CBA cut many term deposit rates by 25 basis points, though there were a few increases scattered around.

A whole range of rates between three months and five years were changed, across a variety of interest payment schedules.

Generally speaking, one can expect a lower interest rate for more frequent interest payments such as semi-annually or monthly.

There are also interest rate premiums for bigger deposits: For example, the 11-month rate with deposit sizes of $5,000 to $50,000 attracts a 3.95% p.a. rate - for deposit sizes between $50,000 and $2 million, the rate is 4.00% p.a.

Below are some of the more noteworthy changes across CBA's TD portfolio, with the rates pertaining to deposit sizes of $5,000 to $50,000 unless otherwise noted.

| Term | New % Rate p.a. (Change) | Interest Paid |

| 3 Months | 3.20% (-0.25) | At maturity |

| 6 Months | 3.45% (-0.25) | At maturity |

| 9 Months | 4.50% (+0.55) | At maturity |

| 12 Months | 4.00% (-0.60) | At maturity |

| 2 Years | 3.80% (-0.15) | Annually |

| 3 Years | 3.55% (-0.40) | Annually |

| 4 Years | 3.55% (-0.40) | Annually |

| 5 Years | 3.55% (-0.40) | Annually |

The changes are noteworthy given its economists are the only team out of the major banks to forecast an RBA rate cut still in 2024.

NAB pushed its rate cut forecast out to May 2025; ANZ's, February 2025; and Westpac doesn't think there'll be one in 2024 either.

CBA greatly lags behind the market leaders when it comes to term deposit rates.

CBA results at a glance

On Wednesday Australia's largest bank also announced its 2024 financial year results.

It posted a $9.8 billion net profit after tax, down slightly on its bumper $10-plus billion result from last year.

The bank cited increased operating costs - ergo, staff salaries - as a headwind; expenses grew 3% to a touch over $12.2 billion.

Its net interest margin (NIM) - the difference between interest paid and earned - fell 8 basis points compared to last year to 1.99%.

Its 'troublesome and impaired assets' grew to $8.7 billion, up from $7.1 billion last year, but still only making up 0.63% of its portfolio.

Home loans in arrears by 90 days or more has crept up slightly to 0.65% - up from 0.47% the year prior; its June 2019 level was 0.68%.

There was a more notable jump in 30 day arrears, now 1.30% of the funding book, up from 0.92% last year.

CBA CEO Matt Comyn at the 2024 half-year results presentation

CBA customer insights

Insights into Australia's largest bank and its customers are a useful bellwether for the rest of the economy given 35.5% of the Australian adult population banks with CBA in some form.

This jumps to 45.8% of young adults, and 62.1% of migrants.

It also has 11.2 million transaction accounts, the majority of which are presumably earning no interest.

Around $50 billion worth of deposits don't earn any interest, down from the $68 billion peak in June 2022, but up from $34 billion in December 2019.

Mortgage holders have stashed $75 billion in CBA offset accounts, steady on six months ago and up from $49 billion in December 2019.

This is noteworthy given the entire value of Australian offset accounts amounts to $271.72 billion (per March 2024 APRA figures), meaning CBA has 27.6% of the market.

This is greater than its 25.2% share of home loans (APRA figures).

Most (87%) of its customers are on variable rate home loans, up from 72% a year ago. This includes Bankwest results.

Cost of living crunch felt unevenly by CBA customers

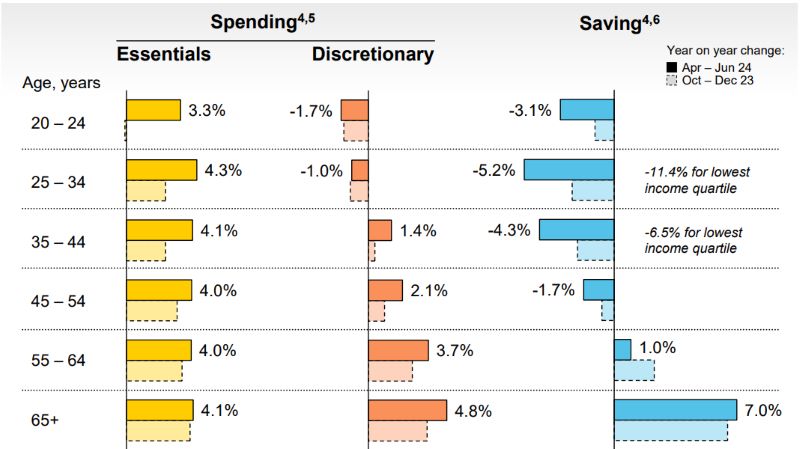

CBA's investor presentation revealed some insights into how the cost of living crunch is being felt by different age groups.

For 20-24 year olds, spending on essentials has risen by 3.1% over the past six months, while discretionary spending has fallen 1.7%.

The rate of saving has fallen 3.1%.

Contrast this with those aged 65+ where the rate of discretionary spending has risen 4.8% and the rate of saving, 7%.

Photos supplied by CBA

.jpg)

Bea Garcia

Bea Garcia

Bernadette Lunas

Bernadette Lunas

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy

William Jolly

William Jolly