which exists in the same postcode, Kincumber saw significant house price growth over the past year, growing 14.1% according to realestate.com.au.

"There’s so many families buying now that the schools can’t keep up," Mr Leporte said.

Nevertheless, he’s tipping Kincumber prices to keep growing in the coming years.

"For people that are looking for a high growth suburb, Kincumber is a great spot," he said.

"The median house price has gone from about $700,000 to $1 million [since pre-pandemic] but there’s still good value there… it’s the gateway to the beach."

Long Jetty (2261)

| Property Type | Median Price (November 2024) | Annual Growth | Median Weekly Rent (November 2024) | Annual Growth |

|---|---|---|---|---|

| Houses | $1,285,000 | 16.8% | $560 | 1.8% |

| Units | $650,000 | -12.8% | $495 | 3.1% |

The final premium suburb tipped for growth next year is Long Jetty, located on the northern side of the coast. If you happened to read last year's edition of Central Coast 'burbs to watch, you might remember that Long Jetty came up then too, tipped by buyers agent Linda Johnson.

"Long Jetty is gaining attention for not only its natural beauty but its transformation into a trendy hub … making it a sought after location for those looking for a peaceful yet well-connected lifestyle," Ms Johnson told Savings.com.au last year.

For house prices, it turned out to be a great call, with the area realising 16.8% growth over the twelve months to 2024, and Mr Leporte is tipping it once again this time around.

"It’s attracting a lot of people from the trendy suburbs of Sydney that want that lifestyle, they want to pay half what they would in Redfern or Newtown," he said.

Killarney Vale (2261)

| Property Type | Median Price (November 2024) | Annual Growth | Median Weekly Rent (November 2024) | Annual Growth |

|---|---|---|---|---|

| Houses | $888,000 | 7.6% | $580 | 5.5% |

| Units | - | - | $425 | 3.4% |

Killarney Vale has also featured in past versions of our Central Coast suburbs to watch. Like Long Jetty, last year’s recommendation of Killarney Vale came good, with the area’s house prices climbing 7.6% over the year to November to reach $888,000.

Mr Powell says the underlying numbers suggest Killarney Vale property prices could be on track to continue climbing – perhaps reaching or eclipsing their previous peak.

"Quick sales with an average of 25 days on market indicates strong demand," Mr Powell said.

"Low stock on market and inventory levels signal potential for price increases."

Hamlyn Terrace (2259)

| Property Type | Median Price (November 2024) | Annual Growth | Median Weekly Rent (November 2024) | Annual Growth |

|---|---|---|---|---|

| Houses | $900,000 | 5.9% | $650 | 1.2% |

| Units | $617,000 | -6.6% | $570 | 1.8% |

Also on the northern end of the coast, Hamlyn Terrace was another data-driven pick from Hello Haus.

"The IRSAD score of 1000 indicates a socially advantageous area, enhancing the desirability," Mr Powell said.

For investors, the renter-to-owner ratio is 33%, which Mr Powell says is "opportune."

"[It] hints at a balanced demand from rental and ownership perspectives," he said.

Buff Point (2262)

| Property Type | Median Price (November 2024) | Annual Growth | Median Weekly Rent (November 2024) | Annual Growth |

|---|---|---|---|---|

| Houses | $815,000 | 8.8% | $530 | 1.9% |

| Units | - | - | - | - |

Buff Point is on the northern side of the Budgewoi Lake and north-east of Buff Point. House prices grew 8.8% in 2024, but the median is still around $800,000, making it another more affordable spot.

It was another to tick several boxes for Hello Haus – the IRSAD score is decent, stock on market is low, and at 3.5% the rental yield for property investors isn’t too bad.

At the same time, the clearance rate is 50%, which Mr Powell calls "below ideal levels."

"This could indicate either overpricing or a market struggling to maintain buyer interest," he said.

Nevertheless, inventory levels are lower than many other areas.

"This suggests homes are selling relatively quickly, hinting at healthy demand," Mr Powell said.

Advertisement:

Looking to buy? Here are some of the top home loans available in Australia

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Row Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.79% p.a. | 5.83% p.a. | $2,931 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | |||||||||||

5.74% p.a. | 5.65% p.a. | $2,915 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | |||||||||||

5.84% p.a. | 6.08% p.a. | $2,947 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure |

Image by icentralcoast

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan