The ASX S&P Accumulation Index, which takes into account dividends as well as share price increases, grew about 11.4% in 2024.

That's about three full percentage points stronger growth than housing, up 8.3% through the year according to the CoreLogic Hedonic Return Index which includes rental income as well as capital growth.

Investing $500,000 into the ASX on 1 January would have returned on average $15,500 more than buying an investment property on the same date.

International share markets performed stronger, still.

While the stock market still had some notable downturns last year, the strong performances of the banking and tech sectors lifted the index over 8,000 points for the first time ever.

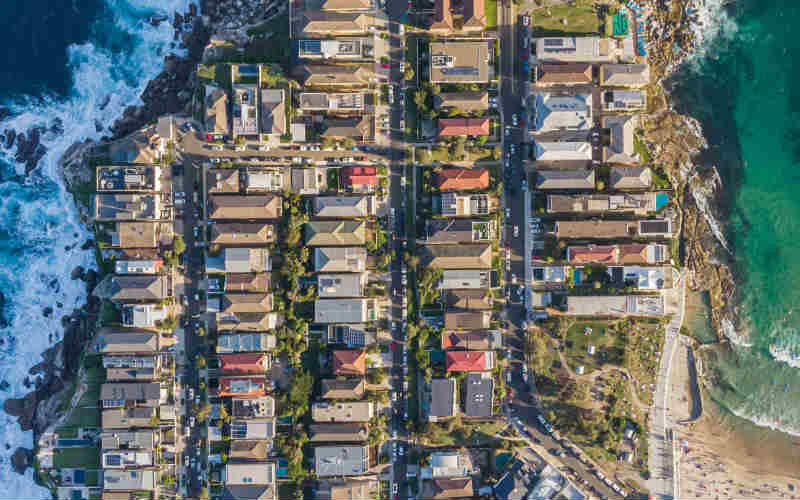

Housing on the other hand stagnated after a decent start to the year, with prices declining 0.1% in December marking the first drop in nearly two years.

"The accumulation of stock and the higher for longer interest rate environment has seen the change in dwelling values slow and in some cities, shift into negative territory," CoreLogic Economist Kaytlin Ezzy said.

"Similarly, the normalisation in net overseas migration and the increase in the average household size has seen rental growth continue to ease over the year."

It was the fifth calendar year since 2014 that equities outperformed housing in Australia.

Property to keep underperforming?

With housing values on the way down for the first time since January 2023, some investors might be getting twitchy feet about backing the wrong horse.

In all eight state/territory capitals, the pace of growth is either negative or slowing, with affordability hurting demand and supply starting to pick back up.

However, CoreLogic Head of Research Eliza Owen says while the December decline is likely the start of a cyclical downswing, it shouldn't be too dramatic.

"The largest recorded decline in the national HVI [Home Value Index] was only -7.7% from October 1982 to March 1983," she said.

"Sellers may be able to withhold their property from sale until values are rising, effectively restricting available supply during periods of price falls."

Of course, some sellers might not have a choice - while mortgage stress levels declined slightly in the back half of last year it remains at the highest point in more than a decade.

So far though, there hasn't been a surge in households forced to sell by high interest rates, and in any case many analysts expect the RBA will cut at least once in the first quarter of 2025.

The ASX also dropped off slightly in December, albeit after strong growth through November coinciding with Donald Trump's election victory in the US and renewed faith in forthcoming RBA cuts.

As Ms Ezzy points out though, investors in either asset shouldn't get too caught up in the short term.

"Whether it's housing or equities, it's normal to see some market volatility and both booms and busts are part of the usual asset pricing cycle," she said.

Over the last 10 years, housing has delivered a total return of 132.6% compared to 126.4% for the ASX.

The majority of Australian household wealth also remains in property - about $11.36 trillion according to the ABS in the September quarter which is about 67% of total household wealth.

For comparison, the total value of shares and other equity held by Australians as of the third quarter of last year was $1.49 trillion.

Read more: Property vs Shares

Picture by Austin Distel on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Alex Brewster

Alex Brewster

Aaron Bell

Aaron Bell