Commonwealth Bank has officially stepped into the crowded buy now, pay later (BNPL) sector in Australia, launching its new BNPL platform 'StepPay'.

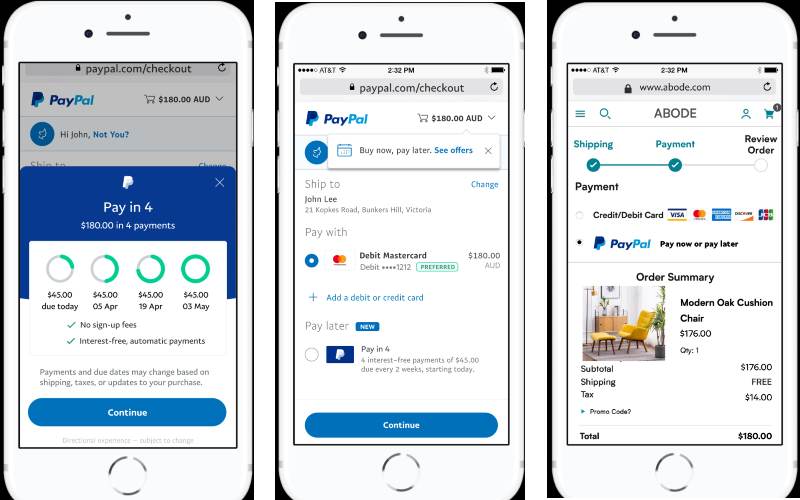

The product will allow customers to make up to four 'interest-free' repayments up to $1,000 (initially).

The BNPL platform can be used to purchase items, with any purchases over $100 automatically coming out in four fortnightly instalments.

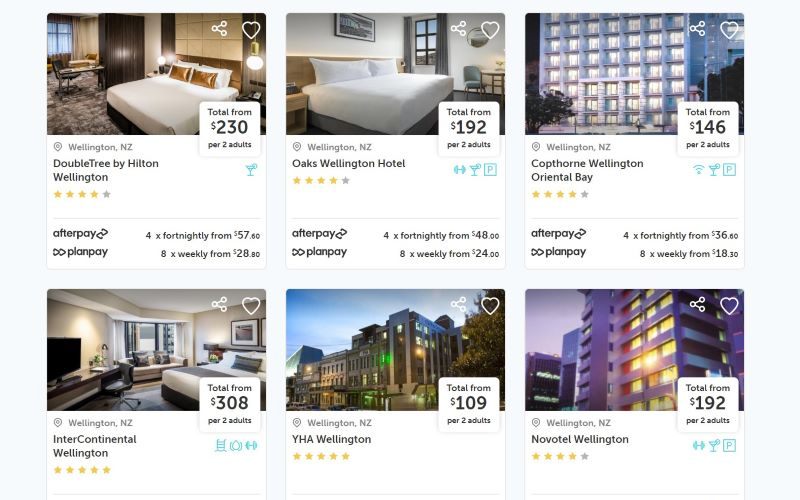

Similar to Afterpay, customers won't be charged any fees unless payments are late or missed (capped $10 late fees apply).

Additionally, any customers who are late on their repayments are unable to use the product until their balance is squared away.

Unlike Afterpay, CBA's StepPay will conduct upfront credit checking upon application, offer lower fees for merchants to use the product, and it has the ability to be used anywhere through a digital card.

The banking giant reported that 86,000 of its customers have already pre-registered for the new BNPL platform, with a further four million that are eligible to use the product.

CBA's Executive General Manager, Marcos Meneguzzi, said they're excited to create a BNPL product that can be used anywhere that also accepts CBA's debit and credit cards.

"We know BNPL is a popular choice among customers, but is hampered by its limited use and availability in only selected retailers and businesses," Mr Meneguzzi said.

"With StepPay, customers have freedom around where they’d like to shop, offering the same accessibility as our other CBA cards."

Image by Jonas Leupe on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Brooke Cooper

Brooke Cooper

Hanan Dervisevic

Hanan Dervisevic

William Jolly

William Jolly

Harrison Astbury

Harrison Astbury