What is positive gearing?

Positive gearing is essentially an investment scenario where the regular income generated by a geared investment exceeds the ongoing costs of the investment

Breaking it down, the word 'positive' is used because the investment’s net income (income minus costs) is a positive number, while 'gearing' refers to the practice of borrowing money to invest, also known as 'leveraging'.

So in property investment, positive gearing is when you then rent out a property that your purchased with a loan and the rent you earn from it is more than the total costs of owning the property (e.g. interest, depreciation, management fees etc.).

As you might have guessed, it's the opposite of 'negative gearing', which has been a more hot-button issue lately.

According to Michael Sloan of Better Homes and Gardens Real Estate, positively gearing isn’t as straightforward as it sounds.

"It is the tax breaks that make property investment affordable for the average homeowner," Mr Sloan said.

"The costs of the loan, property manager, insurance, rates, and the running costs means you need to get very high rent."

These other costs can be the hidden expenses that new property investors may fail to calculate when purchasing a property or setting rental fees.

Other costs can include things like:

-

Body corporate fees

-

Water bills

-

Agent fees

-

Lease advertising

-

Pest inspections

Why do property investors positively gear?

There can be many benefits to a positively geared property, such as:

-

Passive cash flow: an additional income

-

Property essentially 'pays for itself'

-

Lender appeal: having a positively geared property, in addition to the passive cash flow, can make it easier to secure a loan for another property

Positively-geared investment properties are often located in regional areas where the rates of property price growth are typically lower. With smaller capital gains on offer, such properties generally need to be positively-geared for them to be worth investors' risk and effort.

However, when interest rates are low and rental demand is high, many metropolitan properties may also be positively geared because the higher rates of rent are vastly exceeding the lower interest costs.

Case Study

Cheryl is a high school teacher working at a school located within the CBD looking to buy her first home.

She values living close to her work and has a budget of $500,000 - $550,000 and is currently renting.

After researching the suburbs close by to her work, she feels houses she likes are out of her price range. She decides to buy an investment property in an area further outside the city.

She buys a four-bedroom property for $529,000 in an up and coming suburb still within 40 minutes of the CBD.

She purchases the property with a 20% down payment of her savings on a 30-year interest-only loan.

Her estimated monthly interest-only repayments are $1,017 per month.

Cheryl rents out the property to a young family for $1,980 a month.

Cheryl then estimates $600 a month in additional costs in her investment property including council rates, management fees, insurance, maintenance etc.

This leaves her with $1,980 - $1,017 - $600 = $363 surplus per month.

Having this surplus means she currently has a positively geared property.

The property generates a passive income, but doesn’t come without risk. There are many factors to consider when exploring the opportunity to positively gear property.

What to consider

-

There are more expenses to owning a property than just a mortgage e.g. loan repayments, strata fees, maintenance of a property

-

The pressure of having that property occupied by tenants (being a landlord)

-

Paying an agent to facilitate this. Average cost can be anywhere from 6-12% depending on the agency

-

It may seem easier to positively gear a cheaper property, but that may make it harder to rent out.

-

Paying tax on your additional rental income.

-

Covering costs when the property is vacant

Understanding tax on your investment property

In an ideal world, your investment property could generate additional income. But you still need to understand how this income is assessed at tax time.

According to Dr Adrian Raftery, aka Mr Taxman, there are deductions you can make at tax time, on things like:

-

advertising for tenants

-

bank charges

-

body corporate fees and charges, also known as strata levies

-

cleaning

-

council rates

-

electricity and gas

-

insurance (building, contents and public liability)

-

land tax

Dr Raftery told Savings.com.au you can claim a deduction for these expenses only if you actually incur them and they are not paid by the tenant.

It’s important to seek guidance of a professional when tackling your taxable income on an investment property, any deductions you make and what you are entitled to claim.

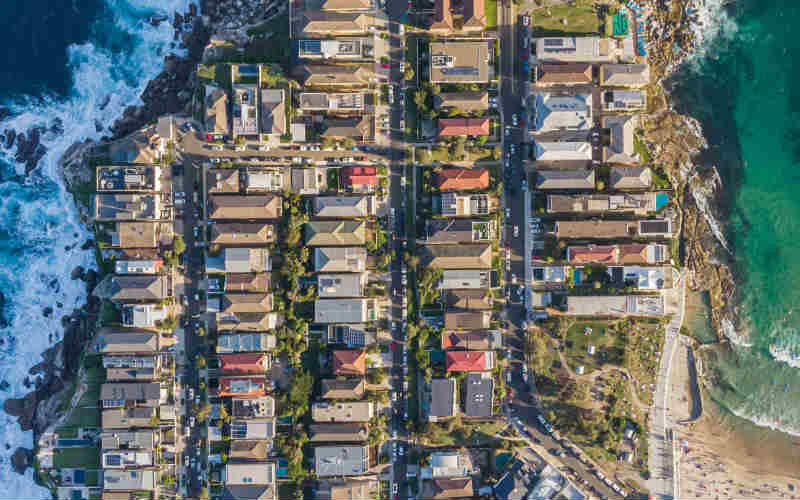

Image by Obi Onyeador via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

William Jolly

William Jolly

Alex Brewster

Alex Brewster