Up to $20,000 can be released from your superannuation under the COVID-19 early release of superannuation scheme. This is a lot of money, and although $20,000 in super could turn into many more thousands by the time you retire, there’s an argument to be made for using this scheme to put more money towards a house deposit, as owning a home can be crucial to having a comfortable retirement.

With house prices forecast to drop substantially on average in the coming months and years, being able to use this scheme for a house deposit could be a unique opportunity.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner-occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Row Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.79% p.a. | 5.83% p.a. | $2,931 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | |||||||||||

5.74% p.a. | 5.65% p.a. | $2,915 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | |||||||||||

5.84% p.a. | 6.08% p.a. | $2,947 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure |

What is the government’s COVID-19 super access scheme?

To combat the ongoing financial effects of COVID-19, the Federal Government announced back in March that some Australians could access up to $20,000 of their super to help get them through the crisis. According to the Australian Taxation Office (ATO), you can get up to $10,000 of your super before 1 July 2020, and a further $10,000 from 1 July 2020 to 24 September 2020, if:

- You’re unemployed;

- You’re eligible to receive a Jobseeker payment, Youth Allowance for Jobseekers, Parenting payment (which includes the single and partnered payments), Special Benefit or Farm Household Allowance;

- You were made redundant after 1 January 2020;

- Your working hours were reduced by 20% or more; or

- You’re a sole trader whose business has been suspended or turnover has been reduced by 20% or more

“While superannuation helps people save for retirement, the Government recognises that for those significantly financially affected by the Coronavirus, accessing some of their superannuation today may outweigh the benefits of maintaining those savings until retirement,” the official Economic Response to the Coronavirus fact sheet says.

More than 360,000 Australians had already registered their interest in withdrawing their super by the beginning of April, and as at May 10, nearly 1.2 million applications have been paid out. Recently released data by AMP found the average person using the scheme is seeking to withdraw an average of $8,000 from a balance of $50,000 or less.

So it isn’t millionaires withdrawing from the scheme by the looks of things, and with 66% of applicants being under the age of 44, it’s likely that the people using it are in the demographic that’s looking to break into the property market.

How much do you usually need for a house deposit?

In all but the most special cases, you will need a deposit of at least 5% to buy a property (that’s 5% of the property’s value), and will usually need at least 20% if you want to avoid having to pay for Lenders Mortgage Insurance (LMI), which can cost thousands of dollars.

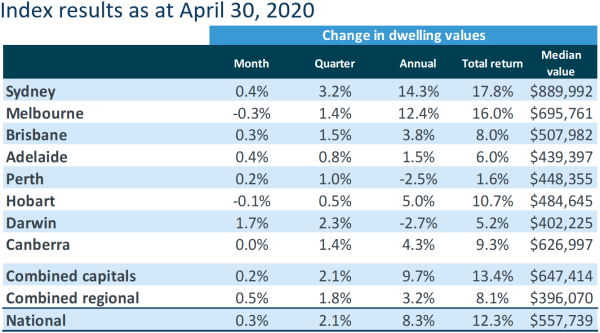

A 20% deposit, and even a 5% deposit in some cases, is a lot of money, thanks to Australia’s sky-high house prices. CoreLogic’s Home Value Index results for April 2020 found the median house price across all capital cities is now $647,414 and is even higher in cities like Sydney or Melbourne.

Source: CoreLogic

A 20% deposit on that median property value is around $130,000. Hardly pocket change. According to prior research from Bankwest, it can take years for the average-income couple to save up for such a deposit (8.2 years in Sydney in fact).

If you want to get a head start on building up that deposit or maybe just want to get over the finish line, you might consider withdrawing from your super using the government’s new scheme and using that money as a part of your deposit.

So how can withdrawing your super help with a house deposit?

The early release scheme could present an opportunity to enter the property market sooner and build capital growth with money you otherwise wouldn’t have access to till retirement. Looking at it simply, $20,000 (potentially up to $40,000 for a couple) could go a long way towards a home deposit. If you’re a couple, $40,000 is almost a third of what you’d need for a 20% deposit on the median capital city property at the moment.

“If you’re a couple and you’re both eligible to take out super early, that's an additional $40K maximum to your house deposit - when else are you able to amass that kind of money in such a short time,” PRD Chief Economist Dr Diaswati Mardiasmo told Savings.com.au.

“In general investing into property, especially as it is the great Australian Dream, is a safe option from a long term capital growth perspective.”

But on the other hand, drawing from your super can harm your future retirement funds, and given the economic fallout from COVID-19, you’d be withdrawing from your super when markets are near or at their lowest point.

Below, we’ll explore the pros and cons of using your super for a house deposit, drawing on the advice of several industry experts.

The arguments for

Breaking into the property market is important

It’s been said that buying a property is one of the most important things - if not THE most important thing - you can do for your own retirement, as those who continue to rent or pay a mortgage are statistically worse off in their old age compared to those who own a property outright.

Alex Jamieson, Founder of AJ Financial Planning, says it’s worth considering withdrawing from your super to access the property market early.

“Having your own home in retirement alleviates some of the non-financial anxieties with being a renter,” he told Savings.com.au.

“It can be stressful having to move home later on in life and this is one risk of being a renter. This coupled with future rental rises can place pressure on a retiree's expenditure.

“With interest rates also particularly low at the moment with leverage, this, coupled with distressed sellers entering the marketplace in the next six months, will make an interesting time for a new buyer to pick up some potential bargains at possibly more favourable prices longer term.”

Mr Jamieson also said a forgotten home-buying demographic - former homeowners - can also really benefit from this scheme.

“Either through divorce or for lifestyle reasons they [former homeowners] have had to sell their home and are currently renting. They are often left out in the cold with not being eligible for any first home benefits provided by the government and this can be difficult to get another property,” he said.

“The COVID-19 early release of super measures might well be a worthwhile capital source to assist them to gain a foothold back into the property market which might otherwise not be possible on a very tight budget.”

Building capital growth

Property investment - or just selling a property you lived in for several years - can be a very effective method of achieving long-term capital growth, and one argument for using your super to buy right now is to buy a property that you can sell for much more in the future.

Those who argue in favour of this strategy say you can make more in capital gains from property than you would from super.

Co-founder of Freedom Property Investors Scott Kuru told Savings.com.au that buying a property now is a “solid way” to create a growth asset for a secure financial future.

“With the opportunity to access up to $20 000 of your super to use toward buying property, really it’s a no-brainer if you ask me,” he said.

“In my opinion, with super funds returning 3% to 8% annually and property more or less doubling every seven years - I know where I would put my money as an investment.

“And, if the $20 000 from your super can help get you ready to buy property - it does not take much to figure out if it is a good idea or not.”

According to the 2018 ASX Long-term investing report, Australian property had higher average returns compared to other investment classes like shares and fixed income.

It could be tax-effective

A crucial point regarding this scheme is that those withdrawing their super will not need to pay tax on amounts released, meaning you can withdraw up to $20,000 completely tax-free.

While you’d have already paid 15% in tax on those super contributions, that’s a massive advantage when you consider most other money you put towards a deposit will be post your marginal tax rate.

Consult the ATO for more info regarding tax and your super, and how it relates to this scheme.

It’s your money

A snap study conducted by Roy Morgan research found a majority (79%) of Australians are in favour of people in financial difficulty being able to access their super. Both women (83%) and men (75%) approve, while those aged 35-49 are most in favour at 82%.

Upon announcing the early access to super scheme, Federal Treasurer Josh Frydenberg said: “This is the people’s money and will benefit the sole trader or casual whose work hours or income has reduced by 20%+ since Jan 1.”

Ultimately, he has a point: The money is yours, and whether you want to keep it in your super account, use it because you have to, or want to withdraw it to make a major investment like a property purchase, the choice is yours.

Dr Mardiasmo said there are arguments for and against withdrawing from super, but that it depends on your individual situation.

“There are many factors to consider: current super balance and strategy, current age and how many more years to retirement, income expectancy, house valuation and projected growth, and others,” Dr Mardiasmo said.

“At the end of the day consulting a financial adviser is always best, as they can run projections that take into consideration your current income situation, expenses, mortgage, home valuation, superannuation contribution.”

The arguments against

Not everyone can access the scheme

As mentioned before, the scheme isn’t available to anyone. You have to either be unemployed, or, since the start of this year, have lost your job or had your work reduced by 20% or more. So if you’re still working full-time or aren’t financially worse-off, you could still try to withdraw your super, but your claim may be rejected.

Women With Cents Founder and author of Wonder Woman's Guide to Money Natasha Janssens told Savings.com.au the primary purpose of the scheme is to help those who are in financial hardship.

“The purpose of the cash-out policy is to assist those in financial hardship, not to boost a home deposit. The ATO has indicated that they will be utilising data matching with the super funds and taking a close look at anyone they feel has not met the conditions of release,” she said.

“In this instance, the best-case scenario will be that you will have to pay tax on the amount withdrawn from super, at your marginal rate. At worst case, you risk potential fees and penalties.”

You may not be approved for a home loan anyway

There are a number of reasons why you can be denied a home loan application, such as having a poor credit rating or not having the correct documentation. Another big reason is not having a high enough income or a stable job, and if you’ve had your working hours reduced to the point where you’re eligible to withdraw super, you might be rejected for most home loans anyway.

“If you have accessed your super with the intention of topping up your deposit so that you can purchase a property in the near future, keep in mind that banks are unlikely to look favourably upon this as accessing super would indicate financial hardship and lack of cash flow stability,” Ms Janssens continued.

Financial adviser Grant Millar shares this sentiment.

“If someone is eligible to make the withdrawal under the COVID-19 release scheme, it means their hours or income has dropped - or they've lost work altogether,” he told Savings.com.au.

“This directly impacts their capacity to borrow, if they're looking to enter the housing market sooner than later.

“Ideally, they should be keeping their super where it is - it's designed for their retirement, not for them to buy their first home.”

If a lender sees your income has fallen for the foreseeable future, you’re unlikely to be approved right away - it might be worthwhile to hold onto the money until your employment becomes more stable.

Withdrawing from super isn’t always advisable

According to the Association of Superannuation Funds of Australia (ASFA), to retire comfortably a single person will need $545,000 in super, while a couple will need $640,000. That’s a lot of money, and withdrawing up to $20,000 now could lead you to be significantly worse off when the time comes to retire.

Mr Millar said to consider the long-term impact on retirement savings before applying for a release of super for a first home.

“You need to take into account the fact that your super may grow at a higher rate than the value of your home over the long-term, and that the sale of your home would include a number of fees to reduce the benefits of holding onto it,” he said.

“You'd need to weigh up the lifestyle vs financial costs and opportunities.”

You may miss out on a market rebound

This is a problem with the scheme pointed out by the Federal Opposition when it was announced. You could be withdrawing swathes of cash from your super at a time when the market is at its bottom, and you could be missing out on gains.

“We also think that there are real issues with encouraging people to divest from super when the market's in the condition that it is now. It's not good for them, it's not good for the system more broadly and we don't want to create problems for people's retirement down the track.”

Shadow Treasurer Jim Chalmers

“Selling your super at the bottom of the market will risk squandering people’s hard-earned retirement savings.”

Opposition Leader Anthony Albanese

Various industry experts share this sentiment.

Ms Janssens said: “Depending on your age, the longer you have to retirement, the greater the impact will be on your retirement balance if you withdraw money now. This is due to the fact that you will be withdrawing your money during a market downturn (i.e. cashing in market losses).

“So you are missing out on the future market recovery, as well as the power of compounding – meaning how much that money would grow in the years to come.”

You could lose your insurance

Although super-based insurance can cop criticism sometimes, more than 70% of Australians who have life insurance have it through their super, according to ASIC, and that includes income protection, TPD insurance (total & permanent disability) and life cover.

Withdrawing so much super that your balance drops too much means you could be losing insurance coverage without realising it.

Mr Millar said this potential impact on insurance needs to be considered.

“If your balance falls below $6,000, you may lose the insurance through your super - which could save you if you haven't sought advice from a financial adviser to discuss your personal insurance needs.”

The costs of needing insurance, but not having it because you withdrew from your super, could outweigh the benefits of buying a house.

Should you just use the First Home Super Saver Scheme (FHSSS)?

For first home buyers, there’s another super-related option for buying a home: The First Home Super Saver Scheme (FHSSS).

The scheme was first introduced in 2017 by then-Treasurer Scott Morrison. Under the scheme, first home buyers can make voluntary concessional (taxed at a discounted rate of 15%) and non-concessional (already taxed at your marginal rate) contributions into their super fund which can later be withdrawn for a deposit, up to a maximum of $30,000 overall.

The scheme has had mixed responses since its inception and hasn’t really been widely used. In July 2018 (the first month of allowing first home buyers to withdraw concessional contributions they’ve made since July 2017) just under 600 people requested a release of their built-up FHSSS funds.

It’s a very different scheme from the early access scheme and is far more limited.

Mr Kuru said: “The First Home Super Saver Scheme applies only to additional contributions you make to your super for the purpose of a first home and you can only access up to $30 000 of your voluntary contributions plus any relevant earnings from this for the purchase of your first home.

“Given that you can access $20,000 of your overall super amount through the COVID-19 measures means that this is not limited to your own voluntary contributions so essentially it lets you access money you could otherwise not.

“And, for those who have already owned property or bought their first home or are struggling to get their deposit together to get into their first property, this is definitely a great opportunity.”

Mr Jamieson meanwhile believes first-time buyers could potentially use both schemes to get into the property market.

“The super saver and COVID-19 super release are very different strategies. I don't think it’s a case of one or the other, but possibly exploring the option of both together to maximise any potential advantages that are available,” he said.

“They both have their merit and it’s unlikely you could just use the COVID-19 strategy alone in isolation to meet the purchasing requirements.”

A couple using both schemes could potentially withdraw up to $100,000 from their combined super accounts:

- $60,000 max from the FHSSS (voluntary contributions)

- $40,000 max from the COVID-19 early release scheme (existing balance)

This is a lot of money to take out of super but could be a more tax-effective method of building a deposit.

Read more about the FHSSS here.

Savings.com.au’s two cents

With every crisis, there’s an opportunity for someone, and if COVID-19 hasn’t destroyed you too much financially, then that opportunity might be entering the property market, either for the first time, again, or as an investor.

On the plus side, you have a tax-effective method of withdrawing a potentially sizable amount of money right off the bat from your super. But on the negative, you could be harming your future super balance at a time when the markets are near their bottom, all while many lenders have tightened their lending criteria due to the looming financial crisis COVID-19 has caused.

If you do decide to use the COVID-19 early release of super scheme to buy a house, it might be better to withdraw the money and wait out the storm, as house prices have been tipped to fall on average by a fair margin. If you don’t plan on entering the property market, then consider leaving your super where it is, and only withdraw it if you need the money badly.

If you aren’t sure of what to do, then the general consensus from each of the experts we interviewed suggest speaking to a financial adviser who can advise you based on your circumstances.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Hanan Dervisevic

Hanan Dervisevic

Brooke Cooper

Brooke Cooper