With savings account rates at historically low levels, Australians are flooding into the stock market to get a better return on their savings.

In just under three years, more than 125,000 Aussies have started using Spaceship Voyager. While past performance is not indicative of future performance, the app has delivered solid returns to many of its customers in the past year.

Find out how Spaceship Voyager works, what it costs, and if it may be right for you.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- Bonus rate for the first 4 months from account opening

- No account keeping fees

- No minimum balance

What is Spaceship Voyager?

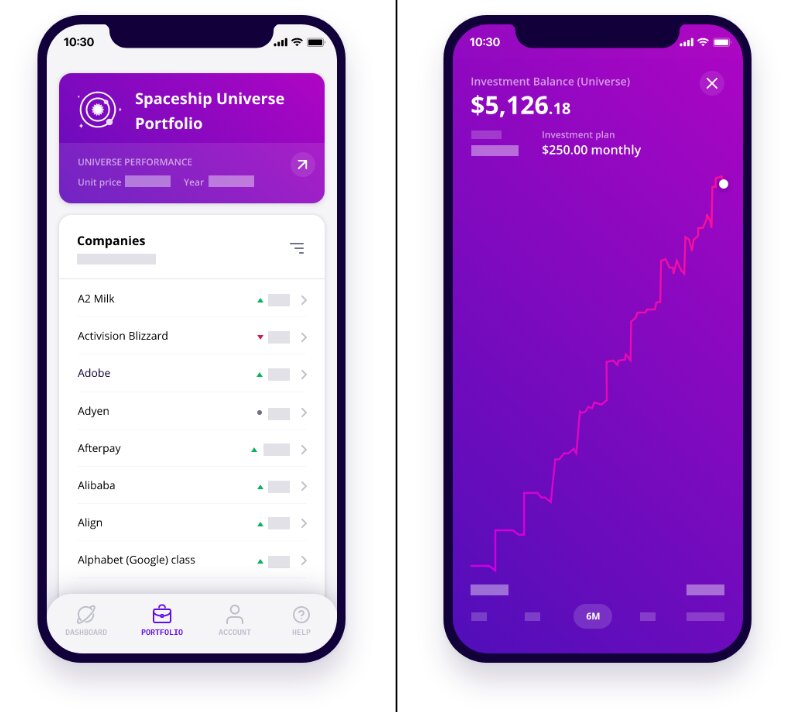

Spaceship Voyager is a micro-investing app designed for people inexperienced with investing to get started in the stock market. There is no minimum investment on Spaceship, meaning customers can invest as little as $1, removing the fear many prospective investors have over forking out large amounts of their hard-earned cash.

As opposed to a human financial adviser that gives personal investment advice based on your circumstances, Spaceship Voyager offers a more automated method of investing through it’s technology. While this takes a lot of the guesswork out of investing, it does make it less personalised. However, this can also be much cheaper than consulting a professional, which may make it a more attractive method of investing to those just getting started or people with less disposable income.

Investors can choose to invest in three different portfolios, with the ability to deposit lump sums or set up regular weekly, fortnightly, or monthly top-ups.

You can track the progress of your portfolios through the app and link to an external bank account to deposit and withdraw money.

Source: Spaceship

How do you invest with Spaceship Voyager?

Spaceship Voyager allows you to invest in three different portfolios, each made up of shares from various different companies from countries across the world like Australia, the US, China, and Argentina. You cannot customise the investment portfolios. The three portfolios are:

Spaceship Universe Portfolio

Spaceship Universe Portfolio is an actively selected fund of 70-100 companies Spaceship believes satisfies its “where the world is going” (WWG) criteria. The WWG methodology analyses each company’s competitive advantage, and future product or service growth potential. The fund boasts household name US companies like Facebook, Tesla, Apple, and Microsoft, and other prominent Australian companies like Afterpay, Zip, and Seek.

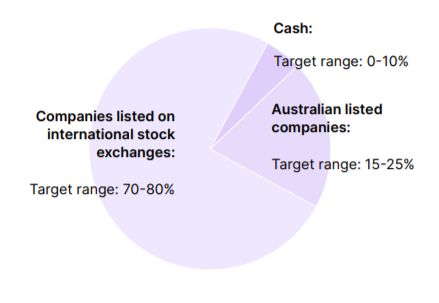

The fund’s assets are typically invested within the following asset allocation ranges:

Source: Spaceship

Over the year ending 31 January 2021, the fund achieved a return of 47.84%. In the 32 months from the portfolio’s ‘funded date' on 15 May 2018 till 31 January 2021, it has achieved an annualised return of 29.46% p.a. These returns are net of fees and may seem impressive, but keep in mind the mantra past performance is not a reliable indicator of future performance.

Spaceship has labelled the risk profile for the fund as high as there is higher risk and volatility associated with it compared to some other funds, but with that comes the potential for higher returns in the long term compared to lower-risk investments. The minimum suggested timeframe of investment for this fund is seven years, which means you should be willing to part with any money you invest in this portfolio for at least seven years.

Spaceship Origin Portfolio

Spaceship Origin Portfolio is a passive index fund made up of the top 100 Australian listed companies and top 100 international listed companies as measured by market capitalisation. Spaceship implements an equal-weighted index to decide which companies to include in the fund, rather than a market-weight index, which increases exposure to smaller companies, minimising the influence of larger companies.

The fund features Australian companies like Coles, Commonwealth Bank, BHP, and News Corp, and US companies like Nike, Netflix, McDonald’s, Astra Zeneca, and Amazon.

The fund’s assets are typically invested within the following asset allocation ranges:

Source: Spaceship

Over the year ending 31 January 2021, the fund returned 2.71%. Since the funded date, 15 May 2018 till 31 January 2021, the fund has achieved an annualised return of 10.05% p.a.

Again, these returns are net of fees and past performance is not a reliable indicator of future performance.

The Origin Portfolio has the same high-risk profile as the Universe Portfolio, and the minimum suggested timeframe for holding this investment is also seven years.

Spaceship Earth Portfolio

Spaceship Earth Portfolio is an actively selected fund of 30 to 50 companies that are considered to have a positive impact on people and the planet, in areas like poverty, climate change, and quality education. The fund uses a negative screening process to exclude companies involved in activities like:

-

Fossil fuels

-

Animal cruelty

-

Human rights abuse

-

Tobacco and alcohol

-

Gambling

-

Firearms, and controversial and conventional weapons

-

Nuclear power

The fund also uses the WWG criteria in conjunction with this process to select which companies to include. Companies featured in the fund include Atlassian, Lululemon, Shopify, Adobe, Etsy, Cloudflare, Visa, Square, and Starbucks.

The fund’s assets are typically invested within the following asset allocation ranges:

Source: Spaceship

Spaceship Earth was launched in November 2020 and as a result, no investment performance data is yet available.

As with the previous two portfolios, the fund is labelled high-risk and the minimum suggested timeframe for holding investment is seven years.

How much does it cost to invest with Spaceship Voyager?

There are no sign-up fees with Spaceship Voyager, and zero fees on the first $5,000 invested. Investors are charged a percentage of their balance for amounts greater than $5,000, which you can see in the table below. There are also no brokerage fees, withdrawal fees or exit fees.

|

Fees |

Universe Portfolio |

Origin Portfolio |

Earth Portfolio |

|---|---|---|---|

|

Fee on the first $5,000 invested |

Zero |

Zero |

Zero |

|

Fee on the balance above $5,000 |

0.10% p.a. |

0.05% p.a. |

0.10% p.a. |

|

Total annual cost on a balance of $10,000 |

$5 |

$2.50 |

$5 |

Source: Spaceship

Who can use Spaceship Voyager?

Spaceship chief executive, Andrew Moore, said Spaceship Voyager was an easy to use, low-cost app, suited to anyone who wanted to get into investing who may have been previously daunted by the prospect.

“Spaceship may suit those who want access to a low-cost, app-based investment product with a focus on global equities,” Mr Moore told Savings.com.au.

“With Spaceship Voyager, you can start investing in a managed fund - with anywhere from 30 to 200 companies - in just a few minutes. We think that appeals to many people, whether you’re just starting out or you’ve invested before.”

Mr Moore said the three different portfolios gave customers a way to invest in a diversified managed fund of global equities.

“Our Spaceship Universe Portfolio has a focus on forward-thinking companies, often with a tech tilt, while our Spaceship Origin Portfolio invests in some of the world’s largest companies by market cap.

“Our latest fund is the Spaceship Earth Portfolio – for Australians who want to invest and have a positive impact on people and the planet.”

What are the benefits of using Spaceship Voyager?

Some of the main benefits of using Spaceship Voyager include:

-

Easy to use app

-

Low fees

-

No minimum investment amount

-

Investment in Australian and overseas markets

-

Curated news and resources to inform you about your investment

-

Ability to set up weekly, fortnightly, monthly investment top-ups

Mr Moore said Spaceship’s focus was centred on giving Australians a best-in-class investment app.

“In the COVID-19 era, it has never been more important for Australians to be able to make the most of their hard-earned cash. We believe that the key to building wealth over the long term is in time in the market, not timing the market.

“It’s not about jumping in and out of investments in the space of a day. We’re investors not traders. Customers can’t trade options or short stocks with us.”

What are the risks of using Spaceship Voyager?

As with any investment, there are risks to using Spaceship Voyager. These include:

-

Market risk: Share markets rise and fall, and while the goal of the app is to increase your wealth, if the market falls, your investment may too.

-

No customisation: Although there is a large range of companies within each portfolio, there are only three portfolios to choose from. You also have no say over what companies are included in the portfolios and cannot customise the portfolios.

-

Currency risk: The portfolios contain companies from all over the globe. Consequently, fluctuations in exchange rates may negatively affect your investment.

-

Liquidity risk: It can often take time to access the funds in your account, so if you need quick cash, you may not be able to access your funds for a few days.

How to start using Spaceship Voyager

If you think Spaceship Voyager may be for you, here’s how to get started:

-

Download the app and create an account or sign up online.

-

Decide which portfolio you want to invest in. You’ll then be required to submit an application with proof of ID. You must be an Australian resident to use Spaceship.

-

Link your bank account and transfer funds to make your first investment. Spaceship will send you a confirmation of your investment, along with the number of units you purchased, the entry price of them and the date they were issued.

-

Continue to invest either by making lump sum payments as you see fit, or setting up recurring investment top-ups.

-

Withdraw as you see fit. You can request a full or partial withdrawal of your investment at any time, which will be processed during the current or next business day.

Savings.com.au’s two cents

Spaceship Voyager makes it relatively easy to invest and may be suitable for people who don’t have the knowledge, time, or money to seriously invest. It’s still vital you do your own research and keep an eye on how your investments are performing.

All investments come with inherent risks, and while Spaceship has delivered solid returns since its inception, this may not be the case in the future.

Only invest what you can afford to lose.

Photo by Matt Benson on Unsplash