The stats on financial literacy in Australia are hardly encouraging. More than a third of men and almost half of all women don't have a good grasp of basic financial concepts, according to the long-running HILDA study of Australian households.

Couple that with the growth in easy consumer credit and the proliferation of so-called 'finfluencers' on social media, it's little wonder 43% of 18-24-year-olds are having trouble meeting their personal debt obligations.

Amid the rise in scams and get-rich-quick schemes, two women saw the opportunity to provide a safe space for young people to learn the basics about finance and investing. And that's how Drip was born.

What is Drip?

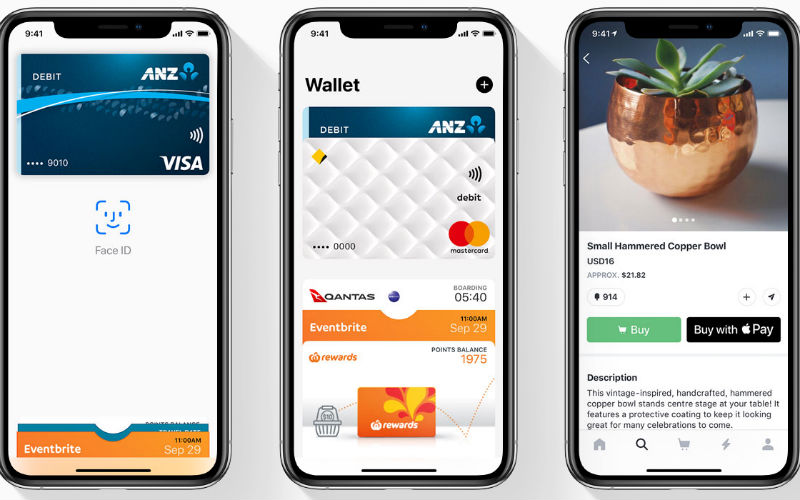

Drip is an app that offers interactive educational tools as well as investing accounts for people under 18 years old that operate with parental controls.

The idea is that young people start out learning about finance through accessing sound investment information before being able to see how it works in practice.

Rather than concentrate on one investment type like many other micro-investing apps, Drip features 15 investment options based on exchange-traded funds, or ETFs.

ETFs are essentially a basket of securities - usually with a theme such as tech, precious metals, or a geographical area - that can be traded via stock exchanges.

Drip co-founder Isabelle Charter told the Savings Tip Jar podcast the ability to make real investments on the app is a valuable learning tool for children, allowing them to experience the ups and downs of investing from a young age before serious sums of money are involved.

"With early exposure, we can build confidence, we can build good habits," she said. "Building discipline, the long-term thinking, is one of the biggest challenges for the next generation; they're so used to having everything immediately.

"But if you'll start learning simple terms from a young age, this will help you build the confidence in order to start acting later."

It is parents who set up and control investing accounts. Their children, or teenagers, see another version of the app which allows them to view what's on offer but any investments they wish to make need parental approval.

Not just for kids

Of course, parental approval relies on parents having some idea of what constitutes a sound investment and a wise investment decision in the first place.

Ms Charter acknowledges that in their research, many parents, particularly mothers, said they knew very little about investing themselves.

"What I always say is that Drip is an opportunity for the family to learn together, because the parents also have access to all of the educational resources that we are offering."

Research has shown many Australians don't make investments because of a lack of knowledge and fear they may lose their money.

Drip also allows parents to learn as well as have their own investment pool separate to that of their children.

They can also remove asset classes they don't want their children to invest in.

"Losing a little bit of money can be a great opportunity to learn and discuss," Ms Charter says.

She offers a story about one user of the app who was giving his child $5 a week to invest. The first three weeks, his child invested the lot in a cryptocurrency ETF that initially made handsome returns.

But crypto is a notoriously volatile asset class and when the ETF went backwards in the fourth week, the parent and young investor discussed the importance of diversification as an investment strategy.

That week, the child invested in a basket of ASX 200 shares to hedge his bets, a valuable investing lesson.

Drip offers real world learning

As well as the educational features on the app itself, Drip provides additional resources including YouTube shorts, a calculator, a dictionary to explain investing terms in plain English, and the company conducts online workshops for parents on how they can best mentor and support their kids in their investing journey.

The funds parents give their children to invest is not monopoly money. It is real cash invested in real funds.

Drip's featured ETFs cover:

-

Australia 200

-

USA 500

-

Europe

-

Asia

-

Emerging Markets

-

Battery Tech

-

Big Tech

-

Sustainability

-

Cyber Security

-

Crypto

-

Precious Metals

-

Growth

-

Conservative

-

Balanced

-

High Growth

Ms Charter believes the value of real-world investing can counter the influence of social media spruikers who would have young people believe they can make a small fortune through cryptocurrency - or any other vehicle - and never have to work a day in their lives.

"A 13- or 14-year-old can be incredibly vulnerable, and very easy influenced by social media and people they respect and admire," she said. "If they're saying you can double your money in a week, that is dangerous because [kids] are going to believe that is possible.

"One reason why it's so important to give [kids] early exposure is to give them a sense of reality. It's a reality check. Because if you only hear, hey, it's so easy to make money in crypto, everyone's making money in crypto, you're going to end up believing that, but when you actually put your $5 into crypto and you see it going up and down, then you will learn that it's not as easy as your TikTok influencer told you it was."

See also: How to start investing for millennials

Does Drip charge fees?

Drip charges a monthly fee of $6.99 per month (correct at the time of writing) on the full version of the app for adults and minors. However, it also offers a basic adult-only account with no monthly fees, but features are limited.

Users can start investing through Drip with a minimum of $5, and there are no transaction fees.

Drip also charges a 0.8% p.a. management fee on investment account balances - equivalent to $8 per year on a $1,000 balance.

That's probably not too bad for small balance trading (depending on the balances involved of course). Other share trading platforms may not work out as cost-effective for small trades while stockbrokers often have minimum trade sizes and fees.

Of course, all investments carry risk. Drip can offer education and opportunity but no guarantee that its users will make money (and that's a good thing).

Pros of Drip

-

Features targeted, easy-to-understand educational resources

-

Facilitates micro-investing rather than having to wait until you save a larger sum to purchase one ETF unit

-

Offers a range of investment options

-

Diversification built into ETF security baskets

-

Unlimited transactions (on the full version) with no transaction fees

-

Offers 'green' Sustainability ETF investment option

-

Full parental control for under-18s

Cons of Drip

-

The monthly fee of $6.99 on the full version of the app is higher than what other micro-investment platforms charge

-

Returns tend to be long-term (yes, real life but may not suit some young people)

-

Offers some inherently riskier investment options such as Crypto or High Growth ETFs

-

ETFs offer no customising of individual shares

How to use Drip

-

Download the app

-

Register as a parent

-

Set up a minor account for user or users under 18

-

Download the app on the young person's device

-

Parent can set safety controls as to what investment options young person can see

-

Parent can set limit for investment requests

-

Parent can approve or decline investment requests on an ongoing basis

Savings.com.au's two cents

Drip is attempting to fill a gap in the market by providing a safe space for young people to learn about investing and giving it a go themselves through trading in real-world ETFs, under parental supervision.

ETFs are recognised as a good way for budding investors to get into the securities market as 'experts' choose the basket of shares contained in a fund. This provides some cushioning that the securities involved are generally sound. ETFs also tend to include larger, more established companies.

Drip allows young people to experience the ups and downs of investing on a micro-scale. It also introduces them to the terminology and jargon of investing.

Allowing unlimited transactions and transaction fees is a plus, as is the parental override. At the end of the day, all investments come with inherent risks. The sooner a young person understands and experiences this, the better they may be equipped to navigate the financial and investment minefield ahead of them.

See also: Savings.com.au reviews of other micro-investing platforms:

Image by Tim Gouw on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward