The report, led by Curtin University, shows BNPL fees are effectively a quasi-interest rate that can actually be more costly than traditional credit card interest interest rates.

This is when the fees are extrapolated on a per-annum basis like a credit card.

A comparison was made between the late fees and account keeping fees of BNPL loans, and the annual interest rates of a typical credit card.

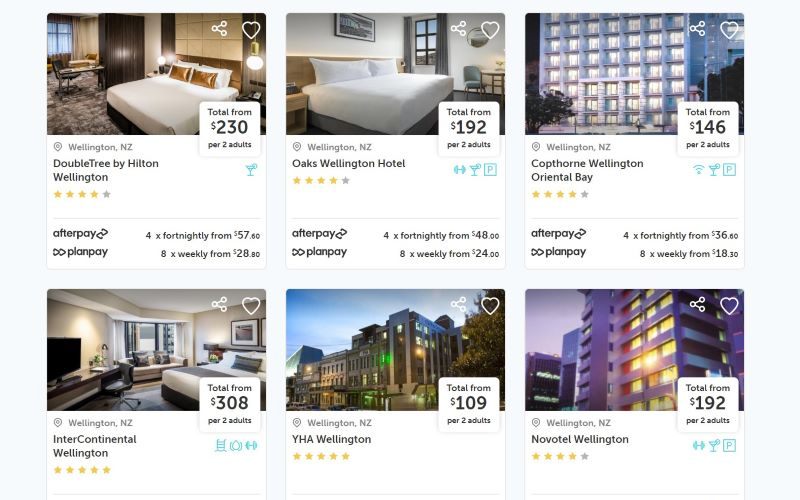

Earlier in the month the BNPL industry group AFIS released its own research, showing the average purchase made through BNPL methods was $151.

Applying the research found by Curtin University to the AFIA's numbers revealed an effective interest rate of 28.25% p.a. for Afterpay on a consumer who incurred either late fees or account keeping fees.

Applying the same scenario to Humm's 'Little Things' product line exposed a 49% p.a. interest rate for those same customers.

According to the report this is a steep increase from the average 22% p.a. annual interest rate for a typical credit card.

Dr Lien Duong, report author and senior lecturer at Curtin University’s School of Accounting, Economics and Finance, said it's evident from the research that BNPL is not a free or low-cost option compared to credit cards.

"The buy now pay later industry promotes itself as being 'interest-free', however, their late payment fee and monthly account fee can add up to an amount that effectively equates to an extremely high quasi-interest charge,” Dr Duong said.

See Also: Every BNPL in Australia compared

Financial counsellors are also seeing an increasing number of clients using BNPL methods for small amounts paying these extra fees on top for multiple transactions.

CEO of Financial Counselling Australia Fiona Guthrie said this is another reason why BNPL need to have the same consumer protections as other forms of credit.

"Each product you buy with BNPL is subject to its own late fees. We heard the story of a person who was late on a $8 repayment getting lumped with a $10 fee," Ms Guthrie said.

"Imagine if that person had multiple different repayments due in a week. People are being slugged with excessive fees."

BNPL is currently exempt the National Consumer Credit Protection (NCCP) Act of 2009 allowing it to bypass consumer protections that apply to credit card.

This is because BNPL terms are typically less than 62 days; the current government has said BNPL can expect to be regulated under NCCP.

"If it quacks like a duck, and walks like a duck, it is a duck," Ms Guthrie said.

"This research reinforces why we need to remove harmful exemptions in our National Credit Law that allows products like BNPL to be unregulated.

"Whether a consumer uses a credit card or BNPL, they deserve the same protections."

People in financial stress and who may be struggling with BNPL debts can contact a free and independent financial counsellor on 1800 007 007 or visit ndh.org.au.

Spokespeople from BNPL providers Afterpay, Zip, and Humm have been contacted for comment.

Image by Mudassar Iqbal on Pixabay

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Brooke Cooper

Brooke Cooper

Hanan Dervisevic

Hanan Dervisevic

Harrison Astbury

Harrison Astbury