Both these products can be useful in providing credit for things like bills, short-term emergency expenses, weddings, holidays, buying a car and more. But they’re quite different, and if not used properly can result in you accruing bad debt, which is never a good thing. Therefore, you need to think carefully about what source of short-term credit is the right one for your needs. There could be thousands of dollars of difference between the right option and the wrong option.

In this article, we’ll compare credit cards with personal loans to help you decide which one - if either- is right for you.

On this page:

What is a credit card?

A credit card is a bank card that essentially gives you a revolving line of credit, up to a specified limit (called a credit limit). If you have a card with a credit limit of $10,000, then you can use that card until you reach that $10,000 limit. You are borrowing this money from the bank, and it must be repaid - if you don’t pay your balance off in full by a specified deadline (usually called an interest-free period), then the bank will charge you interest on what you owe.

For more information on credit cards, including how credit card interest works and the different types of credit cards, visit our credit card hub page.

[Read: Do you really need a credit card?]

What is a personal loan?

A personal loan is a fixed amount of finance given to you upfront by a lender, instead of having a borrowing limit. You receive the money to pay for whatever it is you’re using the loan for (like a car, holiday, wedding etc.), and then pay it back in regular instalments, which include interest payments, over a set time period. Let’s say you borrow $10,000 with a five-year loan that carries a 6% p.a interest rate. Over five years, you would have to repay $193 per month, and would eventually pay $11,600 in total, assuming you pay only the minimum repayments, according to ASIC’s MoneySmart calculator.

How are credit cards and personal loans different?

Credit card and personal loans differ in the following key areas.

Credit cards vs personal loans: Repayments and interest rates

Generally speaking, personal loans tend to have lower interest rates than credit cards. In fact, credit card interest rates are extremely high compared to other products. While Australia’s official cash rate is now just 0.10% at the time of writing (November 2020), many credit cards that come with other features (discussed later on) are still charging interest rates of more than 20% p.a.

[Read: Low rate credit cards compared]

According to Reserve Bank data as at September 2020, the average interest rate for ‘standard' credit cards is 19.94% p.a, while ‘low rate cards’ have an average of 12.93% p.a. Personal loans, on the other hand, have lower interest rates in general, with an average of around 10% p.a.

However, while credit cards may carry higher interest rates, you don’t always have to pay that higher interest. Assuming you fully pay off your credit card balance within every interest-free period (usually up to 55 days or so), then you can end up paying $0 in interest. Personal loans, meanwhile are less flexible, and require you to make regular ongoing repayments. The longer the term, the more you’ll pay in interest, and while you can make extra repayments to pay it off faster, you’ll still be charged interest.

Credit cards vs personal loans: Fees

Personal loans tend to fare a bit better in terms of fees. Personal loans usually charge two different fees: an application fee and an ongoing annual or monthly fee. The application fee can often be anywhere between $0 and $500, and the ongoing fee will usually cost around $10 depending on the lender. Westpac, for example, charges $150 for its personal loan application fee and $10 per month for a servicing fee, which is worth $120 per year.

Lenders can also charge things like late payment fees.

Credit card fees are a little harder to generalise, as they differ between each type of credit card. Common credit card fees include:

-

The annual fee

-

Currency conversion fees

-

Cash advance and ATM fees

-

Balance transfer fees

-

Late payment fees

-

Over the limit fees

-

Dishonour fees

-

Replacement card fees

Various market sources show that cards with an annual fee charge anywhere between $20 and $750, but there’s no shortage of cards on the market that charge $0 in annual fees. You can read more about how much each of these fees can cost in our article, ‘Common credit card fees and how you can avoid them’.

Credit cards vs personal loans: Flexibility

Credit cards are typically the more flexible product. Personal loans offer a more rigid repayment structure whereby you pay a set amount each week/fortnight/month - potentially a more useful strategy for someone who perhaps lacks the discipline to make repayments on their own. They also only allow you to borrow a fixed amount.

Credit cards, however, are a revolving line of credit, allowing you to borrow up to the credit limit and only require you to pay off what you owe. If you don’t use the credit card, you don’t have to make any repayments (although fees still apply). So when it comes to flexibility, credit cards are the winner, although this flexibility may leave you at greater risk of accruing larger debts.

Credit cards vs personal loans: Extra features

Personal loans again get slightly edged by credit cards here. Personal loans are a simple product, and generally only offer a few things that could be considered ‘flexible’ features:

-

Fee-free extra repayments

-

A redraw facility

-

The ability to make more frequent repayments

There’s nothing quite like rewards or premium credit cards when it comes to features. There are a host of cool features your card might come with that can make your life easier, such as:

-

Rental car excess cover

Cards that carry these features are more likely to carry higher fees and a less appealing interest rate, so consider whether a card with any of these features is worth the extra cost over one without them. According to a 2018 discussion paper published by the RBA, 60% of Australians are not getting any monetary benefit out of using a credit card, and that is mainly caused by paying too much in fees for features they don’t use. But if you are likely to use these features, then credit cards can be a very appealing product indeed.

<h3=id "Debtconsolidation">Credit cards vs personal loans: Debt management

You can also use both credit cards and personal loans for paying off debts too. Personal loans can act as debt consolidation loans - loans that allow you to merge existing debts into a single unified loan - and credit cards offer 0% balance transfers - cards that allow you to move debt over to a 0% interest rate for a period of time.

There are pros and cons to both of these methods:

-

Debt consolidation loans can let you amass your debts altogether, but can stretch out debts over a longer period and will charge a higher interest rate than a 0% balance transfer;

-

Balance transfers are a cheap way to get rid of credit card debt, but only credit card debt. You can’t transfer personal loan debts to a balance transfer card, and if you don’t pay off all the debt within the BT period the uncleared debt can be charged at a much higher revert rate, which is something you need to be careful to avoid.

If you have lots of different debts, then a debt consolidation loan could be the way to go, whereas if you only have credit card debts, then a balance transfer might be the better option for debt management

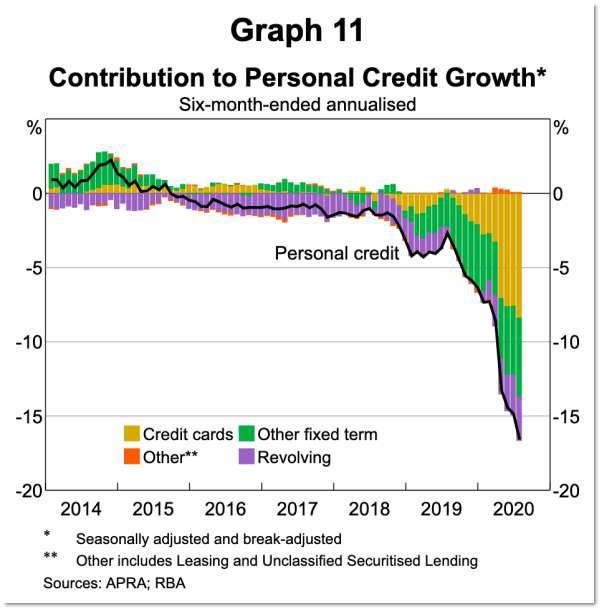

Australians have been paying off their personal credit debts in their droves in recent months, down 16% year-on-year.

Credit cards vs personal loans: Borrowing limits

Personal loans generally work where you apply to borrow a set limit from a lender and work to repay that amount over time with interest. Depending on the type of personal loan you get (secured, unsecured, a car loan etc.) then you’ll be able to borrow different amounts. Westpac for example lets you borrow between $4,000 and $50,000 with its unsecured personal loan, and up to $100,000 for a secured car loan.

Credit cards, on the other hand, have a credit limit, which limits the amount of flexible credit you can withdraw before you incur a fee or new transactions are declined. According to data from the Reserve Bank of Australia (RBA), the average credit card limit in Australia is around $9,500. Generally speaking, $10,000 is a fairly common credit limit on credit cards, while some cards have a maximum of $100,000 or more.

[Read: Credit limits explained]

So while personal loans and credit cards generally have similar ‘borrowing limits’, credit cards continually let you borrow more and more over time as needed.

Credit cards vs personal loans pros and cons

The table below summarises the pros and cons of both credit cards and personal loans.

|

Credit cards |

Personal loans |

|

|---|---|---|

|

Pros |

|

|

|

Cons |

|

|

Which is better: A credit card or a personal loan?

Neither a credit card or personal loan is better than the other, and they both serve their respective purposes well. But one can be more beneficial than the other in given circumstances, as they are quite different products.

You might be better off using a credit card more for your everyday spending, assuming you can control it and not go overboard accruing interest charges, as many credit cards offer rewards points and perks for spending on everyday items like groceries and petrol. Credit cards can also be useful for paying bills, so you can later pay off all your bills as part of one big lump sum at the end of the month, instead of paying multiple different bills at different stages.

Personal loans might be a better option for when you have to make a one-off, larger purchase for a big-ticket item or event, like a new car, a wedding, a big holiday or an emergency expense. For many larger purchases, you may not even be able to use a credit card at all, and even if you can, the risk of an interest blow-out could be too high. With a personal loan, you can work out exactly how much you’ll need to repay overall beforehand, and won’t get any nasty surprises.

Savings.com.au’s two cents

There’s no hard and fast rule for using either a personal loan or a credit card for anything, and you can use a combination of both if you really want. You just need to do your due diligence by:

-

Comparing multiple different products based on the rates, fees and features offered (for both credit cards and personal loans); and

-

Read the terms and conditions to make sure you’re aware of all the little fees, charges and little tricks the lender might have squirrelled away in there

And above all, make sure you’re not going beyond your budget, no matter which option you go with. If possible, straight cash or your bank debit card might be the best option available to you.

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy