- What is a credit card surcharge?

- How much is a credit card surcharge?

- Credit card surcharge reform

- How to avoid paying a surcharge

Surcharges are often transaction-based and can be costly if using your card to pay for something pricey like flights. Such costs can seem counter-intuitive to the convenience of credit cards, so why do we have these surcharges and can they be avoided?

What is a credit card surcharge?

Surcharges exist precisely because of the convenience of using cards to make a purchase. A credit card surcharge is basically just a slight additional fee charged by businesses to cover the cost of using a bank’s merchant service. These services are what allow customers like yourself to quickly swipe or tap your card to make a payment, and they’re not free for businesses to use.

Australian businesses have welcomed the rise of electronic payments, due to the simplicity they provide, in contrast to cash and cheques. The graph below shows a sharp increase in the popularity of debit and credit cards in the last 30 years, although recent data from the Reserve Bank shows the number of active credit card accounts has fallen slightly in the past few months.

Is it legal to surcharge on credit cards?

It is legal to surcharge on credit cards but it cannot exceed the cost of what it costs the business to process the payment. The Australian Competition and Consumer Commission (ACCC) legislated this in in 2016 to prevent consumers being charged excessive fees (more on this later).

Consequently, the majority of businesses charge a flat fee surcharge, rather than a percentage. Businesses are not required to surcharge.

What are merchant fees?

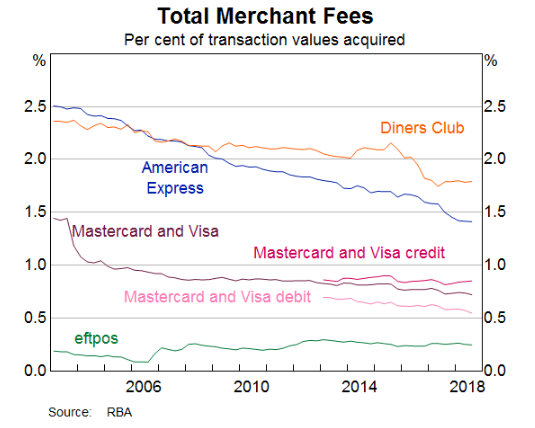

However, these debit and credit card payments incur a cost to the business from their bank. These costs are called ‘merchant fees’ and are often passed onto the customer. More data from the RBA shows banks earned a grand total of $3.1 billion in credit card merchant fees from domestic businesses in 2018, so it isn’t cheap for them to allow you to use your cards so freely.

Additionally, different cards will incur different costs. For example, cards that provide significant rewards to consumers, like American Express rewards cards, are typically more expensive for merchants. Businesses are required by law to notify customers prior to purchase that there will be a surcharge, as well as providing a fee-free alternative such as cash.

This graph shows how much more expensive it can be for both parties to use American Express or Diners Club over Mastercard or Visa branded cards.

Credit card surcharges shouldn’t be confused with credit card fees, which commonly encompass things like annual fees or late payment fees. These credit cards fees are normally outlined in the card’s terms and conditions.

Do debit cards charge merchant fees?

Debit cards charge merchant fees, in the same vein as credit cards. Merchants also cannot charge excessive fees on debit cards, and can choose whether to pass this cost onto customers or not.

How much is a credit card surcharge?

The dollar amount you pay as a surcharge will ultimately come down to the card you’re using, the business and of course your purchase, but the RBA estimates that you’ll usually see a fee between 1% and 3%. It’s also not uncommon for your local coffee shop’s merchant fee to be less than 1%.

Remember, legally you should always be able to see how much the surcharge is before purchase, whether you’re online or in-store. Trustworthy merchants should display their surcharges at the point of sale or tell you before proceeding with the purchase.

Credit card surcharge laws in Australia

In 2016 the Australian Competition & Consumer Commission (ACCC) brought in new legislation to ban excessive surcharges, operating in conjunction with the Reserve Bank of Australia (RBA). The new laws stopped businesses from charging customers more than what it cost the business to process the payment. As a result, most businesses reverted from implementing a flat fee surcharge to a percentage.

An example of the positive effect of this is in the airline industry, where prior to this new framework, a $100 domestic flight would have attracted a surcharge of $8.50 for both credit and debit cards. Under the new reforms, the same flight will incur a surcharge of $1.30 for credit cards and $0.60 for debit cards.

So don’t despair at the thought of paying a few cents extra to pay with a card – you used to have to pay much more.

How do I avoid paying a surcharge?

1. Cash

The most obvious option for avoiding card surcharges is to use good old cash. For small purchases like coffee or snacks, consider withdrawing a small amount of cash each week from an ATM to sidestep credit card surcharges (and to avoid spending more than you should!). This strategy is even better if you manage to avoid being charged those annoying ATM withdrawal fees. Try to avoid withdrawing cash with your credit card, because you will have to pay a cash advance fee.

Using cash might not be viable for bigger transactions, where you might have to accept a bigger surcharge.

2. Debit cards

If credit cards are the weird cousin, debit cards are the little brother that you bond far better with at big family events.

As you can see in the graph above, debit cards typically have significantly lower surcharges than credit cards. Furthermore, selecting “savings” instead of “credit” will allow for the transaction to be processed through the EFTPOS system, allowing you to avoid the credit provider’s system and their charges.

3. Shop around

You should easily be able to see which businesses do and do not apply surcharges to transactions before you get to the final step of paying. This probably won’t be available on their website, but you can always walk up to the counter and inspect the surcharge they have, or you can just ask the person behind the counter.

4. Use your rewards

Often the reason that you have a certain credit card is for the rewards program and it’s easy to forget what we have accumulated. Make sure to utilise these, keep on top of what you can redeem and any offers that come through. Even regular rewards programs like Flybuys can be used to avoid surcharges.

Vouchers, if you’ve got them, also tend to not attract any merchant fees.

5. PayPal

Checking out with Paypal or linking your card to the service can be a quick and easy way to sidestep charges. However some businesses will not accept the service and others will still charge a fee, and they’d be within their rights to do so.

Saving.com.au’s two cents

Credit card surcharges are a necessary tool to prevent merchants from being short-changed by the conveniences that credit cards provide. But it’s rare to find a situation in day-to-day life where there’s no quick way to avoid them.

It doesn’t take long to walk into a coffee store and see if they’ll charge you a fee for your chai latte. The most important thing to do before making a purchase is to be informed and then review your options accordingly.

Article first published July 5, 2019. Updated December1, 2020.

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy