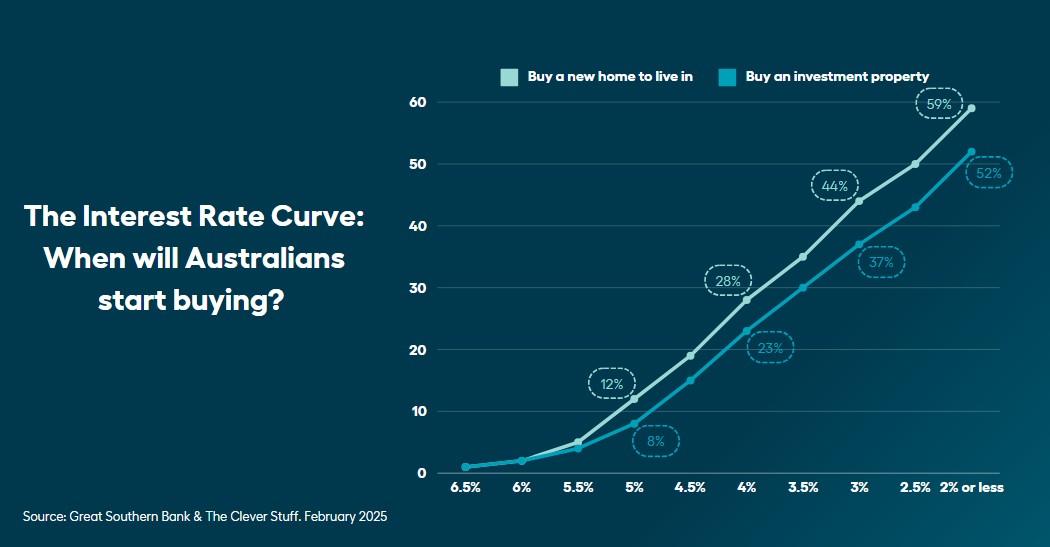

A survey of more than 2,000 from Great Southern Bank - Australia's third-largest customer-owned bank - found just 12% of respondents would consider buying a home at a 5% mortgage rate, and 8% would invest.

At a 4% mortgage rate this jumps to 28% for buying, and 23% for investing; 3.5% mortgage rate, 35% and 30%; and at a 3% mortgage rate, 44% and 37% respectively.

The current average variable mortgage rate for new loans is 6.24% p.a. for owner occupiers - slightly higher for investors.

Homebuyers also need to consider the 3% APRA buffer rate applied on top of most home loan applications.

Great Southern Bank's chief customer officer Rolf Stromsoe said many homebuyers have a "magic number" in mind with where they would feel comfortable taking out a mortgage.

“While we are not there at the moment, it seems a rate between 3.5% and 3% is potentially the point where the waiting period ends for a large cohort looking to buy a new home," Mr Stromsoe said.

Reality points to mortgage rate pipedream

Hopes of a mortgage rate under 4% any time soon may be unfounded.

The RBA is widely tipped to lower the cash rate on Tuesday to 4.10%, which would ostensibly send most new and existing mortgage rates about 25 basis points lower.

However, many economists have pencilled in only two to four rate cuts in total, leaving average home loan rates well above the 5% threshold.

Former RBA assistant governor, now Westpac chief economist, Luci Ellis said the RBA will not be "in a hurry to move further".

"Conditional on further declines in inflation and some softening in the labour market, we see cuts in May, August and November, taking the terminal rate to 3.35%," Ms Ellis said.

Headwinds include the strong labour force, elevated spending levels, and any effect of Trump tariff talk and trade wars, with the US President seeing Australia's GST on online goods as a tariff on American trade.

NAB economists forecast a 3.10% cash rate by early 2026; ANZ's are more hawkish forecasting only two rate cuts in total, which would bring the cash rate down to 3.85%.

CBA's economists were non-committal past February, though said a further cut in April is not off the cards.

HSBC's Paul Bloxham was the only prominent economist to correctly forecast no RBA rate cuts in 2024, in a year where many forecast at least one or two. He only expects two rate cuts in 2025 followed by one more in 2026.

High mortgage rates not exactly stopping lending growth

The Finance Brokers Association of Australia has pointed to "uncertainty and desperation" among would-be homebuyers, struggling with the cost of living and high barriers to market entry.

However, recent lending and credit data from the ABS and RBA points to robust numbers taking out home loans.

More than 31,000 first home buyers entered the market in the December 2024 quarter, borrowing more than $16.8 billion.

While the number of first-time borrowers is consistent with previous periods, the average home loan value has hit a new record high of $543,000 - nearly 13% higher than when the RBA began increasing the cash rate.

Comparatively, CoreLogic's data shows the national median dwelling price has increased 5.85% in that time.

RBA credit growth data also shows housing debt levels are 5.51% higher than a year ago; credit growth among property investors is gathering the most steam, outpacing owner occupiers every month since September 2024.

Photo by Soroush Karimi on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Rachel Horan

Rachel Horan