The property market can seem like a jungle when you begin your quest to purchase a home. One of the first big decisions is likely to be which kind of property you should be searching for – an apartment, a townhouse, or a freestanding home. There’s no easy answer because each has its benefits and drawbacks. As with many aspects of home buying, it all depends on your individual needs and circumstances.

The market too is everchanging. What types of homes are available at your price point, and in the area you'd prefer, will hold huge sway on what home you end up buying. Let's check the stats.

What the numbers say

Many aspects of home ownership in Australia are changing. The last census showed 70% of all dwellings in Australia were separate houses, 17% were medium-density dwellings (semi-detached and townhouses), and 11% were high-density dwellings (apartments and flats). Yet separate houses as a proportion of housing stock continues to shrink while medium- and high-density dwellings account for a growing share of the market. Not surprisingly, this is far more pronounced in Australia's greater capital cities where space is at a premium.

The graph below shows the change in dwelling types being built in Australia over the last two census periods, with by far the greatest rate of growth in high-density apartments.

Source: ABS Census, 2011, 2016, 2021

In 2010, just 27% of homes being built were apartments compared to half of all new homes 10 years later, according to the ABS. In another reading of the data, there is now one occupied apartment for every five occupied separate houses in Australia. That compares with one to every seven back in 1991.

What is driving apartment living?

Once the domain of singles, young couples, and downsizers, apartments are now increasingly home to families too. As housing prices have skyrocketed post-pandemic, more people are embracing apartment living as a long-term lifestyle instead of a temporary stepping stone to detached homes. University of New South Wales research found one in five apartment dwellers are now families with children.

Domain's House Price Report, published in February 2024, found the price gap between median house and apartment prices has widened tremendously post-pandemic, with some cities now seeing a 100% price difference.

Source: Domain

Domain's chief of research and economics Nicola Powell said before the pandemic, the 'natural balance' between house and apartment prices saw houses around 40-50% higher.

Yet the shift to apartment living is not just being driven by price. Urban geographer Sophie-May Kerr from the University of New South Wales said social norms of the 'ideal' type of property to live in are changing.

"There are a range of things going on," she said. "Apartment living is a result of a combination of affordability pressures but also lifestyle factors, so things like wanting to prioritise living close to work or transport routes or amenities within the city."

What about townhouses?

While apartment living is statistically on the rise, townhouses are becoming an increasingly popular choice for both homeowners and developers. Buyers priced out of the detached home market can opt for the happy medium of a townhouse. ABS data shows the proportion of medium-density dwellings been consistently trending higher on a national basis over the last 25 years.

In some areas, however, the growth has been exponential. Townhouse approvals in Australia's most populous states, New South Wales and Victoria, grew by around 120% in a six-year heyday period from 2011 to 2017. In the current market, as at May 2024, townhouses remain the primary choice for new attached dwelling construction with larger multi-apartment developments feeling the effects of increased building and capital costs for developers, as illustrated below:

Source: ABS and Matusik Property Insights

So, with the numbers crunched, let's get down to business.

What to consider before you start looking for a home

Deciding which type of property to buy isn’t always an easy decision.

When deciding between a house, an apartment, or a townhouse, there are many variables to consider. These include whether you’ll need more space in the future if you’re planning to have a family, if you plan on living in the home, or you are buying it as an investment property to rent out.

Here are a few questions you should ask yourself before you start your property hunt to help determine which property type is best for you.

Questions to ask yourself:

- Which area do you want to live in?

- How big is your family?

- What can you afford?

- Do you mind paying body corporate fees?

- Is a garage essential?

- Do you want a backyard?

- Do you have pets?

- Do you mind sharing facilities like a pool/gym?

- Do you want facilities like a pool or gym?

- Will you need to upsize or downsize in the future?

- Do you want to renovate?

- What are you - or aren’t you - prepared to compromise on?

- Do you want to own your own land?

- Do you mind living close to your neighbours?

- Will you be an owner-occupier forever? Or will you rent out the property at some point?

- If so, will renters find the property appealing?

Think carefully what will, and won't, suit your needs and preferences. This can weed a lot of unsuitable properties (but even then, be prepared to widen your scope once you get started). Let's consider some property types, their admirable qualities, and their drawbacks.

What is a detached house?

A detached house is your typical stand-alone dwelling where the buyer is purchasing the land on an individual title.

Detached houses are easily the most popular property type for owner-occupiers in Australia, with 70% of the population living in one in 2021, according to the most recent census figures.

Detached homes offer the most flexibility, space, and privacy compared to apartments and townhouses. They do have their drawbacks though, namely more space to maintain, and generally higher costs.

Pros of buying a detached house

1. More space

If it’s space you’re after, houses offer a lot more room to move than apartments and townhouses. This makes detached houses a good option if you’ve got a big family, are planning on having one, or want room to grow.

2. Outdoor space

Unlike apartments, most houses come with a front and rear backyard. If you’ve got a green thumb, want to expand the footprint of the house, or have kids that need room to roam, a backyard is a boon. You can also build a pergola or entertaining space and add a pool if you’ve got enough outdoor space. These additions can also add value to your property.

3. More privacy

A significant benefit of living in a house instead of an apartment is that you’re (usually) not living in close proximity to neighbours.

No need to worry about overhearing your neighbours’ late-night activities (wink) through paper-thin walls, and then awkwardly running into them the next morning in the hallway. When you live in a house, the only time you have to give your neighbour Shirley a wave is when she’s watering the yard as you pull out of the driveway.

4. Flexibility

If you own your house, you can more or less do whatever the heck you like (within reason of course). As long as you keep council and building regulations in mind, you’re pretty much free to renovate your home however you want.

Always dreamed of having a bright pink bathroom with carpet and a gold bath tub? I’m seriously questioning your design choices (and so will potential buyers if you ever try to sell) but you can pretty much renovate your home as you please.

You can also extend the footprint of the house by tacking on additional rooms – something you definitely can’t do in an apartment.

Cons of buying a house

1. Bigger bills

Living in a house is generally more expensive than living in an apartment. You will usually pay more in council rates (based on land value) and have bigger utility bills simply because you have more space to light, cool, and/or heat - and more furniture to buy.

2. More maintenance

I have enough trouble maintaining my tiny two-bedroom apartment – but a house? You’ve got lawns that need mowing, gutters that need clearing, trees that need trimming, windows that need washing, patios that need to be swept… and we haven’t even started on the inside jobs yet. Maintaining a house can be a lot of work. But if you love spending your weekends gardening, doing a bit of DIY, and getting your hands dirty – go for it.

If you prefer a low maintenance lifestyle and would rather spend your weekends brunching and binge-watching telly, apartments can be infinitely more appealing.

3. More expensive

Houses are, generally speaking, more expensive than other property types in the same area. We've already considered the widening gap between house and apartment prices nationwide in the wake of the pandemic. Between March 2020 and January 2024, house prices in Australia's capital cities rose almost 34% while unit values rose just over 11%, according to CoreLogic data.

That’s because the land detached houses are on appreciates in value as the population increases. Buildings, on the other hand, depreciate in value through wear and tear, and need to be maintained. (Bear in mind though, houses also have greater potential to grow in value through renovations, extensions, or a complete rebuild.)

What is an apartment?

Apartments have long been a popular option for those who either can’t afford to or simply don’t want to live in a detached house. An apartment is a self-contained flat that’s part of a larger complex. When you own an apartment, you’re generally on a strata title. This means the apartment belongs to you, but ownership of the common property (the hallways, rooftop space, lobby, etc.) is shared between the individual owners.

Being on a strata title also means you belong to a body corporate and have to comply with certain bylaws. You’ll need to pay body corporate fees to cover the maintenance and also the wear and tear of common areas.

Because apartments are generally more affordable than houses and are often in convenient locations, they are often favoured among first home buyers and property investors.

Pros of buying an apartment

1. Cheaper

There are some exceptions to the rule, but most apartments are cheaper to buy than houses. Not only are they more affordable, but there are generally far more to choose from (depending on where you're looking of course).

2. More secure

Would-be thieves often have to pass through several levels of security to get to your apartment door.

Many apartment buildings will have locked security doors at their entrances as well as secure parking garages that can only be accessed by those living in the building. Many multi-storey buildings also have secure lifts where you need a swipe card and can only access the floor you live on.

3. Low maintenance

If you hate spending your Sunday afternoon doing housework, apartment living might be the low maintenance solution. Hooray for less space to clean! Chores like repainting, mowing, or gardening are generally outsourced. When you own an apartment, the only outside space you have to worry about is the balcony. Easy peasy.

4. Amenities

Apartment living can give you access to a range of amenities you may not otherwise get with a house. Think swimming pool, indoor gym, rooftop entertaining, covered parking, and a security system. Yes, you have to share them, but you don't have to maintain them yourself. Not a bad deal.

Cons of buying an apartment

1. Parking can be limited

Not every apartment these days comes with a parking space, especially small one-bedroom units. Most apartments only come with one car spot, so if you’ve got multiple cars, you may have to pay a premium for parking or put up with endlessly circling the block looking for street parking.

Parking can also be a challenge for visitors. My building only comes with three visitor spots and next to no on-street parking.

2. There’s less space

The big reason apartments are often more affordable than houses is because they’re a lot smaller. While this means less cleaning, it also means less storage space for all your stuff. While this may not be an issue for someone living alone, the lack of storage space isn’t ideal for a growing family.

My apartment doesn’t even come with a pantry for who knows what reason. I live alone so it’s not a huge issue but imagine a family, or even a share house, trying to manage without one. Nightmare!

3. Privacy and noise

Because you live in such close proximity to your neighbours, you’re going to see and hear them a lot more – whether it’s someone above you having a party on a Friday night or the couple next door having a domestic, you will probably hear it.

4. Strata/owners’ corporation by-laws

When you buy an apartment, you immediately become part of a body corporate. As part of a strata scheme, you’re responsible for stumping up a share of the upkeep and maintenance of communal areas of the property, including the gardens, rooftop space, lifts, stairwells, halls, etc. This comes in the cost of paying strata fees.

Living in an apartment also means playing by the rules imposed by the owners’ corporation, like not hanging your washing on the balcony or having only white curtains. Any renovations or modifications you want to make to your apartment may also need approval first.

What is a townhouse?

If you can’t decide between an apartment or a house, a townhouse has a bit of both worlds.

A townhouse is usually a multi-level building that’s designed to mimic a house but is owned on a strata title. You own the dwelling but share the land with others.

Townhouses usually offer the space and privacy of a house, with outdoor space and room for the family to move. You still face similar restrictions to an apartment though, as you generally still have a body corporate.

There are 'freehold' townhouses on the market, however, which means there is no body corporate.

Townhouses account for 17.3% of residential homes in Australia, according to the 2021 census.

Pros of buying a townhouse

1. More space than apartments

Townhouses usually have two storeys, sometimes three, making them roomier than most apartments. Because of this, they’re ideal for families who need more space than an apartment but can’t afford a house. They’re also a fine compromise for downsizers and the access to outdoor space can make them good for pets.

2. Privacy

Unlike apartments, townhouses usually don't have any shared areas and offer (almost) the same amount of privacy as a house – although there are shared wall/s. End townhouses that only share one common wall are usually more popular among buyers when the time comes to sell – but it also means they’re usually the first to go if you’re buying into a development, so you'll need to be quick.

3. Price

Townhouses are normally cheaper than houses but more expensive than apartments. You are probably buying into a strata scheme, so don’t forget to factor in the costs of maintenance and repair of common areas in your budget calculations.

Cons of buying a townhouse

1. No individuality

Townhouses in a development all tend to look … exactly the same. They usually have the same interior layout and exterior design, and much like apartments, owners’ corporation by-laws mean major renovations or changes to the exterior are out of the question. You may be able to make some interior changes, but it’s likely you will need approval for major works first.

2. Less space than a house

While they’re bigger than apartments, townhouses obviously don’t have the same amount of space as a regular house (in most cases).

3. Small land size

Just as the interior space is smaller than a house, the overall lot size for a townhouse is also smaller, which can be a sticking point for some people.

4. Shared title

As with apartments, you’re probably also on a strata scheme when you buy into a townhouse. This means paying strata fees for the upkeep and maintenance of communal areas.

Home loan options

If you're looking at buying a home, the table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Row Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.79% p.a. | 5.83% p.a. | $2,931 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | |||||||||||

5.74% p.a. | 5.65% p.a. | $2,915 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | |||||||||||

5.84% p.a. | 6.08% p.a. | $2,947 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure |

Better to invest in a house, apartment, or townhouse?

If you’re buying an investment property, the house versus apartment versus townhouse question can be a whole different kettle of fish. It will come down to your overall investment strategy and your goals. When you’re considering purchasing a property as an investment, rental income and capital growth are the two key things to keep top of mind.

See also: What makes a good investment property?

Typically, houses tend to generate better long-term capital growth (as we've seen), while apartments tend to generate better rental returns. However, much of this depends on what is happening in the property market and the wider economy.

Rental yield of apartments

Apartments can offer an affordable entry point into the market in locations that may otherwise be beyond an investor’s budget if they were looking at houses. For many tenants, it's all about location, location, location, so inner-city areas are more attractive and, in return, offer higher rental yields and investment security. If it’s high rental yield over capital growth you’re after, inner-city high-rise apartments can be a good choice.

Insurance, maintenance, and upkeep are often provided by the body corporate, so if you want to maximise rental income while minimising expenses, an apartment can be a better fit.

Capital gains of houses

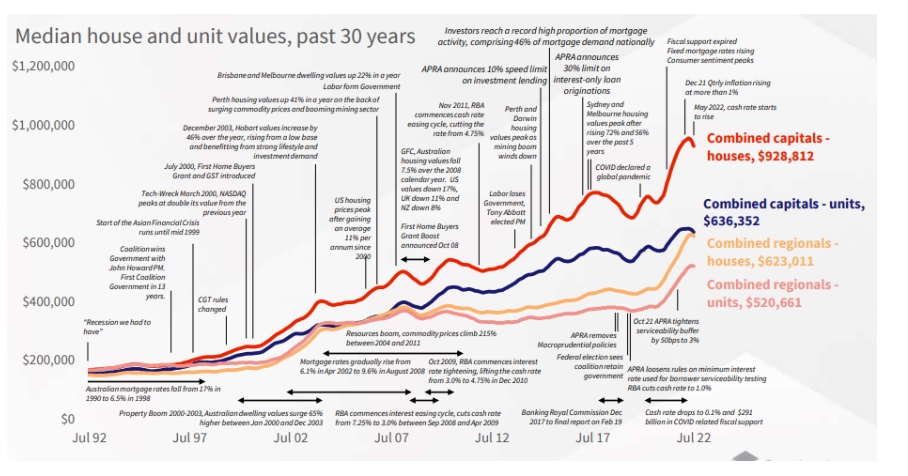

If you’re after capital gains – that is, a rise in the property’s value over time – it's worth bearing in mind that historically, houses tend to command better long-term capital growth than apartments. In the 30 years to 2022, house values have risen 453% compared to apartments at 370%, as illustrated below:

Source: CoreLogic

Simply put, over the long term, capital growth equals greater equity which can give you a better leg up on the property ladder later on.

Land is the major component that boosts the long-term capital growth of a house rather than the building itself. In simple terms, a block of land is widely considered to hold more value than the floor space of an apartment. Of course, this doesn’t hold true in every case. For example, a standard housing block in remote Australia is unlikely to be more valuable than the floor space of a penthouse overlooking Sydney Harbour. Location and other factors also have a big impact.

So, while a property’s type - house, apartment, or townhouse - might be a major consideration when assessing it as a potential investment, there are many other elements that need to be considered, such as:

- Location

- Facilities (pool, gym, lifts, car parking)

- Nearby amenities (shopping centres, public transport, schools, parks)

- Demand for rental accommodation in the area

- Demographic of renters in the area (uni students, young professionals, or families?)

Savings.com.au’s two cents

Whether you’re buying a property as your primary place of residence or as an investment, there are many factors to take into consideration when weighing up the house vs townhouse vs apartment conundrum.

If you’re looking for a home to live in, what are your short and long-term goals? Do you want to start a family in the next few years? Maybe your kids have moved out and you’re looking to downsize. Or maybe you want a house with a self-contained granny flat for the purpose of renting it out so you can pay off your mortgage quicker.

Narrowing down your property options is far easier when you know exactly what you need in a home or an investment property.

Article originally published May 2021, last updated May 2024.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Denise Raward

Denise Raward

Jacob Cocciolone

Jacob Cocciolone