The regulator released a consultation paper on Tuesday on the first proposed use of its new product intervention power – powers that would allow it to intervene where financial and credit products result in ‘significant consumer detriment’.

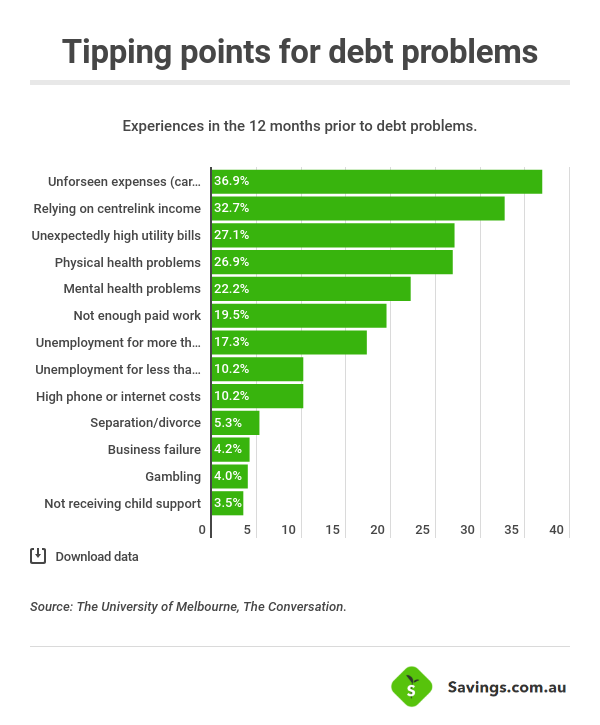

In its paper, ASIC states it considers significant consumer detriment may arise in relation to short term credit providers charging high costs to vulnerable customers, which could be those on low incomes or in financial difficulty.

And its first target is two firms – Cigno Pty Ltd and Gold-Silver Standard Finance Pty Ltd.

These short-term credit providers charge substantial fees under separate contracts, which can add up to as much as 990% on the original loan amount.

Source: Consumer Action

Companies such as Cigno claim to be ‘agents’ rather than lenders and arrange cash loans up to $1,000.

Due to the structure of its ‘loans’, Cigno is not regulated in the same way other payday lenders are.

Here’s a table listing the fees Cigno can charge on any given loan.

| Fee | Amount |

|---|---|

| Lender fee | 5% of loan amount (One-off payment) |

| Financial supply fee | See below |

| – 1 payment loan | 35% of loan amount |

| – 2 payment loan | 45% of loan amount |

| – 3 payment loan | 60% of loan amount |

| – 4 payment loan | 75% of loan amount |

| Account keeping fee | $5.95 per week |

| Same day deposit fee (optional) | $16 |

| Priority transfer fee (optional) | $16 |

| Extension of first payment fee (if requested) | $20 |

| Change of date & amount fee (if requested) | $20 |

| Payment Reschedule Fee (if requested): | $30.00 |

| Collections Phone Contact Fee: | $8.80 |

| Collections Tracking Fee: | $50.00 |

| Investigator/Hand Over Fee: | $175.00 (plus legal fees) |

| 1st Dishonour Letter Fee: | $30.00 |

| 2nd Dishonour Letter Fee: | $50.00 |

| 3rd Dishonour Letter Fee: | $50.00 |

| Dishonoured Payment Fee: | $49.00 |

Source: Cigno

ASIC Commissioner Sean Hughes said they’d already seen too many examples of significant harm affecting vulnerable members of the community through this short-term lending model.

“Consumers and their representatives have brought many instances of the impacts of this type of lending model to us,” he said.

“Given we only recently received this additional power, then it is both timely and vital that we consult on our use of this tool to protect consumers from significant harms which arise from this type of product.

“Before we exercise our powers, we must consult with affected and interested parties.”

“Intervention well overdue”

The Financial Rights Legal Centre (Financial Rights) welcomed ASIC’s announcement they’ll be cracking down on short-term credit providers like Cigno.

Financial Rights’ Chief Executive Officer Karen Cox said they had regularly seen “shocking” examples of vulnerable people being charged ridiculous fees.

“We have seen examples where these companies have demanded between 146% and 952% of the original amount borrowed. A large proportion of our clients owe 400% of the amount they originally borrowed or more,” Ms Cox said.

“This exploitation is way outside of the boundaries of acceptable behaviour.”

According to Ms Cox, many of the people Financial Rights speaks to end up using these providers because they’re unable to access mainstream credit sources (like credit cards or personal loans) to help with their debts.

“A significant proportion are referred to these lenders after being rejected for other pay day loans because it is clear they cannot afford to repay them. Many of our clients have illnesses, disabilities or addictions,” she said.

“These business models blatantly exploit vulnerability and financial hardship for profit.

“Intervention in this space is well overdue and we are pleased to see ASIC proposing to take action here and particularly pleased to see ASIC take on this business model which targets some of the most vulnerable people in Australia as their very first use of the product intervention powers.”

“Time is up” for predatory lenders

Consumer Action Law Centre (Consumer Action) CEO, Gerard Brody has also welcomed the announcement by ASIC, saying Consumer Action is glad Cigno is now in the regulator’s crosshairs.

“Since 2015, Consumer Action’s legal practice has provided legal advice in relation to Cigno 117 times, including 37 times since the start of the year”, he said.

“Many of the people contacting us, including financial counsellors supporting vulnerable clients, complain about unaffordable and exploitative loans facilitated by Cigno”.

“The message for Cigno and similar business models is time is up: you can no longer use tricky business models to avoid the law.”

Neither Cigno or Gold-Silver Standard Finance have released statements at the time of writing.

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy

William Jolly

William Jolly