For the past few months, it seems like every man and his dog have been making house price predictions. Some have gone so far as to predict house price falls of 40% (worst case scenario) but most predictions fall between price dips of 10-15%.

The common consensus seems to be that house prices will go down - the question is by how much.

We can’t predict the future but it can be helpful to look at how previous recessions have impacted property prices to get an idea of what might happen this time.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner-occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Row Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.79% p.a. | 5.83% p.a. | $2,931 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | |||||||||||

5.74% p.a. | 5.65% p.a. | $2,915 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | |||||||||||

5.84% p.a. | 6.08% p.a. | $2,947 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure |

In this article, we’ve explored how house prices in Australia were impacted by the ‘recession we had to have’ in the ’90s to the Global Financial Crisis of 2007-2009, and what the impact could be after COVID-19.

What happened to house prices in the 90’s recession?

The last time Australia was in a recession, it was the early 1990s and The Fresh Prince of Bel-Air had been aired on TV for the first time.

Famously dubbed the ‘recession we had to have’, anyone under the age of 35 (including yours truly) is probably too young to remember it, but the history books show it was a severe and drawn-out recession - the catalyst being the Black Monday share market crash of 1987.

According to data from the Australian Bureau of Statistics (ABS), house prices had been fairly flat around the country before the recession hit.

But during the recession, house prices didn’t plunge. In fact, as you can see from the graph below, house prices even rose slightly during the midst of the recession.

According to Propertyology, the median house price in Brisbane grew 6.8% in the 1991 recession year, while house prices in Hobart grew by 4.3%.

But the biggest exception was in Melbourne, where the median house price fell -2.3%. Melbourne prices didn’t seem to recover until the mid to late 90s.

PRD chief economist Dr Diaswati Mardiasmo says house prices remained relatively stable during the 90's recession because the stock market crash resulted in an increase in interest rates from other countries.

“Because of this, many pulled out their monies from the stock market to avoid further volatility and put it into the real estate market,” Dr Mardiasmo told Savings.com.au.

“We have to remember that we had a real estate boom prior to our recession – Australia had a big economic reform in the 1980s and, most importantly, credit was quite readily available from banking deregulation.

“We had a significant increase in property prices in the 1980s, to the extent that the government had to introduce capital gains tax and higher interest rates.”

Dr Mardiasmo says it was this combination of a strong property market in the mid to late 80s and a 40% decline on the ASX (which led to people pulling their money out of the stock market and into real estate) which protected house prices when the 90s recession hit.

Meanwhile, data suggests regional areas roared during the 90s recession. Propertyology research reported that, in 1991, median house prices in Rockhampton and Shoalhaven climbed by 20%, Goondiwindi 19%, Kempsey 18%, Newcastle and Mackay 17%, Wagga Wagga 13% and Tamworth 15%.

“These regional places had their own economy growing, however, were more protected from shocks,” said Dr Mardiasmo.

“Not many of their companies and businesses were listed on the ASX back then, so not so much impacted by international markets, and deemed ‘safer’.”

What happened to house prices in the GFC?

While Australia avoided a technical recession (two consecutive quarters of negative GDP growth) during the Global Financial Crisis, the impacts of the crisis were short but sharp.

Before the GFC, interest rates had been steadily climbing and so were home loan interest rates. Because home loan interest rates were so high (around 9%) it became too expensive to take out a mortgage, and so house prices began to drop.

In the months preceding the GFC, the Reserve Bank of Australia (RBA) raised the official cash rate to 7.25% (unthinkable these days!) and held it there until mid-September 2008 when the crisis hit.

The RBA’s sharp cuts to the cash rate - along with a boosted first home buyer grant and other federal government stimulus - helped stop the rot in property prices, seemingly turning them around and sending them on a bull run for several years.

According to CoreLogic data, the average capital city property price fell 7.6% over 13 months from peak to trough (mid-2007 to early 2009) during the GFC.

Property Investment Professionals of Australia (PIPA) chairman Peter Koulizos said each capital city also experienced falls in house prices in the five years after the GFC, but some more than others.

“Hobart suffered the most with only 1.7% increase in property prices from 2009 to 2014 but Sydney was the least impacted as property prices were 39.7% higher in the same period,” Mr Koulizos told Savings.com.au.

The post-GFC drop in property prices was particularly pronounced in 2011 with falls across all capital cities, as you can see from the graph below.

Soon after the GFC hit, the Rudd government introduced a number of stimulus measures to shield the economy. This included first home buyers grants and the now infamous pink batts scheme (also known as Kevin Rudd’s Home Insulation Program).

“All of these initiatives worked to some extent but by 2011, all this had been spent. In effect, this stimulus money had delayed the effect of the GFC on the Australian residential property market by three years,” Mr Koulizos said.

But house prices recovered quickly as the Reserve Bank rapidly cut interest rates.

On top of this, a low Australian dollar and an ongoing mining boom meant the economy was already in pretty good shape before the GFC hit.

What does COVID-19 mean for the property market now?

Unlike the conditions leading up to the GFC, the economy was already pretty weak heading into COVID.

Even though Treasurer Josh Frydenberg had been gearing up to deliver the first surplus in a decade right before COVID-19, Australia had been experiencing subdued levels of inflation, slow GDP growth, stagnant wages growth and poor retail sales, not to mention the mining boom had ended.

House prices began falling in 2018 as accusations of irresponsible lending forced lenders to tighten up their lending criteria. In mid-2019, the house price falls bottomed out and had started to recover in the months leading up to COVID.

The Reserve Bank cut the official cash rate three times in 2019 (June, July and October) and twice more in the same month of March 2020, which marked the first out of cycle rate cut the central bank has made since 1997.

The Reserve Bank also unleashed an unconventional monetary policy similar to quantitative easing (QE) for the first time ever in Australia. The emergency cash rate cut and implementation of the QE-like program were desperate last-minute moves by the Reserve Bank to soften the economic blow from the pandemic. Time will tell how effective these were in curtailing the damage.

Because the Reserve Bank has effectively spent much of its monetary policy ammunition (they have signalled they will not take the cash rate into negative territory) founder and CEO of Metropole Property Strategists Michael Yardney says further government stimulus is needed to assist the property market.

“As the RBA cannot really lower interest rates further, our economic recovery and the future of our property market will depend upon fiscal stimulus from our governments to encourage our economy to get moving again,” Mr Yardney told Savings.com.au.

The federal government has already announced numerous stimulus measures including the HomeBuilder scheme, but it’s too early to say what impact this could have on house prices.

Property investment adviser Niro Thambipillay from investmentrise.com.au says that even though the Reserve Bank is extremely unlikely to cut interest rates any further, quantitative easing could give the property market a boost.

“The increased funds that banks now have, as a result of QE, will lead them to drop their retail interest rates and they will have a larger appetite for lending,” Mr Thambipillay told Savings.com.au.

“I expect this will spur property markets forwards and that once the economy is opened up, we could very easily see the start of another very strong upturn in property prices.”

Dr Mardiasmo added that knowing interest rates won’t be moving in either direction any time soon gives people stability in their decision making, which could also be good for the housing market.

“There will be fewer thoughts of ‘holding off’ to wait in case of a cash rate cut, as well as fewer thoughts of 'maybe not now' in fear of a cash rate increase (thus higher mortgage payments),” Dr Mardiasmo said.

“Because of this, there is less chance of fluctuation in demand in the market, allowing the market to continue to perform.”

What will happen to house prices after COVID?

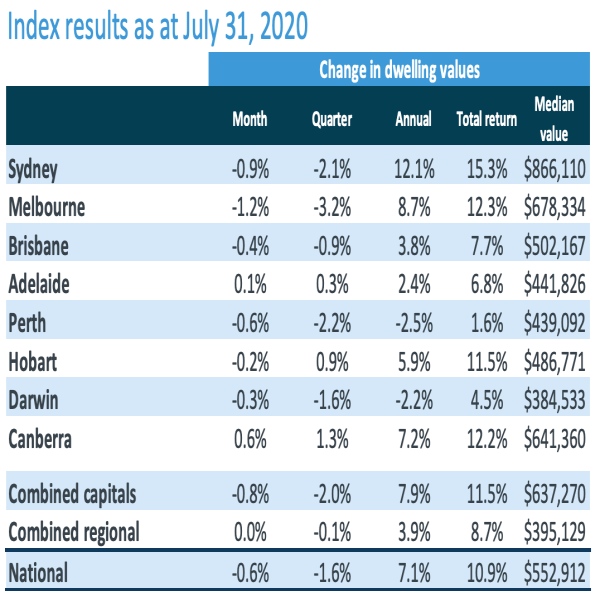

Melbourne’s property prices dropped 3.2% over the July quarter - the biggest fall of any capital city during COVID-19 so far.

CoreLogic head of research Tim Lawless said the second wave of the coronavirus has spooked buyers and sellers.

“Consumer sentiment is again weakening due to concerns associated with the second wave of the virus in Melbourne, and growing case numbers nationally and internationally,” Mr Lawless said.

“Consumer sentiment readings show a high correlation with housing market activity, so the recent downward trend implies home buyers and sellers may once again retreat to the sidelines.”

Source: CoreLogic

But he said housing markets across the country had remained relatively resilient to the impacts of COVID-19.

“The impact from COVID-19 on housing values has been orderly to-date, with CoreLogic’s national index falling only 1.6% since the recent high in April and housing turnover has recovered quickly after its sharp fall in late March and April," Mr Lawless said.

“Record low-interest rates, government support and loan repayment holidays for distressed borrowers have helped to insulate the housing market from a more significant downturn.”

Nationally, property prices have only fallen 1.6% over the three months to July while some areas even saw price growth. Hobart, Canberra and Adelaide continued to trend higher, posting gains of 0.9%, 1.3% and 0.3% respectively.

But with the staggered reductions to JobKeeper and JobSeeker to begin in late September, and home loan repayment holidays set to end in March, the outlook for the property market remains uncertain.

“Urgent sales are likely to become more common as we approach these milestones, which will test the market’s resilience," Mr Lawless said.

Mr Yardney noted that the key factor propping up house prices so far is that few people have been forced to sell their homes due to losing their jobs or having their incomes cut.

“This has been enabled by the government’s financial support packages assisting households whose income has fallen, in combination with banks allowing people in financial difficulties to defer mortgage repayments.”

But fears of a 30% price crash are extremely unlikely to eventuate.

Mr Thambipillay said record low-interest rates combined with a lack of stock on the market will keep prices from plunging.

“For prices to fall substantially, there has to be a huge supply of properties on the market and very little demand. This has not turned out to be the case,” Mr Thambipillay said.

“Property owners are holding onto their property and waiting for things to get better.”

How far house prices fall is anyone’s guess, but the common consensus seems to be that prices will fall modestly overall, while some areas will remain steady.

Mr Koulizos said, “Only time will tell what happens to property prices post COVID-19 but my bet is that they will drop by about 5% to 10%.”

Impacts of COVID-19 on different segments of the property market

Mr Yardney also forecasts overall price falls of 10% but points out that Australia is not one big property market.

“The problem with making these types of forecast is lumping all properties together,” Mr Yardney said.

“There is not one Australian property market. In fact, there’s not one Sydney or Melbourne property market either.

“There are markets within markets dependent upon price point, type of property and geographic location.”

Mr Yardney says prices will fall harder depending on the type of property:

-

“Investment-grade” properties and A grade (above average) homes could fall in value by around -5%

-

“B grade (average) homes could fall in value by up -10-15%,

-

“C grade (less than perfect) will be the hardest hit as there will be a flight to quality.

“But this will be on very low levels of transactions and the pace of recovery from that point will depend on the state of the wider economy,” Mr Yardney said.

Lending policy and interest rates are the key to house prices

Mr Koulizos said how much further property prices fall depends on a number of factors, including interest rates and lending policy because prices tend to rise when it’s easy for people to borrow money.

“Unlike many years ago when falling interest rates increased demand for property and caused property prices to rise, the most recent drops in the cash rate have not increased demand because consumer confidence is very low,” Mr Koulizos told Savings.com.au.

“What will assist property prices to increase is if the lending institutions change their policies so as to make it easier to borrow money.

“As was shown in 2011 the availability of the stimulus money had dried up and caused property prices to fall. If the availability of credit from lending institutions is increased, this can stimulate demand for property and in turn, put upward pressure on prices.”

When property prices fell during 2018-2019, interest rates were low but lending policy became a lot tighter, making it harder for people to borrow money.

Since then, the Australian Prudential Regulation Authority (APRA) loosened some of those regulations and this, combined with record-low interest rates, saw property prices rise leading up to COVID.

Savings.com.au’s two cents

Unlike previous financial crises, our economy was already in a pretty weak position, and then the bushfires happened and COVID came out of nowhere, taking crisis levels from 0 to 100. This makes it hard to predict what may happen with house prices, but looking at past events can help. While there’s obviously no guarantee that history will repeat itself, previous economic crises can be useful guides when trying to forecast future events.

House prices aren’t immune to recessions and it seems there is no doubt that property prices will be negatively impacted by COVID-19 when you take a look at what happened during previous economic downturns and what has already happened to property prices since COVID hit.

However, history has also shown us that the Australian housing market has been resilient during periods of economic downturn. Savings.com.au will stay on top of what’s happening with house prices and bring you the information you need to know.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

William Jolly

William Jolly

Harrison Astbury

Harrison Astbury