Last quarter (January to March 2020), personal insolvency rates fell 16.5% on the same quarter last year - the lowest level since the December quarter 1990, according to Australian Financial Security Authority (AFSA) figures.

But that isn’t telling the true story of financial health in the time of coronavirus, various experts are warning, and the biggest negative effects are yet to be seen.

Need somewhere to store cash and earn interest? The table below features introductory savings accounts with some of the highest interest rates on the market.

| Bank | Savings Account | Base Interest Rate | Max Interest Rate | Total Interest Earned | Introductory Term | Minimum Amount | Maximum Amount | Linked Account Required | Minimum Monthly Deposit | Minimum Opening Deposit | Account Keeping Fee | ATM Access | Joint Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

4.20% p.a. | 4.95% p.a. Intro rate for 4 months then 4.20% p.a. | $472 | 4 months | $250,000 | $99,999,999 | $0 | $0 | – |

| Promoted | Disclosure | ||||||||

0.00% p.a. Bonus rate of 4.85% Rate varies on savings amount. | 4.85% p.a. | $490 | – | $0 | $99,999 | $0 | $0 | $0 |

| Disclosure | |||||||||

0.20% p.a. Bonus rate of 0.00% Rate varies on savings amount. | 4.50% p.a. Intro rate for 4 months then 0.20% p.a. | $308 | 4 months | $0 | $99,999,999 | $0 | $0 | $0 | |||||||||||

0.20% p.a. Bonus rate of 0.00% Rate varies on savings amount. | 4.50% p.a. Intro rate for 4 months then 0.20% p.a. | $308 | 4 months | $0 | $99,999,999 | $0 | $0 | $0 | |||||||||||

2.80% p.a. | 4.35% p.a. Intro rate for 4 months then 2.80% p.a. | $385 | 4 months | $0 | $99,999,999 | $0 | $1 | $0 | |||||||||||

0.00% p.a. Bonus rate of 3.85% Rate varies on savings amount. | 3.85% p.a. | $388 | – | $0 | $99,999,999 | $0 | $1 | $0 | |||||||||||

3.95% p.a. | 3.95% p.a. | $398 | – | $500,000 | $99,999,999 | – | $0 | $0 | |||||||||||

0.10% p.a. Bonus rate of 3.70% Rate varies on savings amount. | 3.80% p.a. | $383 | – | $250,000 | $499,999 | $100 | $1 | $0 | |||||||||||

0.01% p.a. Bonus rate of 4.74% Rate varies on savings amount. | 4.75% p.a. | $480 | – | $0 | $99,999 | $100 | $0 | $0 | |||||||||||

1.00% p.a. | 4.30% p.a. Intro rate for 3 months then 1.00% p.a. | $266 | 3 months | $0 | $99,999,999 | $0 | $0 | $0 | |||||||||||

0.10% p.a. Bonus rate of 4.50% Rate varies on savings amount. | 4.60% p.a. | $464 | – | $0 | $99,999 | $100 | $1 | $0 | |||||||||||

1.00% p.a. | 4.75% p.a. Intro rate for 4 months then 1.00% p.a. | $352 | 4 months | $0 | $99,999,999 | $0 | $1 | $0 |

The brewing insolvency storm

Various stimulus measures for both individuals and small-medium-enterprises (SMEs) are due to wind-up around September, and this could also come as a shock to the financial system.

Savings.com.au spoke to various experts in the law, accounting and insolvency services industries about the potential rise in insolvency - especially for small businesses - in the coming months and years.

Peter Watson, Director at David Hicks & Co

Mr Watson has identified three key events happening long-term due to COVID-19:

-

Businesses shoring up long term debt positions and establishing larger working capital and cash flow reserves moving forward.

-

Principals applying financial checking procedures to ensure suppliers are suitable to complete contractual obligations.

-

Government reviewing current Corporations Laws to facilitate a reduction in external appointments where possible.

“Businesses need ongoing revenue,” he said.

“Government infrastructure spend will promote revenues across all industries through their different phases - initially in the professional space whilst going through procurement, then in the development/construction space whilst being built and moving into the operational space when complete.

“The benefits obtained by those servicing Government infrastructure spend will then invest and spend in other areas of the economy.”

David Hicks & Co is a chartered accountancy firm based in Milsons Point, Sydney.

Peter Hegarty, Principal of Hegarty Legal

Mr Hegarty said while the hospitality industry has been hit hard since lockdowns in late March, other businesses will “no doubt” be impacted in the months ahead.

“Once these deferrals [rent deferrals and other measures] come to an end as they eventually must, there will be an inevitable upswing in insolvency appointments,” he said.

“In my opinion, the stimulus measures were well placed and made for good reason.

“However, I am concerned about some of the recent amendments made to the Corporations Act and Bankruptcy Act which I think have approached the problem from the perspective of the insolvent entity or person without enough regard for other stakeholders.

“My concern with the most recent amendments is that they don’t seem to take proper account of the creditors of those insolvent entities who themselves are struggling to navigate through this difficult period.

“To put this in context, a director of a struggling entity may be more inclined to see his company incur a debt with a supplier which perhaps shouldn’t be incurred because of the relaxed insolvent trading provisions.

“What follows is that the supplier entity doesn’t get paid when their invoices are due and potentially themselves are then not in a position to meet their own obligations to their suppliers and employees.

“An unfortunate outcome of this position is that it inevitably leads to a tightening of credit from those supplier entities who quite understandably need to protect their own corner. This is something which the government should be seeking to avoid.”

Hegarty Legal are experts in insolvency and restructuring, commercial litigation and commercial law, and are based in Sydney.

Malcolm Howell, Partner at Jirsch Sutherland

Mr Howell said a relaxation of insolvency laws merely provide “breathing space” - especially for SMEs.

“Once the government relief measures expire, many SMEs that have deferred their liabilities are likely to receive a severe capital hit six or more months down the track and might not be able to meet their obligations,” he said.

“And given a lot of small-business owners often use personal finances for business borrowings – including using their homes as a guarantee – they are more vulnerable.”

For personal insolvencies, the effects could take longer to materialise and won’t be seen until 2021, according to Mr Howell.

“Personal insolvencies are a longer process, particularly if they are as a result of a failed business,” he said.

Jirsch Sutherland is a specialist insolvency and business recovery practice, with offices across Sydney, Brisbane and regional NSW.

Cameron Allen, Partner at Marsh & Partners

Mr Allen says that bankruptcies will increase “dramatically” over the next 12 months.

“Most businesses are trying to stay alive and to a certain extent are putting their head in the sand in the hope that the government stimulus will get them through,” he said.

“A lot of clients currently can’t afford to seek advice and therefore are trying to do everything themselves and don’t realise the position they are in.

“Assisting those businesses to seek professional advice would allow them to assess their position and either find a way back or deal with the problem.”

Marsh & Partners is a chartered accountancy firm focused on business, wealth and tax advice, and is based in Brisbane.

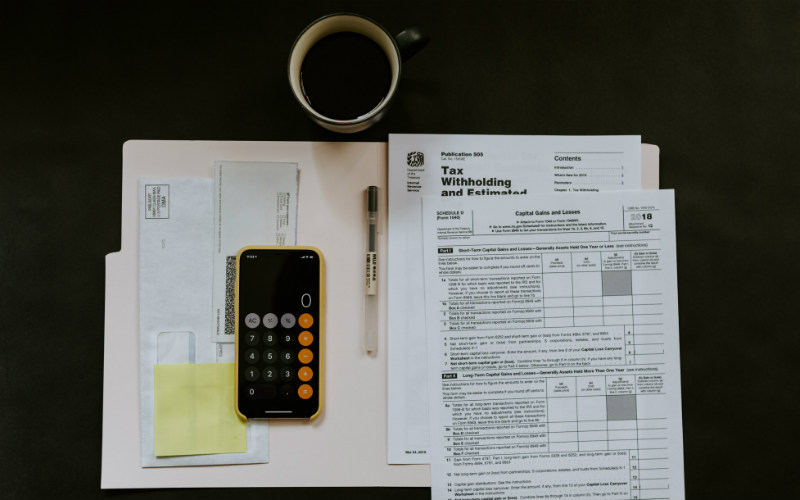

What should I do if I'm facing insolvency?

Where the experts all agree is that if an SME is facing insolvency, it’s important for them to get on the front foot and get professional advice.

Mr Howell says it’s important to get on the front foot if you, or your business, is facing any type of insolvency or inability to pay debts.

“Our message is clear: seek advice early; talk to your accountant or an insolvency specialist,” he said.

“The relaxed insolvency laws mean you have six months to decide what the best solution is.”

Mr Howell also said individuals shouldn’t be ashamed of bankruptcy.

“It’s a result of circumstances and sometimes it’s the only way to recover and to maintain your mental health and wellbeing and that of your family,” he said.

“Financial pressures affect everybody in the family, not just the individual concerned.”

Mr Hegarty said getting insolvency advice can not only help you and your business, but the businesses you deal with.

“My hope is that people do not see insolvency appointments as something which has to be avoided at all costs, but as being a necessary step where entities are trading insolvently,” he said.

“What this then means is that many other businesses with whom they are dealing are able to avoid bad debts and potentially becoming insolvent themselves.”

Mr Allen said many clients who visit his firm do not come looking for an insolvency answer, in particular.

“Most … don’t understand that these options exist,” he said.

“A lot of the time it is explaining these options to clients who are coming to us with cashflow difficulties or large assessments from the Tax Office that they weren’t expecting.”

Mr Watson found that two main topics dominate the discussion he has with clients.

“For those that do have solvency concerns, revenue generation and long term finance questions underpin the initial discussion points," Mr Watson said.

“This then leads to how an External Insolvency Appointment would assist the company and business operation, together with the expected effects on the proprietor/owner in a personal sense.”

What are the types of insolvency?

Insolvency in Australia is basically broken down into three formal arrangements - part IX (9) debt agreement, part X (10) personal insolvency agreement, and bankruptcy.

Part 9 and 10 debt solutions share many similarities, but some details are different.

Part IX debt agreement

Debt negotiators can help you come to a debt agreement with your creditors, enabling you to avoid bankruptcy. To be eligible you must have a certain amount of unsecured debt. You can’t have had a debt agreement or have declared bankrupt in the past 10 years. There is certain other eligibility criteria, as outlined on the AFSA website.

Part IX is listed on your credit report for five years or more, and you must tell new credit providers if you owe more than the credit limit. Your name is also on the personal insolvency index for five years or more, and you may not be able to work in certain professions.

Part X personal insolvency agreement (PIA)

Repayment schedules can be negotiated, similar to Part IX, but Part X, or PIA, could be a more viable solution for complicated situations, such as high debt amounts and high income earners as it is more flexible. It is longer, and more involved and has no eligibility criteria. A PIA may allow you to retain your assets, such as your house or car, if the agreement allows.

Bankruptcy

Think of bankruptcy like the ‘big kahuna’. Most types of debts are covered, meaning you no longer have to pay them, including unsecured debts.

In some cases your trustee may sell your assets or use compulsory repayments if you need to repay other types of debt, such as tax office debts, Centrelink debts, HECS and HELP and debt incurred after your bankruptcy begins. A creditor still has the right to seize secured debts such as your house, car loan or hire purchase/rent to buy products.

Bankruptcy is also split into two categories: voluntary and a court-enforceable bankruptcy instigated by creditor petition. A bankruptcy lasts for three years and one day, and is on your credit report for five years, or two yours from your end date, whichever is later.

Bankruptcy has serious consequences, such as the ability to travel overseas. You must request permission from your trustee to travel overseas, and not doing so is an offence. Your name will also appear on the National Personal Insolvency Index (NPII) permanently. Your ability to get future credit may also be compromised.

Each types of debt agreements have their pros and cons, and it's recommended you talk to your financial advisor, accountant or insolvency expert to determine the best option for you, if you are facing insolvency.

Disclaimers

Savings.com.au does not provide tax advice. This material has been prepared by Savings.com.au and is for informational purposes only, and is not intended to provide, and should not be relied on for tax advice.

For tax advice relevant to you, visit the ATO or consult an independent tax advisor.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Harry O'Sullivan

Harry O'Sullivan