Even if used cars are cheaper than new ones, the truth is, to get anything relatively modern, safe and reliable, you’re still looking at spending more than $10,000.

Not everyone has that cash, and if you need a set of wheels to toot around, your next-best option is probably to get finance of some kind.

Now, there’s a few things to consider, and used car loans may differ slightly in what’s offered for new cars, so it pays to do your homework.

Steps to Finance a Used Car Sold Privately

Buying with cash is a relatively straightforward process - you either hand over a cheque or straight cash to the seller. But with finance, there’s a third party involved, so what’s the go?

-

Your first step is usually to get pre-approved for a car loan from your financier, so you know how much of a budget you have - if you find the car first, you can also organise finance later and explain that you’ve found the car you want. Include all details of the car when you apply for finance.

-

The second step is to pay for it. This happens either through the financier depositing the amount directly into the seller’s bank account, or into yours with the requirement that you pay that onto the seller in a certain amount of days.

After that, it’s most likely just like any other car sale. However, there’s a few considerations to make with the car loan products themselves, which is explained further below.

Considerations to Make

Aside from making sure the wheels don’t fall off as soon as you drive out of the driveway, there’s a few things to consider when it comes to used car finance.

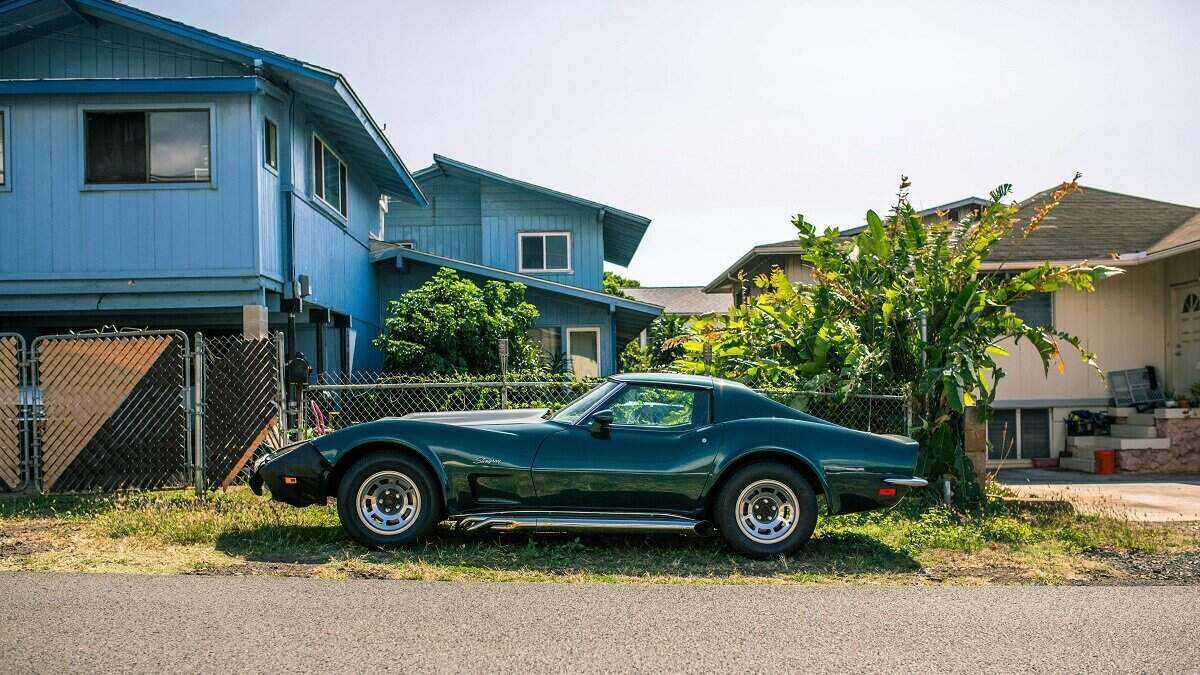

Age limits on cars

Many lenders have a maximum age of cars they are willing to finance. Some are as low as five years, but most tend to be around the seven year mark, while others are willing to finance up to 12-year-old cars.

If your car is a classic, then that could leave out many mainstream lenders. However, there are a bevy of financiers that specialise in classic cars, whether they have clever TV ads or not.

Interest rates

This is where it gets interesting… pun intended. You may have noticed that when comparing new car loans and used car loans, the used car loans often attract higher interest rates. This is because of two key factors:

-

Used cars are considered riskier to finance than new cars

-

Used cars are often significantly cheaper, so the loan is typically smaller. For smaller loans to be worth the trouble for a lender, they may need to charge higher rates of interest

Adding to that, you may have also noticed there are two classes of used car loans - car loans for under a certain age, say six years, and another set for cars older than six years. Some lenders might even label their products as ‘car loans’, when they are in fact personal (unsecured) loans, which we’ll explain below.

Personal loans when you have an older car

If you’re shopping for a used car, especially an older used car (say older than five years), lenders could offer a higher rate of interest than if you bought a new car.

This is because both you and the car will be perceived as a higher credit risk. For example, the car could have a higher chance of being written off in the next few years, as it wouldn’t take much of a prang to write off a $10,000 car. Lenders may also make assumptions about the type of borrower you are, given the fact you’re taking out a loan on a car older than five years.

Lenders may also offer ‘car loans’ that look like secured car loans on the surface, but are actually unsecured personal loans. There’s nothing wrong with a personal loan per se, but just know they often attract significantly higher interest rates. This is because unsecured loans do not use the car as security, meaning if you fail to repay your loan, they won’t come after your car. For this extra risk, lenders charge more in interest.

Other considerations

As with any type of loan, the same general rules apply when shopping around for a used car loan.

-

Check the ins and outs of the loan: This includes the loan term, comparison rate, any balloon payments, and other fees.

-

Do all your usual car checks: Away from looking at the loan, as with any car, do your due diligence when it comes to looking over the car, including if it’s been written off or stolen. This can be checked through the PPSR website, and costs as little as $2.

Buying a privately-sold used car with finance can be just as easy as buying a new car - just know there may be a few little extra things to understand with your loan.

Savings.com.au's two cents

Buying a used car privately, whether it’s a classic or only a few years old, is a popular way to get a set of wheels. But like you probably wouldn’t trust Damo down the street with your first born, you might not fully trust that he has a solid car with a good service history to sell.

This is partly why a private sale can be cheaper than dealer options - plus one of the benefits is that by buying a car a few years old, you let the first owner take the hit in depreciation.

However, if you need a car loan, keep in mind the loan’s interest rate may be higher than if it were for a new car - particularly if the car is older than around five years. Organising finance for a privately-sold used car can be simple - it’s all the other stuff that can be a headache, like making sure it’s roadworthy, has a solid service history and is not a repairable write off or stolen. Shop freely, just do your due diligence.

First published 6 May 2020, last updated 16 February 2021.

Photo by Matt Safian on Unsplash

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly

Harrison Astbury

Harrison Astbury