The Australian Taxation Office (ATO) has released the annual Taxation Statistics report for the 2016–17 income year, presenting snapshots of data from a total of 16.5 million income tax returns for nearly 14 million people.

Based on the average taxable income, surgeons remain the highest paid workers in the country, raking in an average of just under $395,000 a year.

Anesthetists come second with an average salary of over $367,000, while engineering managers round out the top 10 with $147,500.

Meanwhile, fast food cooks, hospitality employees and farmers are in the bottom 10 for taxable income, earning an average of roughly $18,600, $19,100 and $22,400 respectively.

Of the 1,100 occupations recorded by the ATO, there were 72 occupations where females earned more than males on average.

Female authors earned the most by comparison, making $85,006 to the average male author’s $68,342.

Futures traders, magistrates, pro surfers and illustrators were some of the other jobs to see females out-earn their male counterparts.

The highest-earning profession however, – surgeons – still saw a pretty sizable pay gap, with male surgeons earning an average of $430,128 compared to $227,034 for female surgeons.

Top 10 richest and poorest postcodes

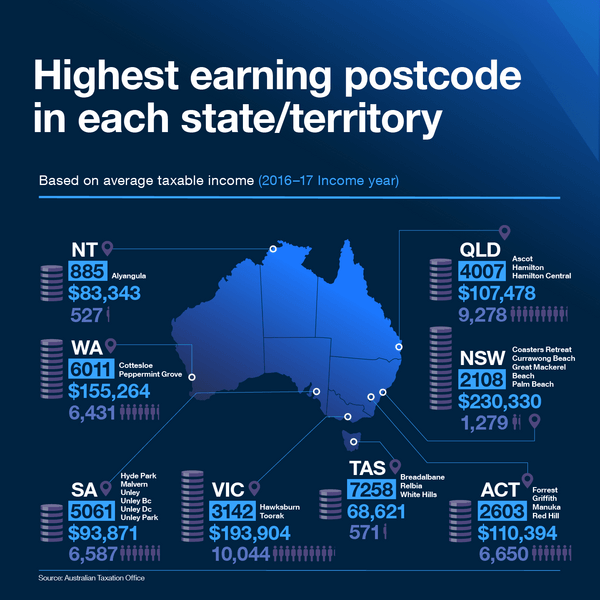

New South Wales – or really just Sydney – dominated the list of the top 10 highest earning postcodes, claiming eight of the top 10. The remaining two belong to Victoria.

Coasters Retreat in Palm Beach (postcode 2108) is officially Australia’s richest suburb, recording an average taxable income.

Melbourne’s 3142 postcode, covering Toorak and Hawksburn, is the second richest, at $193,904.

Rounding out the top 10 is Hunters Hill in Woolwich (2110), which had an average taxable income of $156,069.

This data is unsurprising considering the cost of just buying a house in these areas: Sydney and Melbourne have average house prices of

$1,062,619 and $833,321 respectively, according to Domain’s House Price Report.

The difference in income between the richest ($230,330) and the poorest (

$20,589) is nearly $210,000 annually – this unfortunate title belongs to the suburb of Newcastle University in NSW.

This result shouldn’t come as too much of a shock however, as the vast majority of people living there would be…university students.

The second lowest-earning postcode is 4611 (Mondure and Marshlands) in Queensland, which has an average taxable income of just $23,225.

In fact, Queensland dominates the poorest postcode list, just as NSW dominates the rich list.

Five of the poorest 10 postcodes nationally lie in the Sunshine State – the Queensland postcode of Kooralgin and Cooyar is the 10th lowest at just under $30,000 in annual taxable income.

Top 10 richest Australian postcodes

| Postcode | State | Suburb | Avg taxable income/loss |

|---|---|---|---|

| 2108 | NSW | COASTERS RETREAT, CURRAWONG BEACH, PALM BEACH | $230,330 |

| 3142 | VIC | HAWKSBURN, TOORAK | $193,904 |

| 2027 | NSW | DARLING POINT, EDGECLIFF, POINT PIPER | $187,769 |

| 2030 | NSW | DOVER HEIGHTS, ROSE BAY NORTH, VAUCLUSE, WATSONS BAY | $178,282 |

| 2063 | NSW | NORTHBRIDGE | $169,365 |

| 2023 | NSW | BELLEVUE HILL | $169,334 |

| 2028 | NSW | DOUBLE BAY | $160,378 |

| 2088 | NSW | MOSMAN, SPIT JUNCTION | $158,897 |

| 3944 | VIC | PORTSEA | $156,079 |

| 2110 | NSW | HUNTERS HILL, WOOLWICH | $156,069 |

Source: ATO

Top 10 poorest Australian postcodes

| Postcode | State | Suburb | Avg taxable income/loss |

|---|---|---|---|

| 2308 | NSW | NEWCASTLE UNIVERSITY, CALLAGHAN | $20,589 |

| 4611 | QLD | MONDURE, MARSHLANDS | $23,225 |

| 3482 | VIC | WATCHEM, WATCHEM WEST, MORTON PLAINS, WARMUR, MASSEY | $24,346 |

| 2052 | NSW | UNIVERSITY OF NEW SOUTH WALES | $24,855 |

| 3889 | VIC | ERRINUNDRA, MANORINA, COMBIENBAR, BEMM RIVER, CABBAGE TREE CREEK | $24,863 |

| 2356 | NSW | GWABEGAR | $26,474 |

| 4731 | QLD | YARAKA, ISISFORD | $29,127 |

| 4705 | QLD | MOUNT GARDINER, MACKENZIE RIVER, MARLBOROUGH, CLARKE CREEK | $29,223 |

| 4732 | QLD | TABLEDERRY, MUTTABURRA | $29,584 |

| 4402 | QLD | KOORALGIN, UPPER COOYAR CREEK, COOYAR | $29,891 |

Source: ATO

Other interesting snippets

It’s not just total income by job and

Australians a charitable bunch

In total, Australians donated $3.5 billion to charity in 2016-17, with an average gift size of $770 from those who did so.

33% of Australian taxpayers claimed deductions on their charitable donations, so there may well be many more out there who donated but didn’t claim anything.

Western Australia was the most charitable of the bunch: 30% of residents claimed an average deduction of nearly $1,200.

By contrast, the Northern Territory was the least charitable, with 34% of residents claiming an average deduction of $405.

Average taxable income remains fairly stagnant

According to the data, our average and median taxable incomes have increased, if only slightly.

The average taxable income for 2016-17 was $59,014. In 2015-16, it was $58,689, an increase of $325.

The median income, however, (the middle of the data set) was $44,392. This is an increase of $505 from the previous year.

Super funds low

The average superannuation balance in 2016-17 was $123,024:

- $146,421 for men;

- $114,350 for women

This is an overall increase of $12,079 per balance – about 10%.

BUT, the median super balance is a mere $41,731, indicating the average figure is skewed by outlying accounts with much higher balances.

This $41,731 number isn’t even enough to have a ‘modest’ retirement, according to the Association of Superannuation Funds of Australia’s figure of $70,000.

Tax agent, or do it yourself?

The vast

27% used the government’s myTax website, while the remaining 2% stuck to tradition and did paper returns.

For feedback or queries, email will.jolly@savings.com.au

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harrison Astbury

Harrison Astbury

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy