Openpay was one of Australia's oldest BNPL providers, which started operations in 2013 and expanded instalment offerings in 2016.

Last year it ceased operations in the United Kingdom and United States, and earlier this week went into receivership in Australia.

New purchases cannot be made through Openpay, although customers with existing debts will still need to pay them off.

OpenPay had provided BNPL services for several major retailers including Bunnings and Officeworks.

It's been a bad few months for other players in the BNPL industry too, like Klarna, which laid-off 80 staff members earlier this year, and Zip, the share price of which is down 78% in the past 12 months.

An industry that was once estimated to be worth $85 billion in market capitalisation is now worth less than $1 billion, according to estimates from payments expert Grant Halverson.

For Mr Halverson, it isn't the BNPL concept itself that is at risk, but the fintech companies that currently operate in the sphere.

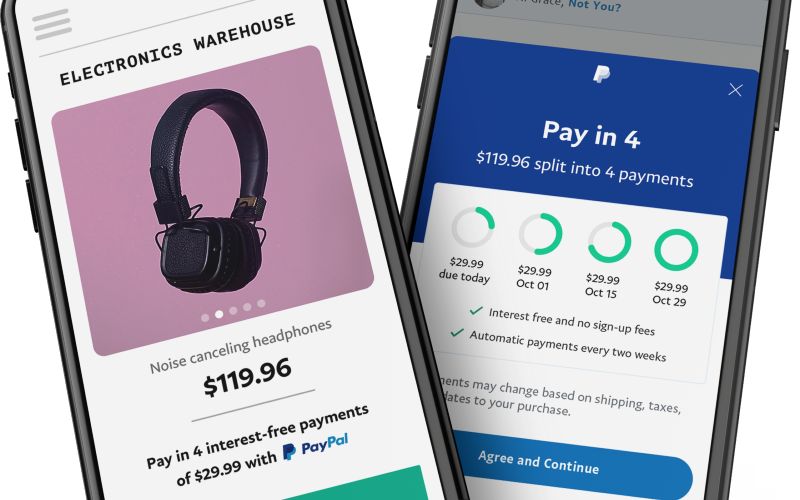

BNPL is generally split up into two main categories - fintechs such as Klarna and Afterpay, and incumbents such as Paypal, Apple and the major banks.

"BNPL will be fine, it’s a niche product - fintech apps won’t survive," said Mr Halverson, a former Citi and Diners Club executive.

"The BNPL sector has lately been under pressure due to rising funding costs and lower consumer spending during soaring inflation.

"This is before regulation and new competitors like Apple take a toll. PayPal is already claiming to be the biggest BNPL app after just two years."

Incumbents such as Paypal and the major banks are already regulated under responsible lending obligations, while the fintechs are not.

See Also: What does potential credit regulation mean for BNPL?

Surging interest rates have made it increasingly difficult for BNPL providers to secure financing to fund their operations.

On top of this, as the cash rate increases, household disposable income also decreases, which hits retail spending.

Already, the ABS has reported a seasonal decline in retail spending for December last year, suggesting households have already tightened the purse strings.

In the US, the New Mexico state government recently limited the interest that could be charged on small loans and capped the late fees BNPL providers could impose.

Both Afterpay and Klarna are now no longer available in New Mexico after this legislation passed.

US President Joe Biden off the back of this mulled over a similar policy to be applied at the federal level.

Mr Halverson said this demonstrates that BNPL is "clearly dependent on late fees".

However previous reports from BNPL Zip claim that less than 1% of its revenue comes from late fees, instead relying on merchant fees from participating brands and outlets.

Advertisement

In the market for a personal loan? The table below features unsecured personal loans with some of the lowest interest rates on the market.

| Lender | Car Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Interest Type | Secured Type | Early Exit Fee | Ongoing Fee | Upfront Fee | Total Repayment | Early Repayment | Instant Approval | Online Application | Tags | Row Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.56% p.a. | 6.56% p.a. | $392 | Fixed | Unsecured | – | $594 | $0 | $23,513 | ||||||||||||

6.57% p.a. | 7.19% p.a. | $392 | Fixed | Unsecured | $150 | $0 | $250 | $23,519 |

| Promoted | Disclosure | |||||||||

16.95% p.a. | 32.99% p.a. | $497 | Fixed | Secured | – | $26 | $125 | $29,791 |

| Promoted | Disclosure |

Picture by Negative Space on Pexels

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Brooke Cooper

Brooke Cooper

Hanan Dervisevic

Hanan Dervisevic

Emma Duffy

Emma Duffy

William Jolly

William Jolly