With that amount of money changing hands, it’s hardly surprising there many players getting in for their slice of the action, mortgage brokers among them.

Almost three-quarters of all new home loans written in Australia come through a mortgage broker, with the total home loans settled by brokers exceeding $350 billion a year.

The graphic below shows how rapidly the share of home loans settled through brokers has grown since 2020.

Source: Mortgage & Finance Association of Australia's quarterly survey of leading mortgage brokers and aggregators

It's no surprise that the number of mortgage brokers in Australia has also steadily grown. At last count, the number was approaching 20,000 - or around one mortgage broker for every 1,300 people.

So, what exactly is a mortgage broker, what do they do, do you actually need one, or is it better to find a home loan yourself? Let's find out.

What is a mortgage broker?

A mortgage broker is a person - or business - who essentially plays matchmaker between property buyers and lenders. They are middle people who help borrowers get home loans and lenders get customers.

What do mortgage brokers do?

Mortgage brokers work on the borrower's behalf to arrange appropriate finance for them to purchase their home, offering advice and guidance throughout the process.

A good broker will:

-

work out what you can afford to borrow

-

understand your property goals and help you achieve them

-

come up with options suitable to your circumstances

-

explain various loan products (fixed or variable rate, split loans, etc.), what they cost, and what features they have (offset, redraw, etc.)

-

help with the home loan application and associated paperwork

Generally, brokers have arrangements with preferred lenders to offer particular home loan products. They typically receive commissions from lenders for every loan settled.

That said, brokers are also legally required to work in your best interest or risk incurring fines in excess of $1 million.

Do you need a mortgage broker?

Whether you need a mortgage broker depends on your own financial knowledge and confidence in navigating the property and lending markets yourself. The increased popularity of brokers likely speaks to a growing consumer need to access expert advice and assistance in navigating the home loan process.

The alternative to engaging a mortgage broker is for people to do the legwork themselves, which is often referred to as going 'direct'.

In recent years, some lenders, particularly larger banks, have taken exception to mortgage brokers taking a larger slice of their home lending margins. Some have fought back by offering 'direct-only' home loan products, often with interest rates below those offered to brokers, effectively cutting them from loan deals.

Australia's largest home lender Commonwealth Bank has gone down this path with its broker-free online home lender Unloan and its own Digi Home Loan to new and refinancing customers, offering loan products not accessible through broker channels.

It's wise to check the offerings of such broker-excluded loans in deciding whether to engage a mortgage broker.

What customers say

Each year, the Finance Brokers Association of Australia (FBAA) commissions independent research for its 'Consumer Access to Mortgages' report.

Its recent report found of survey participants who'd secured a mortgage in the previous 12 months, 66% had gone through a mortgage broker while the remaining third had gone direct to lender.

First-time home buyers and refinancers were more inclined to apply for a loan through a mortgage broker.

Of those who went direct to lender, the vast majority applied for home loans online with less than 10% applying at a bank branch.

The survey found customer satisfaction levels were comparable across both broker and direct to lender channels - 74% of respondents taking out mortgages in the previous year rated their experience in the top two satisfaction ratings (extremely or very satisfied).

This represented a narrowing of the gap between broker and direct channels (brokers' ratings had previously been higher) although mortgage brokers saw a higher rate of extremely satisfied clients (31%) compared to 25% among those going direct to the lender.

The survey found that of borrowers using brokers, 83% said they intended to use a broker again for assistance with their next mortgage application. There were lower loyalty levels among borrowers going direct.

When to go through a mortgage broker

There is no right or wrong answer to this. It depends on your knowledge, confidence, and individual circumstances. Here are some questions to ask yourself:

-

Am I confident in navigating the home loan market?

-

Can I get better access to a desired product by going direct?

-

Will I save money by going through a broker?

-

Do I have in-depth knowledge of loan types and features?

Whichever way you go, it pays to do some research of the home lending market and products yourself. Any education is a useful thing and may be able to help you secure a better deal. Even if you decide to go through a broker, you can better evaluate the advice and products recommended, ask some pertinent questions, and have a better understanding of the information provided.

See also: Home Loans 101

Why use a mortgage broker?

Many borrowers, especially first-timers, have little idea of what's involved in securing a home loan suited to their own individual circumstances. The home lending market is awash with lenders and products, as well as having its own terminology and jargon.

It's understandable many people are hesitant to go shopping for a home loan on their own as there are real risks involved in getting it wrong. These include the obvious financial risks in getting a more expensive mortgage than they could have and locking themselves into loan terms and conditions they didn't fully understand.

Brokers can provide a guiding hand in helping you identify what you need in a home loan, come up with suitable products (among the thousands available on the market), then guide you through the process of applying for your loan and seeing it settled according to your needs.

No doubt, one of the big appeals of using a mortgage broker in Australia is that they can take considerable stress out of the process of finding and applying for a home loan, and there are generally no upfront fees attached to their services … which leads us to the next pertinent question.

No doubt, one of the big appeals of using a mortgage broker in Australia is that they can take considerable stress out of the process of finding and applying for a home loan, and there are generally no upfront fees attached to their services … which leads us to the next pertinent question.

How do mortgage brokers get paid?

Mortgage brokers are typically paid by the lending institution, and not the borrower taking out the loan. Some brokers may charge an upfront or direct fee to borrowers, generally around $50 to $200, but mortgage brokers are largely remunerated via commissions from lenders.

The revenue model currently used in the mortgage broking industry is one where the home lender pays brokers an upfront amount upon settlement of the loan. This is usually based on a fixed percentage of the loan value - generally in the vicinity of 0.55-0.7%. So, for example, a $500,000 mortgage with a 0.6% commission would see a broker take home $3,000.

Some lenders may also pay mortgage brokers a smaller annual payment (also based on the loan amount - usually around 0.165 to 0.275%) while the borrower remains a customer of the lender. This is commonly called a trail commission.

However, many industry pundits (particularly those on the 'direct' side of the business) claim this payment set-up can push up the price of home loans accessed through broker channels compared to those that can be sourced by going direct.

Others would argue these upfront fees paid to brokers are akin to marketing or advertising costs that are part and parcel of bringing new customers to a business and as such, may not have too much effect on the cost of the products offered.

Of course, it's difficult to prove either argument but it remains a grey area that consumers need to be aware of.

Ethical standards of mortgage brokers

In recent years, the remuneration of mortgage brokers has been the subject of ongoing investigation, resulting in new regulatory guidelines being handed down in 2021.

In the wake of an ASIC review in 2017, the final report of the Hayne royal commission into the financial sector also zeroed in on the conflicted nature of mortgage broker payments in 2019.

It pointed out that by taking payments from lenders, brokers were likely to sway their product recommendations according to the commissions they stood to make rather than those that were in the best interests of their clients. The report recommended changing the payment structure altogether so that borrowers, rather than lenders, paid brokers.

That didn't eventuate but the reviews prompted ASIC to change the regulatory guidelines covering mortgage brokers, effectively requiring them to act in the best interests of their clients - or face hefty fines.

One way to check rates and products suggested by a broker is by comparing the loans with similar direct home loan options. Home loan comparison tables, such as the one below, can also give you a good idea of the interest rates available on the market.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

But bear in mind, many comparison sites don't show all the available home loan products on the market - just as mortgage brokers don't deal with all the lenders in the market.

How many loan products do mortgage brokers consider?

The other commonly cited limitation of using a mortgage broker is that they often only peddle a limited number of home loan products from a limited number of lenders.

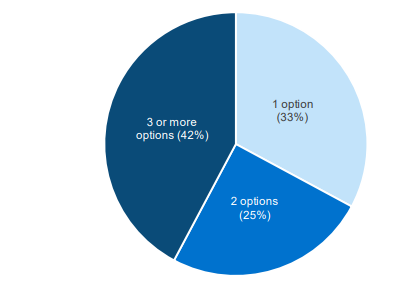

Indeed, ASIC's 2017 investigation into the mortgage broking industry found 58% of consumers received only one or two loan options from brokers.

Number of loan options provided by brokers

Source: ASIC

But more recently, the peak national body for brokers Mortgage Finance Association of Australia (MFAA) says brokers can typically access between 30 and 60 lenders to drive a good deal on behalf of their clients.

The MFAA says its members collectively access more than 100 lenders who all have to compete in the market for borrowers' business, effectively helping drive competition in the home loan sector.

Listen to mortgage broker Rebecca Jarrett-Dalton, founder of Two Red Shoes mortgage broking, speaking to the Savings Tip Jar podcast.

Questions to ask a mortgage broker

1. What are your credentials?

As with any professional, you want to ensure the person you're dealing with has earned their stripes. Your broker should have an approved qualification such as a Certificate IV in Finance and Mortgage Broking (FNS40821) and have an Australian Credit License (ACL), authorised by ASIC. Some brokers may also have a Diploma in Finance and Mortgage Broking Management (FNS50320) in addition to a Certificate IV. They should also be a member of a professional association such as the MFAA or FBAA.

2. How many lenders do you have access too?

To give yourself the best opportunity to get a suitable home loan for your circumstances, you want your broker to have access to at least 20 lenders. If they only deal with two or three, you might as well go direct. It also pays to check which lenders your broker deals with. It's better if they have a good mix of banks and non-bank institutions.

See also: Banks vs credit unions vs non-banks: what's the difference?

3. What are your fees and commissions?

Brokers are required to disclose this information to you. Knowing how much each lender pays can give you an idea of any possible conflict of interests, and ensure your broker is definitely working in your best interests.

Why go direct?

Many borrowers choose to go direct to a lender. Some may have existing relationships with their bank (or banks) through other products such as savings accounts and credit cards, which can make engaging directly with a home lender less intimidating.

Another driver in borrowers going direct is to get direct-only products that may offer appealing interest rates or other terms and conditions.

Financial blogs and home loan comparison sites can also offer a good oversight into what products are on the market. Their analytics can help narrow down the types of loans that meet your criteria and present you with numerous options to consider.

However, when you're using such sites, it's important to know just how many lenders, and their products, are represented on the site. Many comparison sites are simply 'referrers' to home lenders. This means that after you have used them to research the market and create a shortlist of home loan product options, when you click on a particular option, you'll be referred through to that lender's employees to begin the process.

This option is best suited to people who not only have the time, but also the confidence in navigating the home loan market themselves. Some borrowers also prefer to have direct control over the process of securing a home loan to be sure they're getting the best deal.

In more recent times, there has also been a rise in the number of online lenders in the marketplace who have built easy-to-use technology systems that make the process of getting a new home loan online relatively simple. However, make sure you do your research so that you can be sure there will also be a human being at the end of a phone line should you need them.

Frequently asked questions

1. Can you have two mortgage brokers?

Using multiple mortgage brokers is possible although it is not advisable, particularly if they're both submitting applications on your behalf. Using more than one broker may sound like a good idea in theory because it could give you a wider variety of loans to choose from but in practice, it can make matters far more complicated. Don't forget, every time a home loan application is submitted in your name, it can also affect your credit score.

2. Is a mortgage broker worth it?

There's generally no direct cost for using a mortgage broker, so their worth ultimately depends on the quality of the loan they help you secure. If they get you into a suitable loan with one of the lowest interest rates and features that are going to best serve you, that is a good outcome. But if you could've qualified for a similar loan with an interest rate that's 0.5% lower than the one the broker recommended, your broker could end up costing you tens of thousands in extra interest over the life of the loan. That's why it can pay to do your own research so that you have a better idea of whether the broker has found you a good deal or not.

See also: Home Loans 101

3. How do I find a good mortgage broker?

To find a good mortgage broker, you could try seeking advice from family, friends, and acquaintances who have used brokers and research their recommendations. You could also check out brokers' reviews on Google but, as with anything in the murky world of online reviews, view these with a healthy scepticism.

4. Do mortgage brokers assume risk?

Even if a borrower applies for a loan through a broker, it's the lender (not the broker) that takes on the financial risk of the borrower defaulting on the debt. Brokers are generally paid a commission upfront by the lender, so they may have a low incentive to consider a borrower's risk of mortgage delinquency. That said, it is in a broker's interests to maintain good business relationships with a range of lenders by consistently referring good quality borrowers, so in that sense, they are unlikely to refer you to a lender if they assess your default risk is too high.

5. Can a mortgage broker help with bad credit?

If you have bad credit, a mortgage broker may be able to find specialist lenders who may be willing to approve you for a home loan. They could also guide you in strengthening your application to give the best possible chance of approval.

See also: How to improve your credit score

6. Are mortgage brokers regulated?

Mortgage brokers must hold either an Australian Credit License (ACL) or be a credit representative of a licensee (aggregator). While mortgage brokers are not regulated by the Australian Prudential Regulation Authority (APRA), APRA oversees the lending panel accessed by the broker. Any complaints about a mortgage broker can be lodged with the Australian Financial Complaints Authority (ACFA).

7. Why can mortgage brokers get better rates?

Mortgage brokers often work closely with lenders, so they may have access to insider knowledge, deals, and sometimes interest rates the average home buyer doesn't. Mortgage brokers also often have strong negotiating power and may help you get a lower interest rate on your mortgage because lenders may want to keep their business on an ongoing basis. It's wise to check their best offer against what you can find yourself on the market.

Savings.com.au's two cents

The decision to go with a mortgage broker in your quest to secure a home loan depends on your individual circumstances.

Brokers can not only provide convenience and advice but also provide an ongoing contact even after you've settled on a new loan and home. This is because the lender generally pays them an annual fee for the time you have the loan, arguably giving them a vested interest in keeping you there.

If, for any reason, you decide at some point that you want to refinance with another lender to get a better deal, the broker can also help you through this process as well.

Of course, getting a home loan by going direct is an entirely viable option. This can depend on how much time you have and how confident you are in navigating the home loan market yourself.

Another alternative if you're time poor but still want to be sure you're seeing the best products on the market, is to do your own research and present your broker with a list of product options that they can try to better. That way, you go into the process having an idea of competitive loan products and if the broker can get you a similar deal through their own network, you also get the added benefit and convenience of the broker managing the application process for you.

At the end of the day, it never hurts to do some research yourself even if you ultimately decide to go with a broker.

First published on November 2024

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Brooke Cooper

Brooke Cooper