The threshold for fuel efficient vehicles was boosted by $5,257, while the threshold for regular vehicles was boosted by $2,697.

Fuel efficient vehicles are defined as vehicles consuming less than 7 litres per 100km on a combined fuel cycle.

At a tax rate of 33%, this delivers motorists a potential $1,734 and $890 tax saving respectively.

It also means popular electric vehicles such as the Kia EV6 AWD now fall under the threshold.

See Also: Five Electric Vehicles Around $50,000

Source: ATO

Labor took to the election a policy to exempt electric vehicles from the 47% fringe benefits tax, and to remove import tariffs.

The fringe benefits tax - applied to personal use of vehicles purchased via a business - would apply to EVs priced below the luxury car tax threshold, and would take effect from 1 July 2022.

While private buyers won't receive this benefit, it is designed to encourage uptake of EVs purchased through novated leases and other business car schemes.

Australia imposes a 5% import tariff on vehicles imported from countries with which there is no free trade agreement (FTA).

There are already FTAs in place with China, Japan, South Korea, and the United States, which is where the majority of electric vehicles for sale in Australia originate.

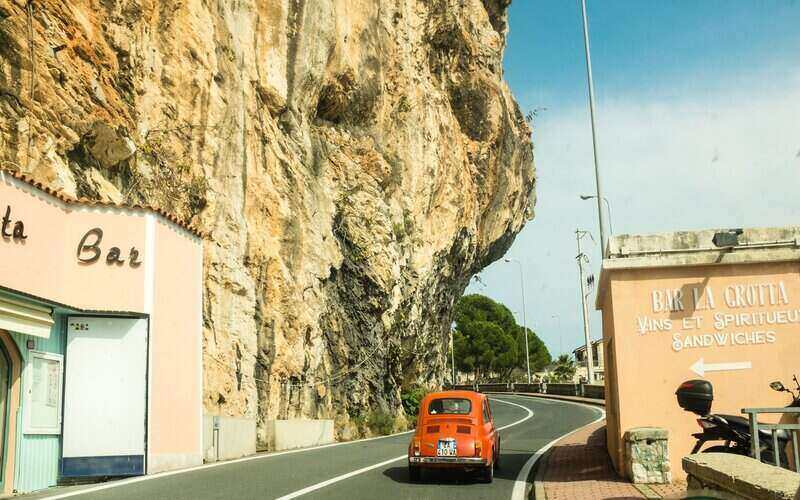

Photo by redcharlie on Unsplash

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy

William Jolly

William Jolly