The introduction of the program from Monday will see first home buyers eligible to opt into paying an annual property tax of $400 plus 0.3% of the property land value up to $1.5 million.

For investor first home buyers, the annual property tax rate is set at $1,500 plus 1.1% of land value for investment properties.

Legislation for the program was enacted previously on 11 November 2022, meaning first home buyers who have purchased a property between 11 November and 16 January can opt in to the annual fee and receive a refund of stamp duty paid.

NSW Treasurer Matt Kean noted he expects the majority of eligible first home buyers in the price range of $800,000 to $1.5 million to choose the annual property fee over upfront stamp duty.

“This is all about giving people choice and helping families get the keys to their own home sooner by removing upfront costs and potentially reducing overall tax,” Mr Kean said.

In November, the NSW Government launched a calculator for first home buyers looking to compare the differences in cost between upfront stamp duty or the annual land tax.

Through the calculator, first home buyers are able to input the number of years they expect to own the property to provide an estimate of the total amount they can expect to pay over that period in present value dollars.

Previous research conducted by NSW Treasury in 2022 revealed half of all purchasers in NSW will sell their property within 10 years of purchase.

At the time, PRD Chief Economist Dr Diaswati Mardiasmo told Savings.com.au the amount of time people are holding their property has become a very situational dynamic as opposed to being reflected by a standard number of years.

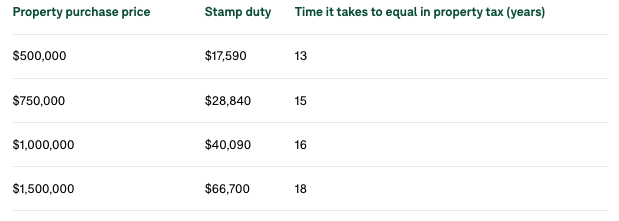

Analysis by Domain revealed those who take up the scheme and purchase a home up to $1.5 million would need to live in the home for between 13-18 years before reaching stamp duty costs.

Source: Domain

Property requirements for the First Home Buyer Choice program

There are some property requirements to be met by first home buyers in order to take advantage of choosing between stamp duty or annual land tax, the first being purchasing an eligible property.

Under the program, eligible properties include a house, townhouse, strata unit, company title unit, flat, duplex or a vacant block of residential land intended as the site of a first home.

Further, the value of the property being purchased as a first home you're buying must not exceed $1.5 million.

If vacant land is purchased with the intent to build, the purchase price of this land must not exceed the value of $800,000.

First Home Buyer Choice eligibility

To be eligible for the choice of an annual land tax or stamp duty in NSW:

- Must be an individual (not a company or trust).

- Must be over the age of 18 years old.

- At least one person you’re buying with must be an Australian citizen or permanent resident.

- Must not have previously owned or co-owned residential property in Australia, nor received a First Home Buyer Grant or duty concessions.

- Property value must be worth less than or equal to $1.5 million.

- Must move into the property within 12 months of purchase and live in it continuously for at least 6 months.

- Must sign the contract of purchase on or after 11 November 2022.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.79% p.a. | 5.83% p.a. | $2,931 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.74% p.a. | 5.65% p.a. | $2,915 | Principal & Interest | Variable | $0 | $0 | 80% | 100% owned by Commbank |

| Promoted | Disclosure | |||||||||

5.84% p.a. | 6.08% p.a. | $2,947 | Principal & Interest | Variable | $250 | $250 | 60% | 100% offset |

|

Image by Rebecca Meenach via Pexels

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Harrison Astbury

Harrison Astbury