Trials of the scheme will be extended for two years in Ceduna in South Australia, the East Kimberley and Goldfields regions of WA, and the Bundaberg and Hervey Bay region of Queensland.

The Government intended to make the program permanent in these regions but failed to win the support of key independent senators such as Jacqui Lambie and Rex Patrick, in a marathon session of parliament that went well into the night last night.

Other votes went mostly along party lines: It was supported by the LNP and One Nation while opposed by the Greens and the Labor Opposition.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

“When I try and balance up everything that I’m seeing, unfortunately the data is not there that supports that the card achieves what it is intended to achieve. On that basis I will not be supporting this legislation," Senator Patrick said.

Tasmania's Jacqui Lambie meanwhile was slightly more descriptive in her reasons for not supporting making the card permanent.

One way or another, the Cashless Debit Card's going to get voted on this week. When that happens, I'll be opposing it.

— Jacqui Lambie (@JacquiLambie) December 9, 2020

Here's why — pic.twitter.com/Yr0yVx1kDa

Social Services Minister Anne Ruston made amendments to the bill after realising it wouldn't pass as is, but reiterated the government still intended to make it permanent.

"We are a Government that listens, and from the feedback I have received I believe that communities in the Northern Territory will be much more comfortable with this being a voluntary choice between remaining on the Basics Card or transitioning to the Cashless Debit Card," she said.

"This amendment does not change our commitment; it simply means we have more work to do to in the future to convince the Parliament they should support this program on a permanent basis too."

Other members of parliament went further to suggest the scheme was racially discriminatory.

Up to 82% of Cashless Debit Card (CDC) users in East Kimberley are indigenous, while indigenous people make up 76% of users in Ceduna, although only 18% of card users in Bundaberg and Hervey Bay are indigenous.

Labor Senator Penny Wong said the government was repeating mistakes of the past.

"This legislation comes in the context of generations of paternalism toward First Nations people in this country," Senator Wong said.

However, Senator Rushton rejected these accusations, saying the card is applied equally to all welfare recipients where there were "high levels of welfare dependency and social harm".

Update on cashless debit card debate - the Govt is now proposing amendments to keep the trial sites going for another 2 years (rather than making them permanent) and giving people in the NT the option to move from the Basics Card @abcnews

— Jade Macmillan (@JadeMacmillan1) December 9, 2020

Just what is the Cashless Debit Card exactly?

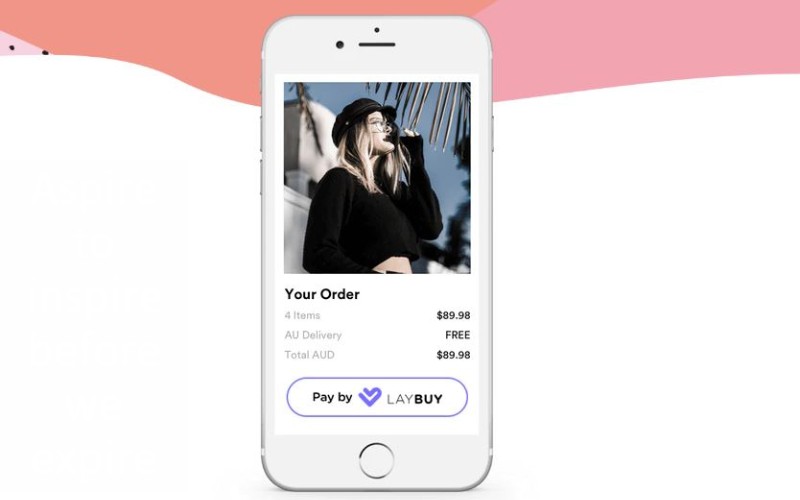

The Cashless Debit Card (CDC), also known as the cashless welfare card, is a card that's been trialled in certain Australian regions since 2016.

The purpose of this card is to 'quarantine' 80% of welfare recipients' income (such as JobSeeker) onto a card that resembles a regular bank card, with the remaining 20% directed to the person's bank account.

This card then requires users to spend the money at approved stores, and cannot be used in places that sell alcohol or gambling products and can't be used to withdraw cash from ATMs.

It can also be used to pay bills, make recurring payments and for online banking.

Image source: Department of social services

The main purpose of the card, according to the Government, is to reduce alcohol and drug use among welfare recipients. According to the Department of Social Services (DSS) website:

"The Australian Government is considering the best possible ways to support people, families and communities in places where high levels of welfare dependence co-exist with high levels of social harm."

"While it is not the only solution, it is a useful tool operating alongside other reforms to address the devastating impacts of drug and alcohol misuse and problem gambling."

Does it cost anything to use?

According to the DSS, the card is free to use for participants. Lost or stolen cards are replaced for free and purchases do not incur transaction fees or account keeping fees.

Although, as the card's provider Indue specifies in its terms and conditions, "(we) are not responsible for any fees imposed by third parties".

There's less certainty around how much the scheme costs to implement for the taxpayer.

The DSS says the card costs around $820 per year to implement: Other analysis of cost data of the scheme suggests it costs around $2,000 per person using it, while previous information released under Freedom of Information by the ABC showed the initial pilot program cost $18.9, worth $10,000 per person.

Around $8 million of these costs went to Indue.

Savings.com.au has contacted the DSS to clarify how much the scheme costs.

Does the Cashless Debit Card work?

There is a range of mixed information analysing whether the scheme worked or not, and a further two years of trials should result in more thorough findings.

A $2.5 million policy evaluation by the University of Adelaide commissioned by the Morrison Government was provided on October 27, but has not been released to the public, and it was revealed in a Senate Estimates hearing recently that the Social Services Minister introduced the latest bill to parliament without having read the report.

“The Government expects the Parliament to vote on the Bill while refusing to disclose the much anticipated $2.5 million report and its findings,” Shadow Minister for Indigenous Australians Linda Burney said.

“If the report proved the card worked, the Government would have released it by now.”

There is a 2017 report commissioned by the DSS which found 41% of participants in Ceduna reported drinking alcohol less frequently (of those who drank beforehand), while 37% reported binge drinking less frequently

Nearly half (48%) of regular gamblers also reported gambling less.

But the report also found:

- 34% of people did not drink, gamble or take drugs prior to the trial

- Of those that did drink alcohol, gamble or take illegal drugs before or during the trial, only one third (33%) reported a reduction in at least one of these behaviours

- 43% reported no change to their consumption of alcohol, drugs or gambling, and

- 49% of people said their lives had become worse since the introduction of the card.

Peer-reviewed research from the likes of the University of Queensland and Monash University reported participants found it harder to manage money and pay for basic goods and generally decreased their quality of life.

The study also said the card could "also stigmatise and infantilise users”.

Many card users previously paid cash for second-hand goods such as clothes and furniture, something the card would allow them to do with only 20% of their income.

Other submissions made to Parliament includes organisations such as the Australian Human Rights Commission, which warned the card was not compatible with Australia’s international human rights obligations.

“The imposition of the cashless debit card diminishes the equal enjoyment of human rights and fundamental freedoms for particular geographic groups where the proportion of Indigenous residents is significantly above the national average,” said Aboriginal and Torres Strait Islander Social Justice Commissioner June Oscar.

“I am very concerned about the lack of consultation with Aboriginal and Torres Strait Islander communities in this process.”

The Law Council of Australia meanwhile recommended Parliament abandon plans to make it an ongoing program, saying its restrictive nature was a red flag.

“The Law Council is not averse to some form of income management, but participation in the CDC and/or income management needs to be voluntary, based on full, free and informed individual consent (opt-in), assessment of an individual’s suitability to participate, and meaningful community consultation," Law Council President Pauline Wright said.

“While a further evaluation is underway, its findings have not yet been released, making it premature to establish the CDC as a permanent measure or to expand it."

Image source: Department of Social Services

Harrison Astbury

Harrison Astbury

Denise Raward

Denise Raward

William Jolly

William Jolly