A few years back, some friends and I moved out for the first time. The house had an electric gate, for which we were given one remote between five of us. We were assured several more had already been ordered and would arrive in a matter of days.

Twelve months later, when the lease expired and they still hadn’t turned up, we began to suspect our landlord might have been a bit dishonest with us. There were a variety of other major issues with the house that we contacted the property manager and landlord about, sending emails that took full moon cycles before receiving a reply. My housemate’s bedroom was missing whatever makes doorframes waterproof, so any rain put his room several inches underwater. This complaint took long enough to receive a concrete response that we ended up just fixing it ourselves.

It was enough to make anyone a bit revolutionary, and I was encouraged to read the following release last month from Joel Dignam, Executive director of tenant advocacy group Better Renting, which laid bare the extent landlords have become Enemies of the People.

"Our analysis…shows that over one in two rental properties are held by a landlord owning an average of 2.6 investment properties. These are the same wealthy investors being subsidised by billions in tax handouts, while renters are choosing between feeding their children and paying the gas bill.

“I think most of us struggle to understand just how well off landlords actually are. If you’re a home-owner struggling with mortgage repayments, you have much more in common with the renter next door than someone who owns their own home plus two others.”

Mr Dignam also revealed that overall profits for landlords in 2020/21 exceeded $10 billion. He is one of many calling for a freeze on rental increases to protect tenants.

“This would create some breathing space for struggling renters while governments work together on a systemic solution,” Mr Dignam said.

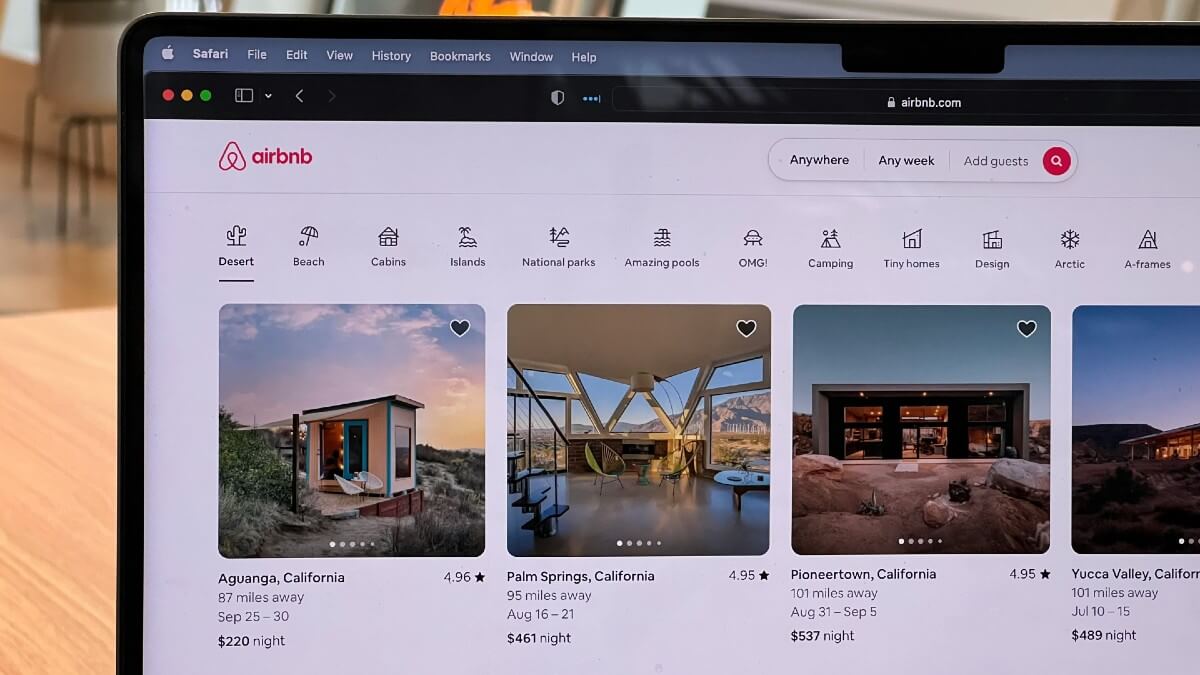

The average tenant is paying over 10% more in rent than last year, and most analysts agree Australia is in the midst of a housing crisis. People all over the country are struggling to find affordable properties, and homelessness is on the rise. Many are indignant about the landlords who are presumably making money head over fist out of the situation. Sympathy for the hard left, who have long maintained landlords are inherently parasitic, is probably as high as it’s been for a long time.

Data from Core Logic's rental report for the June '23 quarter

Are landlords really the enemy?

Before we get cracking with establishing the People’s Republic of Australia, it’s probably worth looking at the issue from the other side. Rental rates have increased dramatically, but that could be at least partially a response to mounting landlord expenses. After twelve successive increases to the cash rate, average mortgage repayments have risen dramatically, while inflation has pushed up maintenance costs and other related expenses.

Simon Pressley of Propertyology recently crunched the numbers, and concluded the average investment property owner has seen annual losses almost double, from $13,600 to $25,000. He is a vocal advocate for property investors, and lays the blame for the rental crisis at the feet of policy makers, who have spent the past few years “hitting investors with the baseball bat.”

In a fiery response to Queensland’s decision to cap rental increases at one per year, Mr Pressley said limiting the earning potential of rental properties would see investors sell up, and leave tenants with nowhere to go.

“As existing rental suppliers process [the Queensland Government’s rental cap], plenty will regard it as the ‘final straw’ and sell,” he said.

“When they do, tell me how this government decision helps the occupant of that property who has nowhere else to rent.”

He might have a point. CoreLogic recently revealed that while overall selling activity for June was nearly 20% lower than the decade monthly average, investor listings are only 2.9% lower. In Sydney, Melbourne and Perth, investor listings were actually above the previous average. Property Investment Professionals of Australia (PIPA) say the net average annual number of people with rental property incomes has fallen 55 per cent in the past five years.

“PIPA has been warning for nearly a decade about the negative impacts of market intervention on rental markets, starting with the APRA lending restrictions that came into effect in 2015, and now a variety of rent caps or controls,” PIPA Chair Nicola Mcdougall said.

With more investors leaving the market, the supply of rental properties decreases. Rental vacancy rates throughout the nation are hovering at near historic lows, which could well have been a significant contributor to soaring rental rates. If we really want to help beleaguered tenants across Australia, many would argue the evidence suggests we need more landlords, not less.

…What about no landlords at all?

So in practice, it’s possible going after investment property owners could be worse for renters in the long haul. If we zoom out though, some people question whether we should have landlords in the first place. While the Greens and Australia’s left are currently focused on policies that freeze rental increases, you just need to search ‘abolish landlords’ on Reddit to find an abundance of people who argue owning property you don’t live in is inherently wrong.

“Rent is theft. Landlords do not actually produce anything or provide any meaningful work. The building has already been built and the workers paid,” says one user.

It’s unclear how this would operate in practice. A single entity, be it the Federal or State government or even local councils would probably need to take control of all the rental properties in Australia. Dr Diaswati Mardiasmo, Chief Economist at PRD research, talked to Savings.com.au about what something like this could look like. She said an important consideration straight off the bat would be who controlled this new industry.

“The worry from many is that if [all rental properties] are controlled by a government or government-controlled commission they would probably give preferential treatment to their political allies and supporters in an attempt to gain more votes and hold on to power,” she told Savings.com.au.

Having the government control the rental market would be centralising authority in Australia in a manner that would make many people uneasy, but let’s say for arguments sake though we trust the powers that be not to go full Mao Zedong. There would need to be price ceilings and floors for rental rates, which Dr Mardiasmo suggested might be based on median family income, with regular adjustments for CPI inflation. There would likely need to be geographical considerations as well: it would be absurd for renters in Sydney to not pay substantially more than in rural parts of New South Wales, for example, so supply and demand would likely still need to play a role in determining rates.

In the long run, how would it all play out? Well, Dr Mardiasmo doesn’t think it would be great.

“The entire housing market would probably collapse,” was her blunt assessment.

“Investors would have to get out of the market, which means selling already available rental stock. If there was a buyback system, this would cost billions of dollars.”

“This would have a profound effect on the entire property market, not just for renters but for owner occupiers as well.”

“Property values would fall dramatically.”

She also pointed out getting rid of the rent industry would have ramifications reaching far beyond tenants and landlords.

“There are also the tax implications as state governments earn billions each year from property tax and investment properties are taxed at a higher rate than owner occupied. Less money coming into the government through tax means less services for the community.”

“The current rental system involves a multitude of stakeholders: property managers, handymen and maintenance people, investment loan specialists, investment insurance specialists, and many others.”

“Managing these stakeholders and transitioning them to another system would prove to be challenging.”

Dr Mardiasmo highlighted build-to-rent (BTR) programs as a less extreme way for the government to get involved in the rental market. However, she said that the evidence of these programs suggested even if the transition to a new landlord-free system somehow worked, renters would not necessarily be better off.

“Build-to-rents charge a premium rent compared to the suburbs’ median, due to higher costs on all aspects construction, design, management, et cetera,” she said.

“Even if you are able to assess the 'affordable' housing part of the BTR, this is only 25% off the premium rent, thus more often than not still higher than the suburb median rent, and is only available for a limited amount of stock.”

Leaving aside the practical concerns, this then might be the question for tenants to answer: is it worth paying a premium rental rate in exchange for guaranteed properties and less unpredictable price changes?

Savings.com.au’s two cents worth

To sum up, tenant advocates say the solution to the rental crisis is more restrictions on landlords, while the property industry says we need less. Shocking. The broader philosophical question about whether it’s right to charge rent at all depends on your politics, and it’s definitely not one I have an answer for.

In practice, renting has become an essential part of the Australian property market. There’s clearly demand for temporary housing, so for now, landlords are here to stay. Like many political issues, the battle lines are drawn in concrete, and there’s often an ‘us and them’ mentality. Tenants like me feel exploited by landlords, who believe renters are ignorant to how expensive owning an investment property has become.

Maybe the solution is for renters and landlords alike to recognise each other's humanity and agree to blame Phil Lowe and the RBA instead.

Picture by Alex Block on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Arjun Paliwal

Arjun Paliwal