The RBA’s Retail Deposit and Investment Rates data, which is updated every month and collates the interest rates from Australia’s five largest banks, shows that the average interest rate in January for a six-month $10,000 term deposit fell by five basis points to 1.90% per annum.

The average interest rates for other term deposit terms – one month through to three years – remained unchanged from December.

As things stand, the average rates for different terms across the five largest banks are as follows:

- One month: 1.40% p.a.

- Three-months: 1.85% p.a.

- Six-months: 1.90% p.a.

- One-year: 2.15% p.a.

- Three-years: 2.35% p.a.

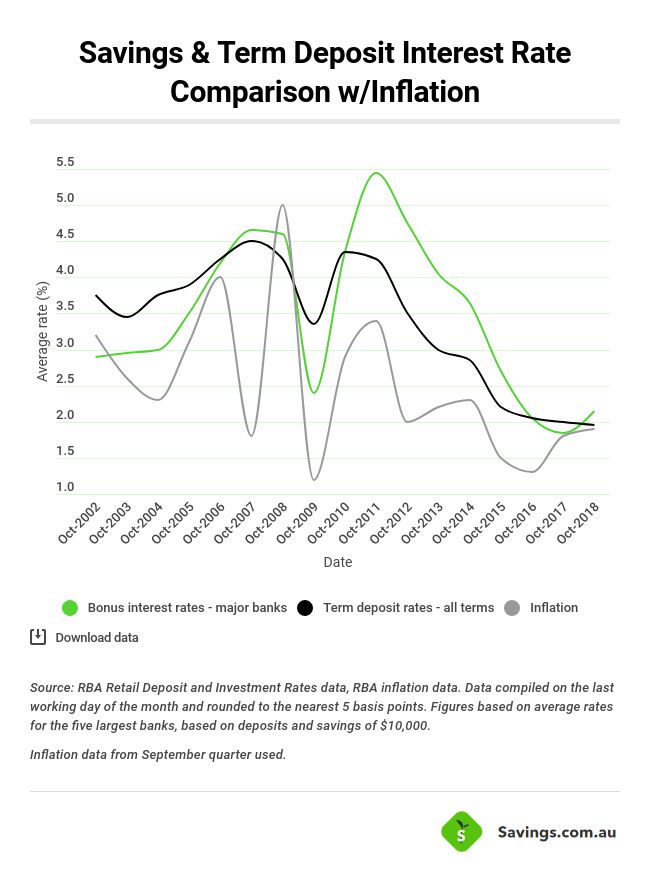

At a rate of 1.90% p.a., six-month term deposit rates are currently level with the annual rate of inflation.

This means that in real terms, customers investing in these term deposits aren’t earning anything.

Longer-term deposits provide greater returns, at the cost of having your money deposited for a longer period of time.

With several prominent economists predicting further cuts to the official cash rate by the end of the year, this month’s record low could potentially be broken again soon.

Look outside the big banks for higher rates

The data above consists only of term deposits from Australia’s five largest banks, which includes the usual ‘Big Four’ – ANZ, CBA, NAB and Westpac – plus Macquarie Bank.

But customers will find that by looking beyond these institutions, higher rates can be found.

For six-month term deposits, the highest rate currently on the market is 2.85% p.a. – almost a whole 1% per annum higher than the average offered by the big banks. Five-year deposits can earn up to 3.40% p.a.

These higher rates can make a substantial difference to the interest that can potentially be earnt by investing in a term deposit.

| Big 5 average | Highest available rate | Difference | Extra interest earnt on $10,000 | |

|---|---|---|---|---|

| One-month | 1.40% | 2.12% | +0.72% | $6 |

| Three-months | 1.85% | 2.70% | +0.85% | $22 |

| Six-months | 1.90% | 2.85% | +0.95% | $48 |

| One-year | 2.15% | 3.00% | +0.85% | $85 |

| Three-years | 2.35% | 3.00% | +0.65% | $195 |

Bea Garcia

Bea Garcia

Bernadette Lunas

Bernadette Lunas

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly

Dominic Beattie

Dominic Beattie