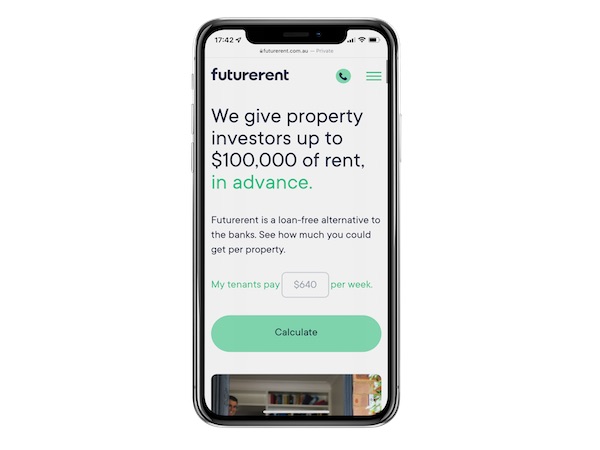

This is where Futurerent steps in. Futurerent is a property-technology platform providing investors up to $100,000 upfront to cover rental income. This can help in the early stages of property investment where it can be hard finding tenants.

However, Futurerent is not a personal loan. So what is it? Read on to discover how it works.

What is Futurerent?

Savings.com.au spoke with Futurerent co-founder and CEO Godfrey Dinh (pictured above) to find out how the platform is changing property investment.

Futurerent provides property investors up to $100,000 in rental income in advance. There is technically no interest rate on this advance - unlike a personal loan. Instead, investors are charged a monthly admin fee of 0.5% of the total advanced amount.

“Futurerent is a simple, fast and loan-free alternative to the banks, that gives property investors up to $100,000 of their rent, paid in advance,” Mr Dinh told Savings.com.au.

“[We are] helping property investors with funding for renovations, new property purchases, small businesses and other investments.”

If an investor has a rental charging $3,000 per month ($36,000 a year) takes out a $36,000 advance through Futurerent and pays back $1,000 per month, it will take them 36 months to pay off. At 0.5% of the $36,000, their monthly admin fee will be $180 per month. Over 36 months, this will cost $6,480, which is the equivalent of a 6% p.a. interest rate per year.

How does Futurerent work?

“We pay our clients in two business days, while the banks are known to force property investors into waiting two to three months to refinance,” Mr Dinh said.

“Property investors can save on hours of paperwork when they use Futurerent. We don’t require a valuation, bank statements, or income verification. We get everything we need from each client’s property manager.”

How is Futurerent different from a loan?

“The key difference between Futurerent and any loan is you’re not borrowing money – you’re just getting your rent paid in advance. This means there’s none of the paperwork associated with a loan like serviceability and valuation assessments, no impact on your credit file, and no interest,” Mr Dinh said.

“The rent you’re paid in advance is repaid in equal instalments over a maximum of 3 years, from a portion of the rent paid by your tenant. Futurerent’s 6% cost is also paid from the rental income, like your property management fees.

“This means Futurerent clients don’t pay anything out of pocket and repayments are paused or adjusted if the tenant vacates or if the rent changes.”

What sets Futurerent apart from other funding avenues for investors?

The main funding avenue for investors looking to access capital through their property is refinancing or equity release, and Mr Dinh said Futurerent can be a favourable alternative to these options.

“Our low fixed cost of 6% per year leaves more dollars in our clients’ pockets than other financing services. Refinancing a home loan can cost up to $3,000 in additional fees alone, plus tens of thousands in break costs and lenders mortgage insurance,” he said.

“Add on interest payments and it’s clear why refinancing is an inefficient and expensive way for property investors to access capital.”

Futurerent did a calculation and found if a property investor wants to access $25,000, refinancing to add this amount onto their home loan would cost them an additional $15,370 in interest over 30 years, on a variable interest rate of 3.42%.

Using Futurerent to access $25,000, investors can repay in three years, and it will only cost them a maximum of $4,500. If they choose to repay in 1.5 years, their cost is halved at $2,250.

“Compared with 7-year personal loans and 30-year investor home loans, our short 1.5-3 year repayment terms enable property investors to avoid years of additional interest payments,” Mr Dinh said.

Photo by R Architecture on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harrison Astbury

Harrison Astbury

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy

William Jolly

William Jolly